The superiority of proof of work over proof of stake; Review a point of view

The two algorithms “Proof of Work” (PoW) and “Proof of Stake” (PoS) are consensus mechanisms used to validate and secure blockchain transactions. Proof of work requires a lot of energy for the computing power it costs. In contrast, proof-of-stake without the need for high energy consumption and based solely on capital validates the blockchain wheel. The optimal consumption of energy in the proof-of-stake algorithm has made this consensus mechanism have many fans. Is proof of stake more optimal than proof of work to the extent described?

Read more: What is Proof of Stock?

In most discussions related to the comparison of these two mechanisms, there are many concerns about energy consumption in the Bitcoin mining process. The common perception of proof-of-work algorithm being overused and outdated is fueling the increased use of proof-of-stake as the consensus mechanism for most new blockchains. However, there are still people and organizations who look at this trend from another angle.

What you are reading in this article is a unique point of view that is being put forward with the aim of defending the proof-of-work algorithm. This view in the format an article Published on the blog of mining service company “Braiins”. This article explains why proof-of-work is an important feature of the Bitcoin protocol and how it is still a unique algorithm among the many proof-of-stake networks that emerge every month. The underlying reasons and logic of this article seem worthy of reflection; However, this view, like all topics in this field, may have weaknesses and cannot be considered as a general criterion.

beforeTheHistorical context

It may be strange to you; But the first use of proof-of-work as a consensus algorithm was not the Bitcoin network. To identify the first traces of proof of work, we must review the story of the action that was taken against spam. Adam Back explains the story well in an interview he did in 2014 on episode 77 of the Let’s Talk Bitcoin podcast.

Cryptographer Adam Beck is the creator of what we now know as proof of work on the Bitcoin blockchain. He first used the proof-of-work algorithm as a way to combat spam in Usenet newsgroups. In this news and information exchange network, spammers used the forum space to send useless and irrelevant messages and emails.

Since the cost of sending messages was almost zero, sending spam to access millions of computers did not cost the spammer, and on the contrary, it was a profitable possibility. In this situation, Adam Beck tried to use the proof-of-work algorithm to force the CPU of users’ computers to perform work and calculations. As a result of this action, sending messages in the network required energy and money.

With Adam Beck’s proposed plan, the cost of operation would not be expensive for ordinary users; But for people who intended to abuse the resources, it was not economical. He used the “Birthday Collision” theory for this. The simple idea of the mentioned theory is that if we imagine that 367 people (that is, days of the year + 2) are present in a room, we can be almost sure that at least 2 of these people were born on the same day and month and have the same date of birth.

By implementing Adam Beck’s “birthday coincidence” theory, each computer can be expected to continue SHA1 hashing the input until it finds the desired output (a second person with the same birthday). Usually, the intended output was found after a certain period of time, and then a digital “stamp” was recorded as proof of postage. This digital stamp represented the amount of electricity and computing power that was used to find the intended output.

This incident led to the emergence of a concept called “Hashcash”. From what we said, you probably noticed the connection of this system to Bitcoin: a completely similar consensus algorithm that requires a certain amount of energy and computational work from the user, in return for which a special “time stamp” is created that guarantees the authenticity of the data.

Bitcoin as a communication protocol

With the help of Adam Beck of the “Cypherpunks Mailing List”, which was composed of cryptography experts, the idea of using HashCash and Proof of Work in a digital payment network was formed. Looking at the history of the idea, it probably becomes clear why proof-of-work was used in a digital payment network; Because the Bitcoin protocol itself is considered a very large communication network.

The Bitcoin blockchain is a ledger consisting of interconnected blocks that contain the network’s data. This blockchain is designed in such a way that a new block is created every 10 minutes and the space of each block is limited.

Due to limitations, the Bitcoin communication protocol has a natural limit on the number of transactions per minute. Consequently, if the cost of writing blocks was zero, anyone could do it and flood the network with fake transactions. In fact, if there was no cost involved in manipulating the network, an attacker could easily disrupt and censor the network through a Denial of Service Attack. In this attack, people’s access to the network is cut off so that network services are not provided to users.

Furthermore, if another consensus method is used, attackers may influence the order of transactions and their placement in each block by creating a large number of accounts without paying a fee. This attack, so-called “Sybil Attack”, occurs when malicious actors try to take control of the network by creating multiple user accounts.

Read more: What is Eclipse Attack and Sybil Attack?

Fortunately, writing to the Bitcoin ledger is not free; Because proof of work requires miners to complete trillions of hashes to find a block. This issue requires spending more energy and, as a result, a lot of money. Considering the time required for processing and block space and bandwidth, the process of processing and participation requires spending a certain amount. Miners receive a block reward for the services they provide, which is in excess of the fees paid by users to include a transaction in a block.

Electricity and Bitcoin

Electricity is the most important and widely used energy in the world and can be considered the main currency of the digital world. Also, according to the mechanism of Bitcoin, the safety of each block can be calculated with this basic currency in the form of the number of joules or kilowatt-hours used to create the block. Thus, the amount of joules or kilowatt hours of electricity required for mining is equal to the number of miners multiplied by the average hash rate for each miner multiplied by the number of hashes required to create a block.

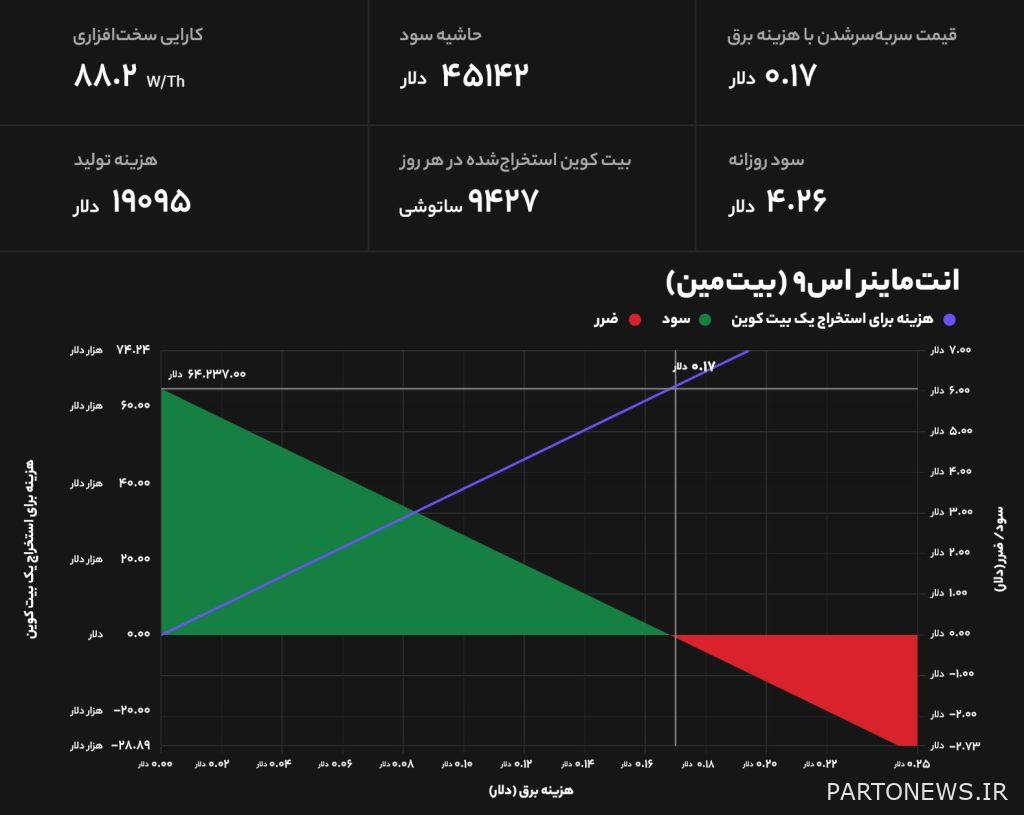

The average hash rate for each miner can determine the efficiency of each mining device. In the image below, the cost of mining Bitcoin with the Antminer S9 mining device is shown.

Obviously, the cost of electricity must also be calculated, and for this purpose, you must multiply the rate of electricity consumed by the rate of electricity per kilowatt-hour to finally obtain the cost of producing a block. Since miners do not create any blocks for free, the combination of block reward and user transaction fees must be more than the cost of electricity consumed by them.

After reviewing the statistics at this initial level, we see that the miners providing proof of work services are actually selling block space to network users. For this reason, the price of the block is evaluated in the form of consumed electricity; Because computers use electrical energy. in other words:

Important note: the energy consumed is always determined by the available reward for network miners, including the block space fee.

Ethical rules of Bitcoin energy consumption

Is it wrong that the Bitcoin network uses a lot of electricity? Honestly, no. As we have shown in the previous section, the power consumption is directly related to the value that users place on the block space. As the demand for block space increases, the miners’ reward also increases. This problem causes the energy consumption of the network to increase; Just as we saw in the Bitcoin bull market in 2020.

Undoubtedly, there is a demand for an asset like Bitcoin and the blockchain space in which this asset takes place. Instead of accusing Bitcoin of consuming energy, it’s better to look a little more closely at the energy sources that supply the consumed electricity. Also, it is worth noting again that the energy consumed is actually a guarantee of value that is transferred throughout the network. Simply put, Bitcoin uses electricity; But the source of fuel for generating electricity is not important to him. Whether it is compressed coal, or cleaner sources such as methane gas and hydroelectric power or renewable energies.

Is Proof of Stake algorithm the best alternative?

Instead of consuming computing resources and energy to produce a block, the proof-of-stake algorithm works based on the tokens that the miner or “validator” has locked in the network. Thus, the right to produce the block is given only by the validator’s locked capital, which is at risk of “slashing” in order to prevent the violation of the consensus protocol. This means that if the validator tries to make a mistake, it will lose its original property.

Although at first glance this algorithm consumes less energy and seems more efficient, ultimately the staked tokens are used as a medium of exchange in economic activities and There is no guarantee that the source of the invested capital will be environmentally cleaner than the energy consumed in a network based on a proof-of-work algorithm.

Furthermore, the capital required to secure a proof-of-stake network is millions of dollars more than the capital that must be spent on mining equipment. However, the main advantage of proof-of-stake networks is that they often face less criticism by reducing the energy footprint consumed. Currently, it is widely assumed that the Proof of Stake algorithm produces less environmental impact; While all aspects of its energy consumption may not be seen.

Read more: Proof of work and proof of stake, concepts and differences

The last thing to consider in the proof-of-stake algorithm is the issue of voting power in this algorithm, which is determined by the value of the validator’s stake. In proof-of-stake networks, the more stake a validator has, the more likely he is to receive a profit from other stakeholders. This issue can lead to the concentration of power in the network.

In fact, users who stake more assets may expose the network to the risk of censorship by centralized power. This condition has already been seen in the Ethereum 2.0 Beacon Chain; Where the top five validators own more than a third of the total stake, this is enough to stop or damage the network!

TotalTheclassification

As you read, this groundbreaking article took a different angle to examine the strengths and weaknesses of proof-of-work and proof-of-stake algorithms. In this article, looking at the historical background of proof of work, we found out the reason for its emergence and the necessity of its use in the international monetary network. Then, we paid attention to the fact that due to the energy that is used to provide the capital and property of the shareholders, the problem of reducing the energy consumption in the algorithm of proof of shares may be slightly exaggerated. In addition, this article was able to draw our attention to the necessity of energy consumption and cost to continue the decentralization feature of the Bitcoin network, and instead of questioning the consensus mechanism of Bitcoin, it raised criticisms about the source of electricity supply.

Proof of work is a brilliant invention first introduced by Adam Beck and is now an essential and integral part of the Bitcoin network. This algorithm was formed in order to deal with “denial of service” attacks and “Siebel” attacks, and later on the Bitcoin network, it made sabotage on this platform so expensive that no one thought of attacking the network. Proof of work in Bitcoin makes using this communication network costly. This issue makes block space or network bandwidth expensive; A feature that is directly related to transaction fees. The transaction fee is the value that users assign to the possibility of data transfer in the network. Meanwhile, Bitcoin miners also provide services that consume electricity to provide them.

Proof of Stake is an alternative way to build consensus in blockchain; But the large capital needed to secure proof-of-stake networks may also be obtained in a way that harms the ecosystem. In addition, in this algorithm, it is possible for a few people to take over a large part of the capital and move the network toward centralization; Conditions that can create risks for the protocol over time. For Bitcoin, proof-of-work is an innovative solution that, despite repeated attacks from society and politicians and even economists, seems both durable and secure in the long run.