Three Reasons to Correct Bitcoin Price Before the Uptrend Begins

The beginning of 2023 was promising for the digital currency market. Many altcoins saw significant price growth and the total market cap once again reached the $1 trillion mark. However, a review of data from China shows that despite the price growth of around 23%, Bitcoin probably does not have enough support to continue its upward trend.

Dominance of altcoins trading at an alarming level

According to Aruzdigital, Maartunn, one of such certified analysts in CryptoQuant, opinion The fact that the dominance of altcoins trading has reached its highest level in the last 2 years can be very worrying.

As traders tire of Bitcoin, they start trading altcoins, and as altcoin trading volumes increase, the potential risk of further price declines increases.

Examining the available data shows that currently the dominance of the trading volume of altcoins has reached about 64%, which is its highest level since January 2021 (December 2019). On the other hand, the dominance of Bitcoin trading volume has reached about 16%, its lowest level in the same period. It should be noted that the remaining percentage is related to Ethereum transactions, which is calculated in this index separately from other altcoins.

Martin said about this:

Note how increasing volume dominance rates of altcoins have often led to price declines in the past, and in contrast, sustained price uptrends have started with Bitcoin’s growing volume dominance.

That being said, he believes that increasing trading dominance of altcoins usually leads to lower Bitcoin prices, while sustained uptrends begin with high Bitcoin dominance.

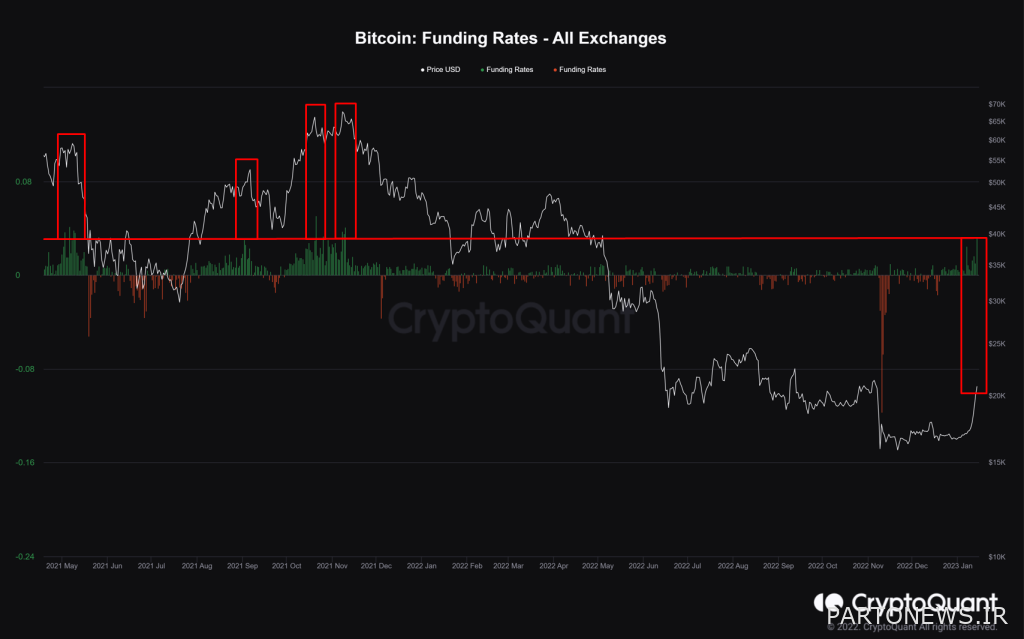

Funding rates are the highest in the last 14 months

Funding rates are the amounts that long and short traders pay each other to maintain their trading positions. As a result of this process, the price of permanent futures contracts remains close to the price in the spot market.

Positive capitalization rates mean traders are betting on price increases. Also, the price of Bitcoin in the futures market is higher than its price in the spot market. Conversely, negative capitalization rates mean that short traders have paid to hold their positions and are betting on a decline in price.

Marton Pointed It shows that the capitalization rate of Bitcoin has reached its highest level since December 2021 (Azer 1400). This means that Bitcoin traders are bullish on the current situation and hope for higher prices.

However, this analyst concludes that:

Examining the capitalization rate chart shows that this may not always happen. In previous periods when funding rates were as high as they are today, we have seen bitcoin price correction.

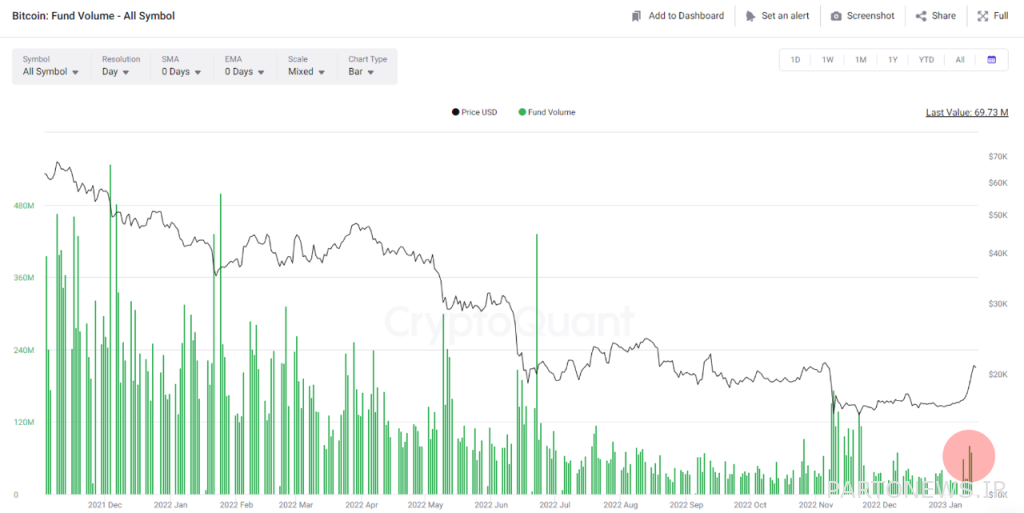

Institutional investors watching the market

Another cryptocurrency analyst with the nickname MAC_D, with Check 3 indicators have concluded that there is no buying signal from institutional investors despite the increase in the price of Bitcoin to $21,000.

A look at the Fund Volume index data, which measures the trading volume of investment funds, shows that the trading value is insignificant and there are no unusual movements.

According to data from the Fund Holdings index, which represents the bitcoin holdings of investment companies such as Grayscale Trust Fund, the amount of bitcoin held by institutional investors has been slowly decreasing since July 2022.

In addition, institutional investors are usually interested in buying Bitcoin quietly through over-the-counter (OTC) transactions. A review of the data shows that no unusual transactions have occurred in OTC trading.

As a result, according to this analyst, the current increase in the price of Bitcoin does not mean the beginning of a long-term upward trend.

McD says in his conclusion:

I believe that the current increase in the price of Bitcoin is the result of the increased willingness of traders to buy, which was formed after the release of US inflation data. Institutional investors have remained calm and just watch.

In the end, he noted that if we ever see a significant increase in the volume of OTC transactions, then we can say that institutional investors expect a full-fledged turnaround and the beginning of an upward trend.