Volatility of major stablecoins with increased market volatility in the past day

In the midst of the FTX crisis, almost all major stablecoins lost their dollar pegs. Although the situation of these stable digital currencies also improved with the relative return of stability to the markets, some experts are still worried about the collapse of another stablecoin such as Terra.

To Report Cointelegraph, the fall in cryptocurrency prices was not the only consequence of the FTX crisis this week.

Significant market volatility, caused by the collapse of the FTX exchange this week, also affected stablecoins; To the extent that many of them lost their parity with the US dollar for a short period of time.

According to Julio Moreno, chief cryptocurrency analyst, almost all major stablecoins have experienced some level of volatility in their parity this week.

He noted that the price of Tether, the market’s top stablecoin, briefly dropped to $0.97 on November 10; Because the value of redemptions exceeded 600 million dollars in the last 2 days.

According to CoinGecko data, the price of Tether is still slightly below $1 and is trading at 0.997 at the time of writing.

Cointelegraph also cited evidence that FTX and Alameda Research were trying to short the stablecoin in its report on the loss of the Tether (USDT) dollar peg.

USDC is also not spared from fluctuations; Because the value of his redemptions has exceeded one billion dollars. According to CoinGecko data, the USDC price briefly fell to $0.977 yesterday; But he was able to quickly regain his stability.

Despite Monero noting that the value of TroySD (TUSD) redemptions barely surpassed $1 million, the stablecoin’s price dropped to $0.98 yesterday. Also, with the market value of Pexos USD (USPD) purchases reaching 100 million dollars, the value of this stablecoin fell to 0.96 dollars.

Binance’s stablecoin, BUSD, was also volatile on the Gemini exchange, leading to a brief drop to $0.98.

Tron’s algorithmic stablecoin, USDD, has yet to achieve one-to-one parity with the dollar and is currently trading at $0.98. The price of this stablecoin fell to 0.952 dollars yesterday at the peak of volatility.

Concerns are growing about the value of the collateral backing this stablecoin; Because the price of Tron, which is used to buy back USDD, has decreased by 14% since the beginning of the week. Justin Sun also accused FTX and Alameda Research of shorting Tron’s algorithmic stablecoin.

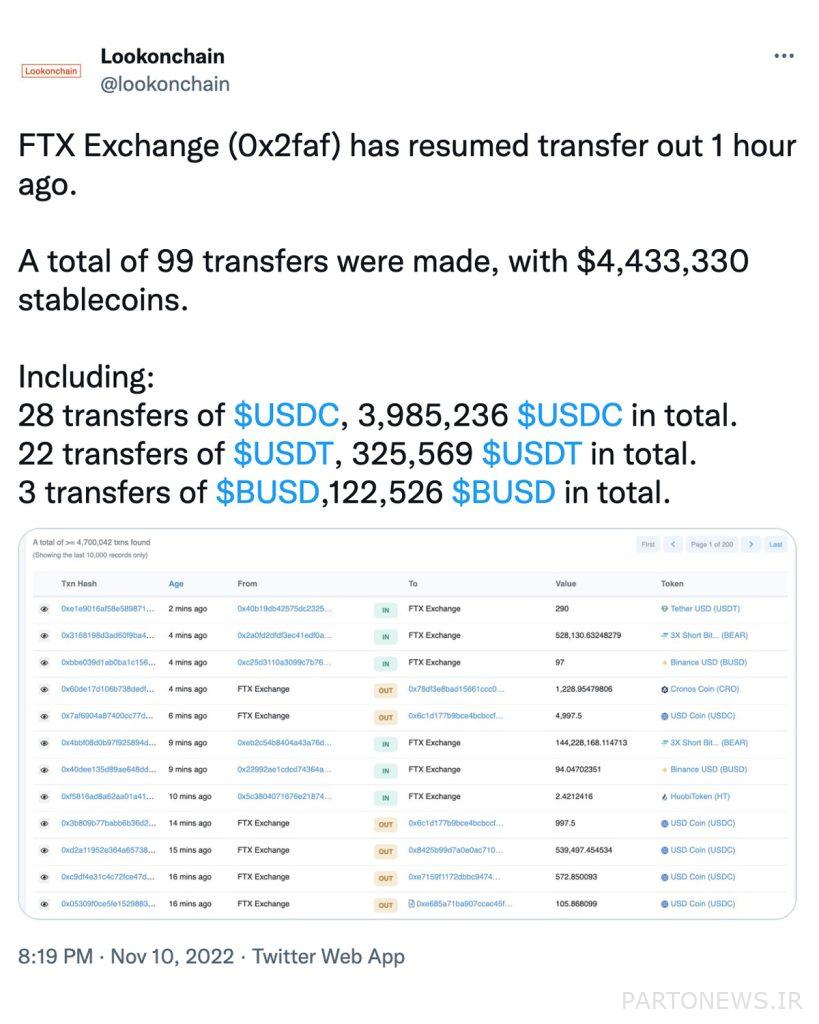

The loss of parity with the dollar coincided with the massive withdrawal of stablecoins from the FTX exchange on November 10.

At the time of writing, almost all major stablecoins, including USDC, BUSD, USDP, GUSD, and TUSD, have regained parity with the dollar. This means that market participants who fear the collapse of another stablecoin like Terra can now breathe a sigh of relief again.

The market situation also slightly improved compared to the previous day’s stagnation, and the total value of the digital currency market, with a growth of 4% in the last 24 hours, returned to above 900 billion dollars.