Walk and lose money! Investigate the 80% drop in the price of stepper

The main token of the STEPN program, known as “GMT” in the market and known for the idea of ”earning money by walking”, has lost about 80% of its value over the past 30 days. Some experts say that the model of activity and reward in this program is not stable and the tokens related to it may face falling prices again in the future.

To Report Kevin Telegraph: Stephen’s downtrend over the past 30 days seems to have calmed down a bit now. The price of this digital currency increased from $ 0.80 to $ 0.99 between May 27 and 28 (June 6 to 7) and grew by almost 35% during this period. The previous bullish correction of this digital currency had started after the price fell to the same range. This area used to act as price support in the past before the 500 and 120% growth of steppe in March (May) and May (May), respectively.

In addition, the next step of Stepan’s correction caused the price of this digital currency to drop by 80% compared to its $ 4.5 peak on April 27 (May 7). During this fall, the Stepan market was in a state of saturation and its daily relative strength index (RSI) fell below 30 on May 26 (June 5).

The support on the chart and the placement of the Stepan relative strength index in the sell saturation range, shows that this digital currency is approaching its price floor.

Important Stepan price levels

If we set the Fibonacci correction levels on the Stepan chart from the bottom of $ 0.0099 to the high of $ 3.82, this digital currency will be in a broad price stabilization range. In this case, the 0.382 Fibonacci retracement level (close to $ 1.5) acts as a temporary resistance and the 0.786 Fibonacci correction level (close to $ 0.82) acts as its temporary support.

Therefore, if Stephen continues to move above the $ 0.82 support level, its next target will be $ 1.5, which is about 40% higher than the current price. In addition, if the uptrend is strong enough and continues, the digital currency could reach $ 2 to $ 2.5. It should be noted that in this case, it can be said that Stepan had reached its price floor after the recent fall.

Conversely, if the uptrend is weak, the price of Stepan may return to $ 0.82 again and then move to $ 0.54. It is worth mentioning that the $ 0.54 support from March 17 (March 26) to March 21 (April 1) was able to prevent the deep fall of Stepan price.

Did Stephen grow just because of the excitement of the traders?

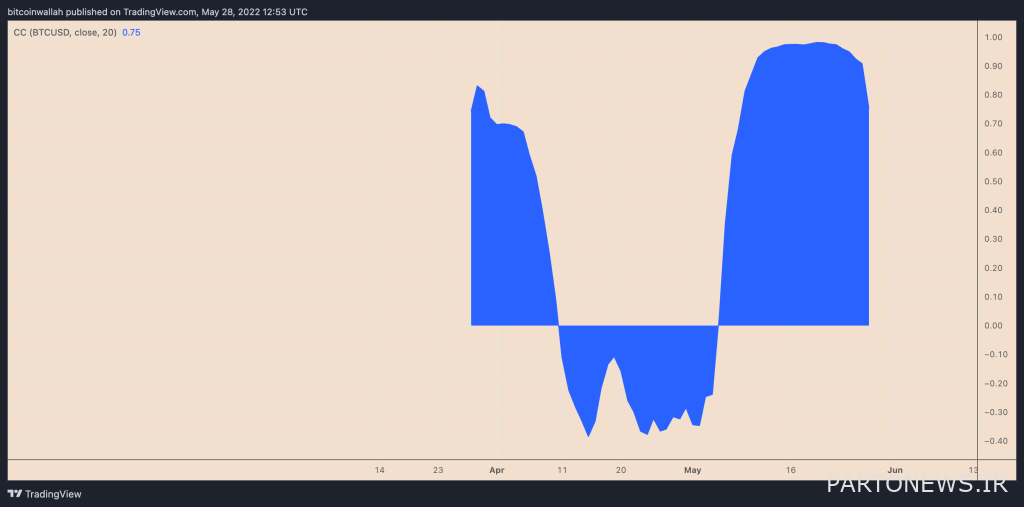

Fundamental factors are mainly in order to reduce the price of steppe. Stepan’s movements during this period have been close to Bitcoin and other top currencies in the market, and its daily correlation coefficient with Bitcoin, which peaked at 98% on May 21, has recently reached 75%.

Therefore, as many analysts believe, if the price of Bitcoin remains below $ 30,000, the price of Stepan may continue to fall due to its positive correlation with Bitcoin.

Second, the price of staples may fall further due to investor distrust of the project’s business model. In this model, users who exercise by walking, walking or running will receive another platform’s native token, the Green Satoshi Token (GST), as a reward.

Mike Fay, an analyst and author of the Heretic Speculator financial newsletter, says Stepan’s so-called “earnings momentum” model is not scalable and cannot be sustainable in the long run.

This analyst also points out some of the main problems of the Speten application. He first talked about the big hurdle to accepting this app. He says Stepan encourages people to buy NFTs for the app’s sneakers, and that people are buying these digital assets for hundreds or thousands of dollars, expecting to be able to raise the money spent on the shoes by earning GST tokens by running and Compensate for their sales.

However, many users, such as Sebbyverse, a digital currency’s YouTuber, have been able to recoup the money they spent on the game’s shoes by running the app. The YouTuber claims that one day he walked the restaurant for only 15 minutes to buy dinner and earned $ 219 in Stepan.

“The price of the GST token is also falling,” said Mike Phi.

The result will be that eventually, with the fall in the value of GST, Stepan’s in-app tokens, newcomers to the platform will provide the cash they need to outsource their early users.

This can hurt users who have paid thousands of dollars for NFTs for Stephen sneakers. Therefore, if the demand for these NFTs decreases and the motivation of the users decreases, Stepan will not be able to attract new users to its application and as a result, the demand for Stepan tokens (GMT) will also decrease.

The analyst said:

Stepan has grown only because of the excitement of investors and the attention of seasonal traders, and I personally will never invest in it. I will not invest in the Stepan token (referred to as GST), the Stepan sovereign token (referred to as GMT), or its NFTs.