What did he do with the stock exchange target of 4200 Tomans?

According to Tejarat News, the fluctuation of the foreign exchange market had become the main challenge of the system since 1996, at which time many measures were put on the agenda to prevent the fluctuations and control the exchange rate, which eventually led to new decisions. In order to control the exchange rate, the policy of allocating 4,200 Tomans to basic goods began in April 1997.

Giving 4,200 Tomans to those who deserve to receive this currency was accompanied by the reaction of many economic activists in the country who believed in the negative impact of using this currency in the market and repeatedly protested against the increase in rent distribution in the country, calling for the elimination of such a plan in the country. They were.

In 1401, we do not have the currency of 4200 Tomans

Now, after years of widespread protests against the use of this currency in the country, in the past few days, speculations have been raised about the possibility of removing the 4,200 Toman currency, followed by speeches by Mehdi Toghyani, a member of the Economic Commission of the parliament, about removing it. Gradually, the currency of 4200 Tomans should be introduced until the end of the year, and in the continuation of his words, he has announced that in 1401, we will not have anything called the currency of 4200 Tomans.

The government agrees with the parliament to eliminate the 4,200 Toman currency

Also, during the past few days, following the support of market activists for the removal of 4,200 Tomans, Mohammad Reza Poorabrahimi, Chairman of the Economic Commission of the Parliament, stated that the government agrees with the Parliament to remove 4,200 Tomans: The exchange rate of 4,200 Tomans is nothing but There is no rent or corruption, but about eight billion dollars a year is allocated to it and 160 thousand billion tomans is the difference with the half rate, and the question is what percentage of it has reached the people?

The head of the Economic Commission of the Islamic Consultative Assembly, stating that the decisions from the very beginning of the thirteenth government should have been expertly said, said: the continuation of the preferential exchange rate even for one day is not in the interest of the country’s economy.

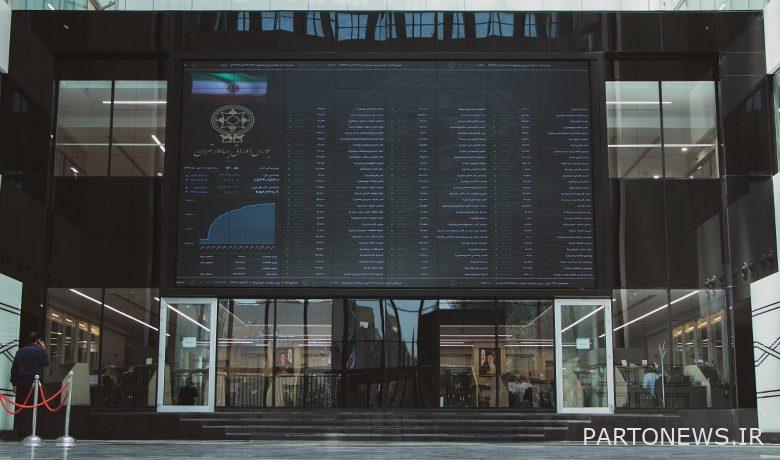

The making of such remarks by the country’s officials gave the color of reality to the rumors of the removal of this currency, which to some extent influenced the decisions of shareholders to change the direction of buying their shares, and this issue drew more attention of market participants to the company’s shares. Stock exchanges and their influence from this event.

The effect of removing 4,200 Tomans on various stock exchange industries

In this regard, “Mohammad Azad”, a capital market expert, today (Friday) pointed to the effect of removing the 4,200 Toman currency on various stock exchange industries and said: “The removal of this currency is mainly on industries such as pharmaceuticals, rubber, food, agriculture and animal husbandry, candies.” And خواهد will be effective in receiving this type of currency as well as the issue of pricing in their products.

He stated: Although many companies active in these industries, although they used the currency of 4200 Tomans to supply the raw materials they needed, but in return the sales rate of their products has been under the control of the government.

Azad said that in general, the net effect of this decision depends on various factors that show themselves in the profit margins of the companies involved, adding: “To what extent does the increase in the prices of the products of these companies occur is considered as the most important issue.”

He stressed: “If the increase in product prices is commensurate with the increase in cost, we do not see a significant effect on the performance of companies, this option seems to be more in line with the attitude in the country’s macroeconomy and government policies to curb inflation.”

The capital market expert continued: “Certainly, the full liberalization of product prices in the long run has a positive effect on companies that are more successful in terms of asset management and operational efficiency, which will increase the value of the company or the stock price.”

He emphasized the negative effect of using the currency of 40 Tomans on the stock exchange industries and said: “Certainly, as a general principle, government interference in pricing, whatever it is applied, is contrary to the spirit of the free market and ultimately leads to rents and corruption.” Becomes.

Azad believes that as a general answer, one cannot expect a positive effect on various industries from the subsidy method.

This capital market expert, emphasizing that the effect of the exchange rate of 4200 Tomans that was applied since 1397 can be examined from two general aspects, said: At first, the companies that were subject to receiving and using this currency, including to provide Received raw materials or equipment, and the other group includes companies that were active in the same industry but were not eligible to receive this currency and had to compete and maintain their market share in this situation.

He noted that both groups were affected by the pricing of their products, but the second group was under more pressure than the first group in the supply of raw materials and other production costs.

Azad emphasized: controlling the production and sale of a manufacturing company is basically not compatible with the spirit of private ownership and efforts to manage assets and improve the efficiency of the company’s operations, so it can not be said that the use of 4200 Tomans currency has a positive effect on Has had the performance of active industries and companies.

The capital market expert continued: “Although at first glance and in the face of inflation, offering a preferential rate leads to a lower increase in the cost of a company’s products, but interference in the selling price of the product can completely neutralize this effect.”

He said: “Also, the time and ability of the management and executive staff of eligible and non-eligible companies, instead of focusing on increasing productivity and optimal use of available resources, will be biased towards more use of this rent.”

Azad stated: Apart from the positive or negative effect of using 40 Tomans currency on the financial results of companies’ performance, it seems that this issue has negatively affected the operational capacity and quality of eligible and similar non-eligible companies.

According to this report, with regard to issues related to the return of the Borjam negotiations and the possibility of eliminating the 4,200 Toman currency that has affected stock exchange transactions, most experts have made recommendations to shareholders on how to invest in the stock exchange and have repeatedly stated: People who are looking for their capital to enter this market should refrain from any hasty decisions and prevent any possible losses in this market by placing the opinions of experts in this market for stock trading.

Source: IRNA

Read the latest stock market news on the Trade News website.