What happened to the orders of the president’s stock market? / The market is in the crosshairs of demagoguery!

According to Tejarat News, the Stock Exchange President’s orders to establish stability and transparency in the stock market have once again raised the issue of the impact of his orders on the capital market.

Last week’s stock market order by Ebrahim Raisi has once again become one of the hot topics in the stock market circles. In this order addressed to Seyed Ehsan Khandozi, Raisi emphasized the need to create predictability, stability and transparency in the capital market. But the point is, is such a thing possible? And if it is possible, in what way and in what way can it be realized? Or is the problem of the capital market due to the lack of transparency, or is there something else involved?

The similar things that exist in between are that the points mentioned by the president are all basic demands of the shareholders. Keywords that are constantly repeated in the stock exchange circles and have become sensitive points for shareholders. Among these keywords, we can mention command economy, stock market boom, market predictability, establishing stability, creating transparency, etc. These similarities create the suspicion that maybe the president and his advisors are trying to manage the minds of the people of the stock market by relying on the sensitivities of the market. However, the government’s approach to the stock market is in accordance with the policy that the critics 13th government Do they refer to it as “deception” or “populism”?

November 1400; Eliminate worries!

In the summer of 1400, the people of Bursa experienced relatively balanced and positive days, and for this reason, they did not protest much against the government’s performance. However, the 13th cabinet was established in early September, and if there was any shortcoming in the market, no one would blame it on the President’s government. But with the beginning of autumn and the beginning of market fluctuations, murmurs of complaints could be heard in the stock exchange circles.

The situation progressed to the point where the total index experienced a significant drop in the last days of Mehr to the beginning of November 1400. These conditions caused the shareholders to worry about the fate of the market in the President’s government. Concerns that were rooted in the determination of the quality of the cabinet of the less known president to the people.

Although in the fall of 1400, a specific record of the economic and foreign policy team of the 13th government had not yet been recorded, but the strange approaches, comments and actions of some members of the cabinet from different strata, including the people of Bursa, had worried.

The protests and concerns of the people of the stock market intensified to such an extent that the main focus of the meeting of the government board on November 9, 1400 was focused on the stock market and the problems of this area. Ebrahim Raisi also issued an order in this meeting regarding the need to address people’s concerns in the stock market. The order was based on the keyword “relief of concern” and its emphasis was on the decline of the entire stock market index.

But the reaction to the orders of the chairman of the stock exchange was to hold an urgent meeting on November 10 last year. The meeting was held under the management of the Minister of Economy and with the presence of the head of the stock exchange organization as well as managers and legal shareholders of the stock exchange. The result of this meeting was a strange and unimaginable growth of more than 21 thousand units of the total index at the same time as the said meeting was held. This is while the day before that, the total index faced a heavy drop of 35,000 units, and the sudden and overnight change in the direction of the market was not expected by any of the experts.

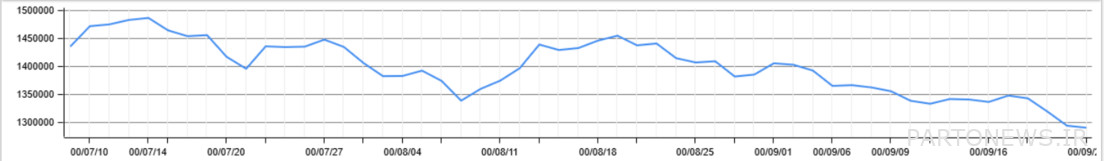

Fluctuations of the total index – from October 10 to December 20, 1400

Promise of love!

But the issue that aggravated the concern of experts and experienced shareholders of the market at that time was the comment of Majid Eshghi, the head of the stock exchange organization, in the evening of November 10 last year. Eshghi, with a surprising appearance on the television of the Islamic Republic of Iran and in a live program, promised to reduce the redness of the stock market signs and improve the market situation from tomorrow!

The head of the stock exchange organization said in the program “Good morning” on Channel 3 and at the same time as the stock market trading started on the morning of November 10, 1400: “The redness of the board did not come all of a sudden, but it will also go away all at once.” God willing, it will gradually decrease from today and the stock market board will turn green.

At first glance, these statements seemed pleasant to newcomers to the market. But most of the experts over the reaction Ministry of Economy And consequently Stock They raised criticisms about the order of the president. They also said that there is no market in the world that suddenly gets out of the crisis with the actions of governments overnight, unless it is manipulated. That is exactly after the meeting of the Minister of Economy with the legal actors of the market, which was considered by the economic observers as a direct intervention of the government in the internal affairs of the market.

The first command is burnt!

The mentioned conditions caused green days for stock market signs until a few days after the presidential decree was issued. Even this orderly growth trend of the index did not last and Tehran Stock Exchange ended its work in November 1400 with a drop of 3.4%. This trend continued in Azar 1400 and the return of the entire stock market index was also negative in this month.

With the beginning of winter and the continuation of the unfavorable situation of the bowl market, the patience of many shareholders was exhausted. The return of the stock market in January 1400 also registered a decrease of 2.9%, causing dissatisfaction and concern for the capital market activists. Mass gatherings of Bursa residents on Thursdays had also become a normal practice. In fact, novice and even old shareholders had realized that the implementation of the president’s orders will not only solve the problem of the market, but also aggravate the problems.

10 household packages; Raisi’s new playing card

The atmosphere with which the Tehran Stock Exchange started the winter of 1400 continued in the early days of February of the previous year. The atmosphere was so tense that Ebrahim Raisi once again had to issue a direct order on 5 Bahman 1400 to organize the capital market. But this time he appeared as a critic and directly ordered Khandozi to unveil the plan he prepared to support the stock market as soon as possible.

On the evening of the 5th of Bahman 1400, the president promised that the economy minister would introduce this support package the next morning. The wait continued until the evening of the 6th of Bahman, when Seyed Ehsan Khandozi introduced a 10-point package in an interview, which they had organized a wide publicity maneuver around days before. In fact, Ebrahim Raisi reopened the opened Khandozi package, and the Minister of Economy promised to implement it without question, despite widespread criticism of the provisions of this package.

Raisi said in his fourth TV interview: He has been worried about the stock market since the beginning, and therefore he has assigned the economic team of the government, headed by the first vice president, to follow up on solutions to overcome the current problems of the stock market. The economic team of the government reached a conclusion that the Minister of Economy announces these decisions and approvals. The approvals that result from the government’s point of view is the exit of the stock market from the current situation.

Raisi’s stock market orders were issued while the stock market index had a downward trend in the four months ending in Bahman 1400 and caused dissatisfaction among the shareholders. But as it is clear in the graph below, the downward trend of the total index experienced a significant jump after the order of the President. But this surge did not last as expected, and the market entered a recession phase after a few days, and this situation continued until the end of 1400.

Fluctuations of the total index – from 20 December to 10 March

The third intervention ordered by the government in a recent year

Last week, Ebrahim Raisi issued a stock market order to the Minister of Economy for the third time since the beginning of the 13th government (from August 12, 1400). The president’s stock exchange orders are based on creating transparency in the market while preventing frequent changes in the rules, which has surprised experts. However, many analysts believe that the problem of the market is not the non-transparency of the rules. Rather, the problem is the occasional interference of the same government that has now issued an order to expand transparency in the market.

The order of 19 August Raisi has apparently not led to the organization of specific measures by the Ministry of Economy. But shareholders are expected to see changes in capital market rules in the coming days and weeks. A change that Raisi considered to be the cause of people’s confusion, but at the same time he complained about the lack of transparency in this field.

However, according to the pattern of immediate market developments after the issuance of the presidential decree, the stock market index increased by more than 18,000 points on Saturday. But this unprecedented and unusual growth did not last more than a day and the upward trend of the index stopped on Sunday. Now the shareholders are worried that the government will organize measures to change the laws with unprofessional interventions.

According to the government officials, the changes will be in line with reform. But market skeptics are often worried about any unreasonable action by the market.

President’s stock market orders and the damage of government institutions to the market

According to the investigations in this report of the consequences of the president’s stock market order at three different points of time, it can be concluded that the government’s approach to the capital market follows a fixed pattern. A model that is based on “orders” and “shock therapy” from the authorities. in such a way that they try to manage public opinion in the market by interfering in the fluctuation process of the total index.

In the meantime, the government also uses levers to advance its goal, among which we can mention total index engineering with the help of index-making shares. On the other hand, the behavior of lawyers has been strongly affected by the government’s approach at different times. A point that indicates the influence of the government in different parts of the market.

According to most experts, this kind of government intervention will weaken transparency in the market. In other words, if the government intends to strengthen the element of transparency in the capital market, it is better to stop interfering in the affairs of the market before taking any action.

The consequences of such interventions are so devastating that many stock market experts consider the government to be the main cause of the current market situation. This model has existed in the past governments and the 13th government also follows this model completely. Of course, these interventions have been reduced at times, but in most cases, the government’s hand in the capital market has been clearly palpable.

Now, if an order is to be issued to improve the situation of the stock market, it is better to issue an order to shorten the government’s hand from the market. until Chairman’s stock exchange orders or other authorities to influence the market to such an extent. In fact, it should be noted that the situation will not improve significantly as long as strong and effective stock exchange levers are at the disposal of the government.