What is the main problem of the housing market? / The impact of banks’ exit on the market

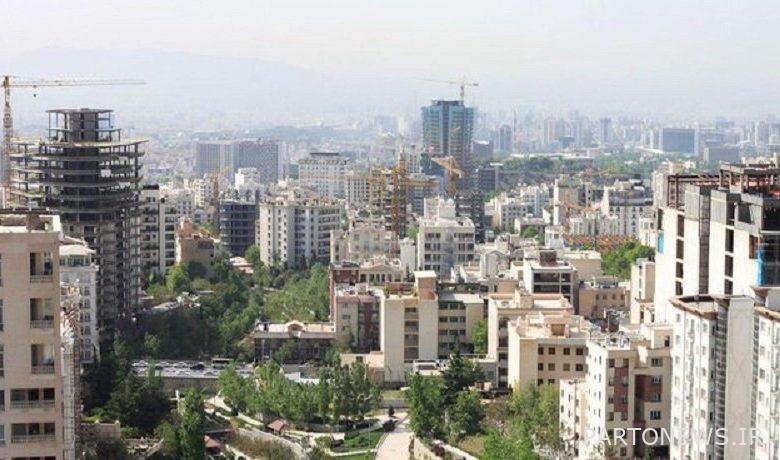

According to Tejarat News, the Central Bank announced the average purchase and sale price of one square meter of residential unit infrastructure in April of this year as 34 million and 200 thousand Tomans. This figure is related to Tehran, but the situation in some other metropolises is not so simple for their residents. Prepared in such circumstances Housing It has become a dream for some families.

Now Tehranians have to save their income for 46 years to buy a 100-meter house. According to international standards, this area is suitable for a family of 3 to 4 people.

In such a situation, experts and activists in the housing market are talking about a recession in this market. Fardin Yazdani, an expert in the field of housing, said that the main problem of this market is the lack of demand and said: Developments in the last 10 to 15 years have shown that whenever there is enough demand and financial resources to buy, the market creates production volume. But whenever it does not exist, the market stagnates.

Regarding the impact of the lack of supply of Mehr housing and national housing on the market, he said: “A lot of housing that enters the market will remain unused as empty housing until there is demand and purchasing power.” Almost all units of Mehr housing are still empty.

The reason for the bank’s presence in the real estate market

In such cases, more than 50% of the banks’ assets are real estate. The result of this situation during the recession is their inability to liquidate assets and, as a result, their overdrafts from the central bank. This situation increases liquidity (IRNA).

Now, while the previous laws and regulations in this area have not been implemented much, a while ago Ministry of EconomyBanned the investment of banks in the field of real estate.

Regarding the presence of banks in the field of real estate, Yazdani said: “One of the reasons for the expansion of the role of banks in the field of housing is that their real estate has been property that they have received due to non-receipt of receivables from debtors.” So they had no choice but to enter this market.

He continued: “Banks’ exit from this market has two meanings, one is not to make new investments or to cash in on investments.” The other part means selling the confiscated property at any price that does not make sense.

Impact of banks’ exit on the market

Regarding the impact of banks’ exit on the market, the expert said: “It does not have much impact on the market because their share of the market is not large.” But banning bank investment, in my opinion, could be a good thing.

Regarding the replacement of banks in the housing market, Yazdani explained: There are some non-governmental organizations and the public sector. Their entry into the current structure is not much different from the presence of banks in this field.

“But in general, there may not be a suitable alternative with their departure,” he said. Given that investing in the sector is not attractive to the private sector due to low profits.