What is the state of the digital currency market on holidays?

Many people believe that the volume of digital currency exchange transactions decreases on the weekends compared to other days of the week; But how true is this view? Does a decrease in trading volume at the end of the week mean a decrease in the net volume of bitcoin inflows to exchanges?

The fact is that the volume of bitcoin transactions in exchange offices decreases more than expected on the weekends; But these days, despite the decline, the net amount of bitcoins entering the exchanges is either fixed or slightly increasing. This pattern is fixed in all bitcoin supercars and bear and cow markets.

Given that trading in exchanges requires the entry of bitcoins into them, some may expect that the low volume of transactions on weekends will also mean a reduction in the input-to-output ratio of bitcoins in exchanges. If so, such a relationship could be important for those traders and investors who use these metrics as a signal of future price changes.

In this regard, with the help of an article from the website The Block, We have dedicated this article to examining the trading volume of exchange offices on the weekends, the amount of bitcoin inflows in these days and the relationship between these two variables. Stay with us.

Data and survey method

In the previous section, we mentioned that the purpose of writing this article is to examine bitcoin transactions on weekends, or Investigate the “Weekend Effect” on Bitcoin Trading Is. To examine the effect of weekends on bitcoin transactions, historical data related to the daily volume of bitcoin transactions (the amount of money transferred between currency pairs in bitcoin) and the net daily flow (difference between the inflow and outflow of bitcoins in exchange wallets) were analyzed. And have been reviewed.

The data of this analysis have been extracted from 7 major exchange offices, from December 1, 2017 (December 4, 1996) to August 24, 2021 (September 2, 1400) with a sample size of 1,454 transactions. It is worth mentioning that the data related to the volume of Hobby exchange transactions were only available from January 18, 2018 (December 28, 1996) to August 24, 2021.

The price of bitcoin is displayed in dollars. As for the data on trading volume and net flow, those that were as much as three units of standard deviation from the overall average were excluded in all exchanges.

In addition, in addition to descriptive statistics, inferential statistics and statistical hypothesis testing were used to determine whether statistical differences over the weekends were valid and generalizable or minor and insignificant numerical differences. Descriptive statistics is a type of statistics that independently examines and describes the characteristics of a collection and its results can not be generalized to other collections; Inferential statistics, on the other hand, examine the ability to generalize the characteristics of a smaller statistical community to larger communities.

Finally, all of these analyzes were performed separately for the entire period, for the two observed super-cycles (before May 2020 compared to May 2020) and for the bear and cattle markets (January 2018 to January 2019 compared to other days). You can see the results of these analyzes in the following sections.

Weekend differences in bitcoin trading volume

First, we look at historical data on trading volume. The chart below compares the average volume of Bitcoin transactions on normal days of the week with the weekends at different exchanges.

An examination of the appearance of this chart shows that in all the exchanges surveyed, the volume of bitcoin transactions on the weekends is lower than on normal days; But to see if the difference between the average trading volume on normal days and on weekends is significant, Wlech’s t-test was used.

Unlike the Student’s t-test, the Welch t-test also considers the deviation of unequal criteria between the weekly and weekend samples.

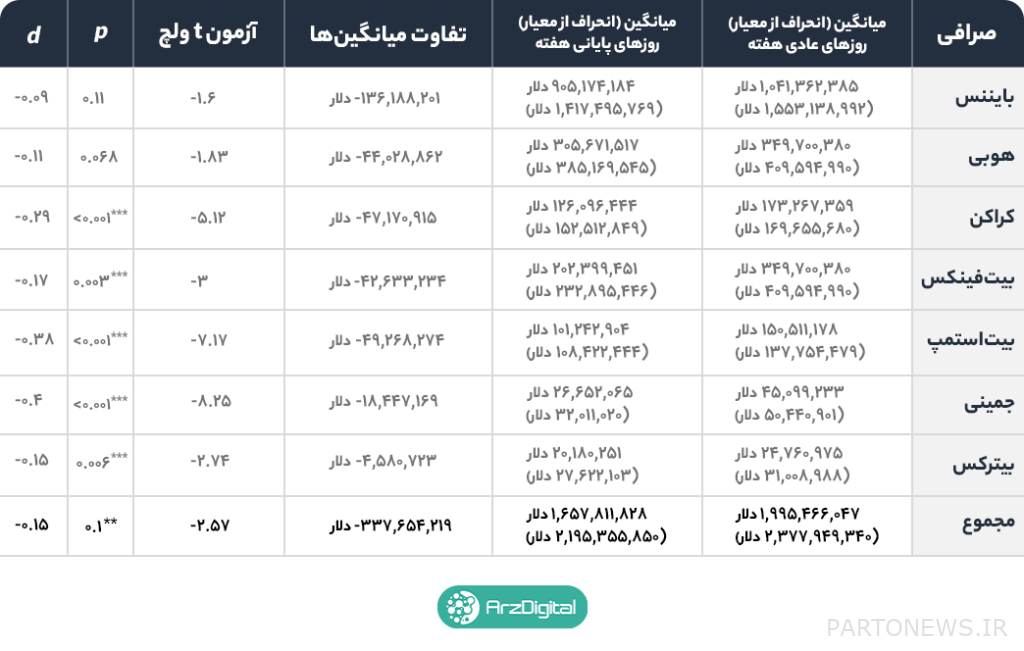

As you can see in the table below, with the exception of Bainance and Hobby exchanges, the effect of the weekend on trading volume is statistically significant in all exchanges.

You can see the exchanges whose difference between the means of the two statistical populations was significant, with the * sign next to their number p.

To take a closer look at the effectiveness of the weekend effect, we can use Cohen’s d effect. The Cohen d effect indicates the standard difference between the two means. Traditionally, if the absolute value of the effect d is equal to 0.2, we consider it small, if it is equal to 0.5, we consider it medium, and if it is equal to 0.8, we consider it large.

In the samples we studied, the effect of d varied from a minimum of -0.15 for the Bitfinx exchange to a maximum of -0.40 for the Gemini exchange; Therefore, it can be considered as a range from small to medium effect size. The total effect size in the total exchanges was -0.15; Which indicates a small overall decline in weekend trading volume.

These results show that in smaller exchanges such as Bitstamp and Gemini, the volume of transactions on the weekend is slightly less than normal days. However, in larger exchanges such as Bainance and Hobby, the high range of changes in the difference between trading volume on normal days and weekends in different weeks makes the difference in trading volume not significant.

However, further analysis shows that the effect of the weekend on the Bainance exchange during the third supercycle (d = -0.29) is greater than the fourth supercycle (d = -0.19) and in bear markets (d = -0.42) larger than the bull markets ( d = -0.11). This pattern is also repeated in the trading volume of total exchanges; That is, the total trading volume of all exchanges during the third supercycle (d = -0.41) is larger than the fourth supercycle (d = -0.21) and in bear markets (d = -0.40) is larger than cattle markets (d = -0.15).

Note, however, that the sample size is relatively small for normal days of the week in the fourth supercycle (n = 133) and bear markets (n = 114). Therefore, we warn you to be careful in interpreting these results.

Differences between weekends during Bitcoin exchanges

Next, we examine whether the net volume of bitcoin inflows to exchanges reflects the volume of transactions. The chart below shows the average net bitcoin flow on normal days of the week compared to the weekends, between September 2017 and August 2021 in each of the exchanges surveyed.

An examination of the appearance of this chart shows that the average net flow in some exchanges (including Bainance) on weekends is lower than normal days; But the opposite is the case in some other exchanges. Therefore, it is necessary to examine whether this difference in means can be validly generalized. In this way, the effect (or ineffectiveness) of the weekend effect on the net flow of exchanges can be understood.

The results of the Welch t test along with Cohen’s d effect are shown in the table below.

The results are different; But what is clear is that the daily net flow of bitcoins does not reflect the volume of daily transactions. In general, the net volume of bitcoin inflows to exchanges at the end of the week is more than the normal days of the week. However, the volume of bitcoin transactions on weekends is less than normal days.

The effect of the weekend is statistically significant only in Hobby and Bitstamp exchanges. This effect is positive in both exchanges; This means that the net flow over the weekend is higher than the normal days of the week.

Wherever the effect of the week is significant, the Cohen d effect indicates a small effect size (from 0.12 to 0.15) but continuous. The net flow of bitcoins in Hobby and Bitstamp exchanges and the total exchanges on weekends is more than normal days. By combining deviations from large criteria, it can be concluded that the net flow of bitcoins On average Weekends are slightly higher than normal days of the week; But this difference is very different in different weeks.

If we consider the differences based on supercycles and market conditions, we see that the effect of the weekend in the third supercycle (d = 0.06) is smaller than the fourth supercycle (d = 0.26) and in the bear market (d = -0.12) is smaller than the market. Is a cow (d = 0.20); This is in contrast to what we saw in trading volume data.

Here again we warn to be careful in interpreting the results; Because the sample size of the fourth superbike and the bear market is relatively small.

Conclusion

People seem to trade less on weekdays than on normal days; But the difference in trading volume is small and strongly depends on the size of the exchange, the super-cycles and market conditions. Also, changes in bitcoin trading volume over the weekend are generally not directly related to changes in bitcoin inflows and outflows to exchanges over the weekend.

It should also be noted that Bainance Exchange behaves differently among the exchanges examined. Bainance, in addition to being the largest long-distance exchange in terms of trading volume, does not have a significant decrease in Bitcoin trading volume on weekends like other exchanges. Also, despite the fact that the net volume of bitcoin flows on the weekends increases significantly compared to normal days in other exchanges, it remains either constant or decreases in the binance exchange.

These findings may come as a surprise; This is because it is generally thought that a decrease in the volume of Bitcoin transactions over the weekend will lead to a decrease in the net flow of this digital currency in exchange offices. One possible reason for this is that traders save bitcoins over the weekend to be ready for weekly trading. Hence, the net flow of bitcoins remains constant or even increases over the weekend. This is while its trading volume increases on normal days of the week.