What properties does the government tax?

According to Tejarat News, after tradesmen and business owners, it was the turn of luxury car and house owners to settle their accounts with the Tax Administration.

Tax Affairs Organization By publishing a notice, he gave a deadline to house owners and luxury car owners to settle their tax debt within a month.

The basis of this deadline is clauses “X” and “S” of the sixth note of the budget law of 1400, which allows the government to collect such a tax.

Which cars are taxed?

At Clause “sh” Note 6 of Budget Law 1401, which is related to the issue of collecting tax from cars, non-governmental persons whose value of cars or cars belonging to their family members exceeds 10 billion Rials (one billion Tomans) are required to pay tax.

This general tax includes cars, vans and two-room cars, and its amount will vary from one to four percent depending on the daily value of the car.

Which properties are subject to tax?

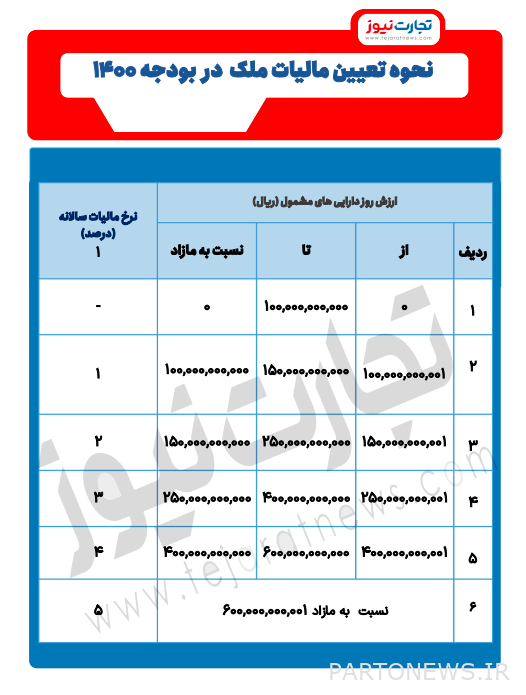

Regarding the housing tax, the basis for collecting this tax Clause “X” From the sixth note of the Budget Law of 1400, based on these regulations, all natural and legal persons whose real estate value is more than 100 billion Rials (10 billion Tomans) are required to pay taxes.

This tax is imposed on all types of real estate from buildings, villas and apartments, and its amount varies from one to five percent of the daily value depending on the value of the property.

The effect of the increase in the inflation rate on tax collection

In the budget of 1400, two thousand four hundred and seventy nine million Rials tax revenue was predicted for the government, compared to the tax revenue of the previous year, it had grown by twenty one percent.

Part of this income goes back to the collection of taxes from real estate owners and car owners, but considering that in the relevant regulations, the criteria for determining this tax is the daily price of the car or property, it seems that as a result of the significant increase in the past year for Inflation rate has happened, this part of the government’s tax revenues will increase significantly.

According to the statistics center of Iran, the inflation rate has experienced unprecedented growth in the last two months and is currently at 54%.

This means that, taking into account the current inflation of the car and real estate market, the property value of more owners and owners is above the tax exemption limit, and as a result, the tax affairs organization will be dealing with more taxpayers.

According to critics and economic experts, this situation is that the increase in the value of the assets of a significant part of these owners is not the result of creating wealth and earning new income, which is the result of inflation caused by the performance of government managers.