When will Ethereum take the place of Bitcoin in the first place of the market? Experts answer

Bitcoin has always been the undisputed leader of digital currencies; But its market dominance has decreased significantly in recent years. Flippening or turning Ethereum into the largest digital currency in terms of market capitalization is an event that fans of this digital currency have high hopes for. Can the significant growth of the Ethereum price in the last month and approaching the update date of this network make Ethereum take the place of Bitcoin in the first place of the digital currency market?

To Report Bloomberg, Bitcoin, the world’s largest digital currency, has always reigned supreme in the realm of digital currencies; But now, thanks to Ethereum’s dramatic rise in popularity, its proponents are predicting that the second-largest token by market capitalization could one day take over the throne and replace Bitcoin as the number one market. In the world of digital currencies, this event is known as Flippening.

Despite the increase of more than 60% in the price of Ethereum in the last month, the market value of this digital currency is still less than half of Bitcoin, about 240 billion dollars. However, fans of the digital currency are happy to be approaching a milestone that increases the likelihood of flipping.

Mati Greenspan, founder and CEO of Quantum Economics, says in a note written in the vernacular of digital currency users:

I keep hearing people ask the question, when does flipping happen? While there is no guarantee that this will ever happen, if we were to go by the numbers alone, it seems that we are getting closer and closer to when this event will happen.

After the introduction of Ethereum in 2014 and its launch the following year by Vitalik Buterin, the developers of this project presented it as a better version of the Bitcoin blockchain. The Bitcoin White Paper was also introduced in 2008 by Satoshi Nakamoto (pseudonym of the person or group who developed Bitcoin).

The increase in optimism in recent weeks, regarding the Ethereum software upgrade, which is moving from a mining-based system to a system with less energy consumption and based on staking, has caused the price of this digital currency to increase. The change to the proof-of-stake mechanism is expected to take effect in September this year after several years of hiatus. Recently, the developers of Ethereum have announced the continuous progress in the process of testing this new system, and they are going to hold a series of events for investors and other members of their community in the coming weeks.

QCP Capital, a cryptocurrency trading platform, says it has seen a surprising increase in Ethereum call option trading volume over the past few days, with hedge funds being among the biggest buyers. “We expect this volume of demand to continue as we approach Ethereum’s September Proof-of-Work to Proof-of-Stake merger,” they wrote on their Telegram channel in the market news section.

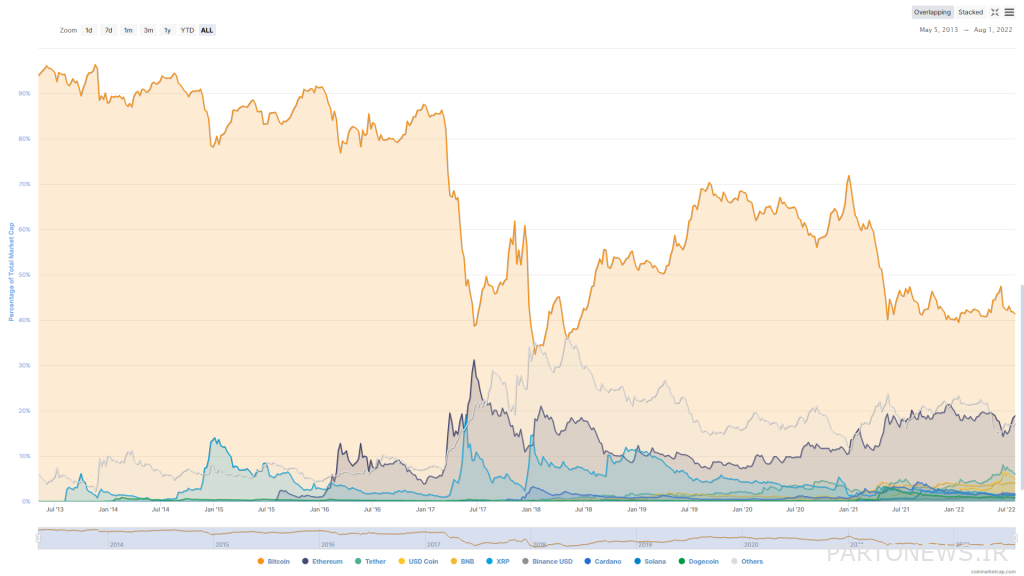

From the middle of June (end of June) until now, the price of Ethereum has increased by more than 60% and the value of assets related to it has also increased. Data collected by Bloomberg shows that the price of UniSwap, the native token of the most popular decentralized exchange of the Ethereum network, has increased by about 70% over the past month. At the same time, the dominance rate of Bitcoin has also decreased from around 70% in January last year (December 2019) to around 40%.

Joe DiPasquale, CEO of BitBull Capital hedge funds, says:

We like Ethereum and think it stands out from other cryptocurrencies. Bitcoin has so far appeared to be a big deal; But Ethereum is also really powerful and can outlast everything else.

DiPasquale said last week that he increased his investment in Ethereum, and his company, which holds Ethereum, bought some of this digital currency when the price of Ethereum rose from $1,000 to $1,500.

Bodhi Pinkner, an analyst at Arca Capital Management, believes that the possibility of flipping is very high.

He says about this:

We are optimistic about the future of Ethereum. Anti-inflation of Ethereum [پس از ادغام] It could lead to an increase in its price against Bitcoin on paper; Especially in the current situation where countries have adopted contractionary monetary policies.

If Ethereum takes the place of Bitcoin, we will not face a new and unexpected event. The digital currency community has long been looking for signs of the emergence of other projects or tokens that could reduce Bitcoin’s dominance of the market. Ethereum integration has been in the works for years, and the project has been delayed many times. Even when we expected it to be done in June, it was delayed once again.

Read more: What is Bitcoin Dominance? Everything about Bitcoin Dominance

Matthew Greenspan believes that the Ethereum merger itself is a high-risk event and that anything can go wrong.

He said in this regard:

As always, more risk means higher returns in the market. However, many users do not consider Ethereum integration to be a risky business and in their opinion it will be simple and safe to implement.

Henry Elder, head of Wave Financial’s Defy platform, agrees.

He said:

They have been overhyped on the price impact side of the Ethereum merger. This will be a very significant change in Ethereum technology, but 99.99% of users will not experience any difference for months or years. It will take some time for the reduced supply and reallocation of Ethereum to affect its price.

He also noted that the impact of Bitcoin’s halving process, a pre-planned update that halves miners’ mining rewards every four years, will last several months in the market.

Elder says about this:

I won’t be surprised if the price of Ethereum increases after the implementation of the merger; But I don’t think that this event will have a lasting effect on the price until the second half of 2023.