Which divisions have good investment opportunities?

The DeFi industry did not grow as it should after it became so pervasive in the summer of 2020 until the first quarter of 2021. Now that investors are trying to assess the downtrend or downtrend of the current market trend, it is a good opportunity to examine the situation in the field of defense and find protocols that may work well in the future.

Based on that Report According to the Kevin Telegraph website, we will take a look at the top sections and protocols of the defense industry and the strategies of the users of these protocols.

Stable coins are the basis of Defy

Stable coin diff protocols are the cornerstone of this ecosystem, and when it comes to stacking stables, curves are still the most important protocol in this sector.

Data from the Defi Llama analytics website shows that four of the top five protocols in terms of total value of locked capital (TVL) are dedicated to creating and managing stable coins.

It should be noted, however, that while these protocols top the table in terms of the value of total locked-in capital, the value of most of their native tokens is a long way from their 2021 peak.

The bottom line is that when investors invest in the defense industry through Yield Farming and shareholding of stable coins, they also get a steady return. In addition, these investors receive government tokens from these platforms and can use them to offset the loss of value of their other tokens.

Stable coins continue to play an important role in the overall performance of the defense industry. It is worth noting that with the growth of the value of the total capital locked in new protocols such as Frax Share and Neutrino, as well as with the increase in the number of interconnected Chinese blockchain networks, the defense industry can continue to grow.

Also read: The most comprehensive defense training; From garlic to onions decentralized platforms

Lending is at the heart of Defay’s activities

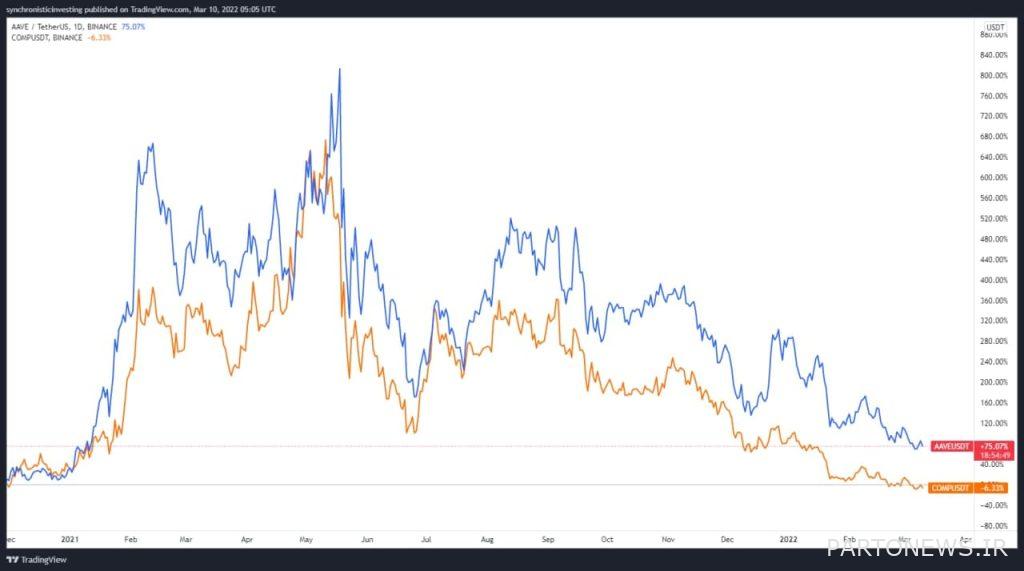

Lending platforms are another key component as well as one of the most important parts of the Defy ecosystem that investors can use even in declining markets. The AAVE and Compound protocols are the current leaders in the field of lending, with a total locked-in capital value of $ 12.09 billion and $ 6.65 billion, respectively.

Like other Stable Quinn protocols, the value of Avi and Compound native tokens peaked in 2021, and to date the price trend for both has been declining.

The growth in the value of the total locked-in capital of Avi and its price overtaking of Compound has been mainly due to the inter-chain cooperation with Paligan and Olench networks. With the formation of this cross-network connection, the number of assets supported in this protocol has increased and AVI users no longer have to pay high fees for the Atrium network.

Long-term investors in risk-averse digital currencies can easily lend their tokens and make a modest profit.

Sharing increases defy applications

With the increasing popularity and application of digital currency sharing protocols, more traders are using the defa industry. For example, the Lido Finance Sharing Protocol was initially set up as a Chinese blockchain solution for Atrium Shares; But now it also supports tokens Luna, Solana, Kusama and Paligan.

Defai Lama data show that with the increase in the number of new digital currencies supported in the Lido protocol, the total value of locked capital in this protocol has also increased and reached its historical peak of March 14. (March 19), ie $ 14.96 billion.

In the Lido protocol, users can share Atrium and Solana and receive “stETH” and “stSOL” tokens in return. These tokens can be used as collateral in the AVI protocol to borrow stable coins. In addition, traders can use or trade these tokens in the profit-making process. In this way, their overall return on the principal equity is increased.

Other notable protocols active in the field of shareholding include StakeWise, which also allows its users to share in Atrium 2.0. Stader Labs and pStake are some of the relatively successful protocols in this area.