Who are the shareholders of the commodity exchange?/ The threat to the profitability of pension funds due to the withdrawal of industries from the commodity exchange

According to Tejarat News, Mehrdad Bazarpash made a claim in a group of journalists that the commodity exchange has raised the price of steel and cement; He had threatened to talk about who are the shareholders of the commodity exchange and how the commodity exchange was formed later! But it must be said that threatening words are not necessary to clarify the shareholders of the commodity exchange; Because the capital market and all its elements are placed in a glass room and access to company information in this glass room is possible for everyone.

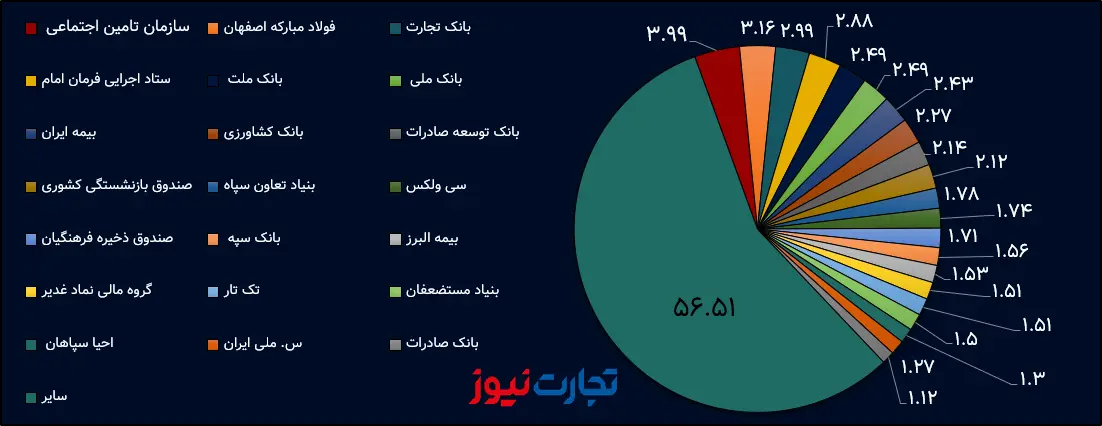

Commodity stock exchange shareholders composition

To check the commodity exchange, it is enough to look at its shareholders’ page with the “commodity” symbol on the exchange website. According to this page, Mellat Financial Group is the largest major shareholder of this company, having 2.47% of the shares of the stock market.

Based on what is clear in the above diagram, the other two major shareholders are “Kala” Iran Insurance Company and Tamman Capital Insurance Company, each of which has acquired about 2.38 and 2.12 percent of the company’s shares.

Consolidated shareholders

On the other hand, the titles of the consolidated shareholders of the Commodity Exchange are different. Because Fars and Khuzestan cement companies, Petrochemical Industries Investment, and several other companies are considered to be subcategories of the Social Security Organization. In this way, the Social Security Organization is considered to be the largest consolidated major shareholder of Commodity Exchange by taking over 3.99% of Commodity Exchange’s shares.

Also, Isfahan Mobarake Steel Group, which owns Tokafolad Investment, Mines and Metals Development and several other companies, is another major shareholder of Commodity Exchange. So that 3.16% of the shares of the commodity exchange are in the possession of Foulad Mobarakeh.

Among the other major shareholders of the Commodity Exchange, we can mention the National Pension Fund, Farman Imam Executive Headquarters, Revolutionary Guards Cooperation Foundation, Farhangian Reserve Fund, and Mustafafan Foundation.

The threat of income of pension funds and educators

It is interesting to say that a large part of the income of the National Pension Fund and the Farhangian Reserve Fund depends on the shareholding. Now, if the profit of the commodity exchange decreases, the income of these funds will also decrease drastically.

It should be noted that a large part of the Commodity Exchange’s income comes from providing services such as the right to list the offered goods, the membership fee of brokers, the income from transaction fees and the right to accept goods and warehouses. Now, if it is assumed that cement and steel, which are two important elements in commodity exchange transactions, are removed from this field. What will happen to the income of the commodity exchange?

With the decrease in the income of the commodity exchange, the dividend of the pension fund and the educators will also decrease, which means that the withdrawal of steel and cement will indirectly affect the income of those who are members of these funds.

In addition, the withdrawal of two important products such as cement and steel from the glass room of the commodity exchange will be the cornerstone of the road that leads to the dark room of rent and economic corruption.

Read more reports on the capital market page.