Why did Luna fall and what will be its future? Everything you need to know about Tera’s collapse

Two weeks ago, one of the most controversial crashes in the history of digital currencies took place, following which the price of Luna and “UST”, the main tokens of the Terra network, dropped to near zero in a few days. Luna, which recently set a new price record near $ 120, is now trading at around $ 0.0001, and the so-called stable UST digital currency is now worth $ 0.05!

Digital Currency Exclusive – Last week there was intense tension and anxiety among digital currency traders, and everyone was somehow shocked by the unprecedented fall; But what brought the Terra network and the Luna and UST tokens, once the market-leading currencies, to what is now considered a dead project in less than a week?

To answer this question, we first need to get a little familiar with how UST, the StableCoin Network, works, and then move on to the reasons and hypotheses associated with this historic crash.

What is UST and what does it have to do with Luna?

As you probably know, the stable value of dollar coins should always be approximately constant and equal to 1 US dollar, and large fluctuations in the price of these digital currencies are not uncommon. There are many types of stable coins, and well-known examples, such as the Tetra (USDT), are backed by Fiat; This means that for each unit of tetra in the market, $ 1 in cash (or equivalent securities) is stored in the treasury of this digital currency.

The UST token, however, unlike the Tetra, is an algorithmic stable coin and is not supported by Fiat currencies. Algorithmic stable coins can be said to be the most complex type of stable coins whose value is controlled using special algorithms and intelligent contracts. These algorithms automatically increase or decrease the UST supply in the market, thus keeping the price of this stable coin always equal to one dollar; But what happened that caused Tera’s network to lose its balance to maintain UST value?

To keep the UST value constant, the Terra protocol relies on its native token, Luna, and uses the mechanism to multiply and burn dual tokens; This means that if the UST price deviates from the US dollar, it allows UST and Luna holders to exchange the two currencies with the network system for a price of one dollar per UST.

Simply put, when the UST is worth less than a dollar (ie, demand is less than supply), UST holders can seize the opportunity and burn one UST token, equal to one dollar of the Luna token (newly multiplied) from Receive system and make some profit. Also, if the UST price rises above one dollar (ie when demand exceeds supply), Luna holders can burn their tokens and receive the UST (newly multiplied) token equivalent of the dollar value from the system to Balance again.

Also read: What is China Terra Block and LUNA Digital Currency?

What caused Luna and UST to fall?

This system seems perfect at first glance; But the problem starts with the fact that the cross-sectional decline in UST prices is tied to an increase in supply around Luna, and an increase in supply means a gradual decline in the price of this digital currency. This means that if a large amount of UST was once for sale, naturally Luna would have to experience a significant price drop.

On May 7, 2022, this happened, and in an unprecedented move, $ 2 billion worth of UST tokens were taken out of the Anchor Protocol and several hundred million dollars were immediately sold. Anchor used to be the heart of the Terra ecosystem, and when the UST market value was approximately $ 18 billion, about $ 14 billion, or more than 70% of the total USTs on the market, were subscribed to the protocol. The reason for the high shareholding in the protocol anchor was the seductive annual profit of 20% that the protocol paid to UST shareholders.

This heavy sale, considered by many to be a deliberate and planned attack, quickly pushed the UST price below $ 1; But that was just the beginning. Despite the high volume of USTs sold, no one at first considered this a serious threat, and many expected traders to gradually curb this selling pressure by converting their USTs to Luna on the Tera network. The second problem, however, was that the design of the tera network algorithm was closed to users, and they could only trade UST $ 100 million in 24 hours for newly hit lunas. The third problem was those UST holders who, for fear of a further fall in the value of this stable coin, put their tokens up for sale and accelerated the fall in UST prices.

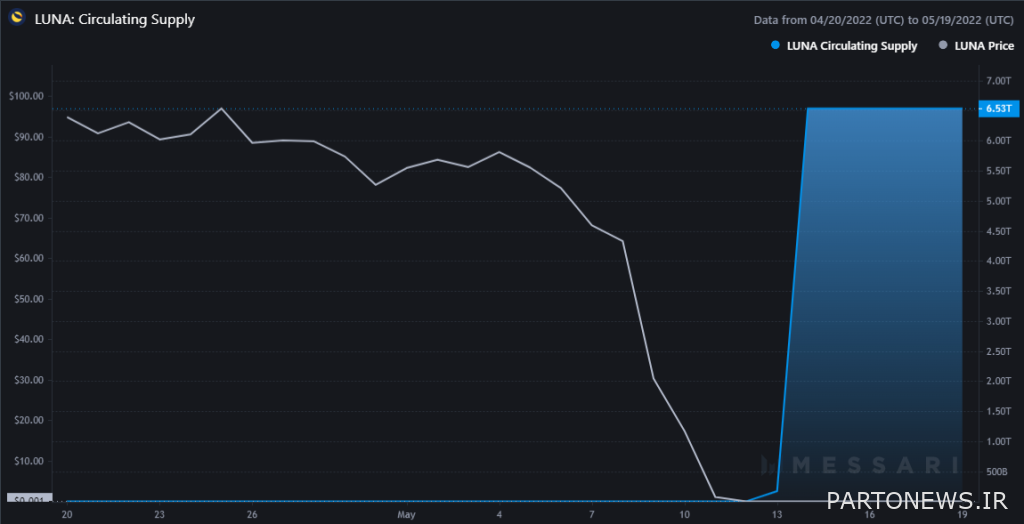

These events together led to the formation of a crisis in the Terra network, which coincided with the fall in the value of the UST, the supply of Luna’s turnover in less than three days, from about 370 million units to an incredible 6.53 trillion (6.530 billion) units. رساند. As the catastrophic increase in the number of circulating units turned the Luna into a worthless token, the digital currency also lost its ability to maintain the UST dollar value, and the price of this stable coin continued to fall even faster; As of today, the Luna is priced at around $ 0.0001 and the UST at around $ 0.05.

Those who see this as a planned attack believe that the attacker’s goal was to sell a large amount of UST all at once, to make a profit from the price reduction (short trading) and to manipulate the Bitcoin market; But what does this have to do with bitcoin?

If you’ve been following the news of digital currencies in recent months, you probably know that the Luna Foundation has been buying large quantities of bitcoins for some time, and its purpose in doing so was to provide financial support for the UST. This means that if the UST price falls below $ 1, the bitcoins will be sold if necessary and UST will be used to buy the proceeds to bring the market back to equilibrium.

The attacker may or may not have been familiar with the mechanism, knowing that if they could bring the UST price below one dollar so that your network would be in an emergency, the Luna Foundation would have to sell its bitcoins to maintain its stable coin value. . With the Luna Foundation holding 80,394 ($ 2.4 billion) worth of bitcoins, selling this significant figure could cause the value of this digital currency to plummet.

The same thing happened, and the Luna Foundation confirmed that it had sold 80,081 units, or 99% of its bitcoin reserves, to maintain UST value. From May 7, when the price link between the UST and the US dollar was broken, to May 12, when the market stabilized slightly, Bitcoin also lost about 30% of its value, and at the lowest The level was priced at $ 25,400.

What fate awaits Luna?

Since the emergence of the network problem to date, the community has made many proposals for the recovery and revitalization of its ecosystem, two of which have received more attention than the other options; The first is token burning and the second is the launch of a new fork from the Terra network, which is the founder of the fork, the idea supported by Do Quan, the founder of the Terra network.

Proponents of the token idea argue that members of the Tera community should burn Luna’s surplus supply, which was once 300 million units and now stands at more than 6 trillion units, out of the network cycle to restore the value of this digital currency.

The plan of the two Quans, however, is to build a new fork from the Terra network and then call the current Terra Classic network and the new Terra China blockchain. The old Luna Classic network tokens and the new network tokens will also be called Luna, with a total supply of probably one billion units, and will be used to compensate for damage to Luna and UST holders. At the same time, according to the proposal of Do Quan, in the new network, there will be no more news about UST and stable algorithmic Quinns.

voting The formal and in-network implementation of the two-kuan proposal started 3 days ago and will continue for another 4 days. So far, about 63 percent of participants agree, 17 percent oppose the plan, and the remaining 20 percent abstain. If the share of those who oppose the proposal of the two Quans and have the right of veto exceeds 33.3%, the implementation of this plan will not be approved. It is worth mentioning that some of the validators of Terra Network have not participated in this poll yet and therefore the final result may be different from the current statistics.

Also read: What is a fork? Simple definition of hard forks, soft forks and their impact on price + video

If the plan is finally approved, we will have to wait for more details on when to launch the Fork Terra and how to compensate Luna and UST holders. Of course, Do Cowan said that if the validators agree, they can launch a new version of the Terra network by May 27 (June 6). On the other hand, if the idea is opposed, the token offer will probably be considered more seriously this time around, and other new initiatives may be proposed in your community.