Why do most cryptocurrency traders lose money? ChatGPT Answer + Risk Management Methods

The sentence “95% of active traders in the financial markets end up losing”, true or false, is one of the most used statistical references among traders, long-term investors and financial market activists in general, and that’s why people are not surprised to hear it.

There are various estimates and studies about the percentage of people who suffer losses from activities in the financial markets. Together, these various reports show that between 50 and 90 percent of traders in traditional financial markets such as Forex and stock exchange suffer a total financial loss during their activity.

Some experts believe that the real figure can be even higher than 95% and it can be said that everyone has come to the conclusion that it is impossible to measure an exact rate for this subject. Like traditional financial markets, for the digital currency market, there is no accurate and verifiable statistics of the percentage of people who make losses from digital currency trading, but some experts say that due to the risks involved in the activity in this newly formed market, this rate can be about traders that only buy and sell digital currency, even more than traditional markets.

The common point among all these reviews is the fact that most people who enter the financial markets with the hope of making a profit from their capital, end up leaving the market after losing part of their capital.

As for cryptocurrency traders, what are the reasons why most traders leave the market at a loss, and what can people do to minimize their long-term losses?

To get the answers to these questions, we have gone to the noisy artificial intelligence of “OpenAI” company, namely “ChatGPT”, which has simple but practical tips for traders. Read more about my conversation with ChatGPT about the reasons why cryptocurrency traders lose.

+ Why do most cryptocurrency traders lose money?

ChatGPT’s response: People lose money in digital currency trading for several reasons, some of which are:

1. Lack of necessary knowledge and understanding: Many people enter this space without having full knowledge about the functioning of digital currencies, their infrastructure technology and other factors affecting the price of these assets.

2. Involving emotions in trading: Cryptocurrency trading can be influenced by emotions and many traders make rash decisions due to fear, greed or unfounded hope. This behavior usually leads to buying at the top and selling at the bottom, resulting in heavy financial losses.

3. Using excessive trading leverage: Some traders use high trading leverage to increase their profit in trades and this makes their possible losses even heavier. If the market moves against their expectations, they may be forcibly liquidated or face a margin call.

4. Poor risk management: Without a proper risk management strategy, traders expose themselves to the risk of heavy losses; Especially in volatile markets.

5. FOMO (fear of missing out): Many traders get caught up in the hype of a particular cryptocurrency and buy at price peaks. These people in the future [احتمالاً] They will witness the fall in the value of that particular currency and will suffer a significant loss.

6. Scams and Frauds: The cryptocurrency market is vulnerable to frauds and scams, and some people have lost money by investing in fraudulent projects.

7. Hacking and security threats: Exchanges as well as digital currency wallets can be targeted by hacker attacks and that is why some people lose their capital due to security flaws.

ChatGPT’s answer to this question ends with this sentence:

It is important for traders to educate themselves, have a thorough understanding of the market and its dynamics, and implement a proper risk management strategy to reduce the likelihood of heavy losses.

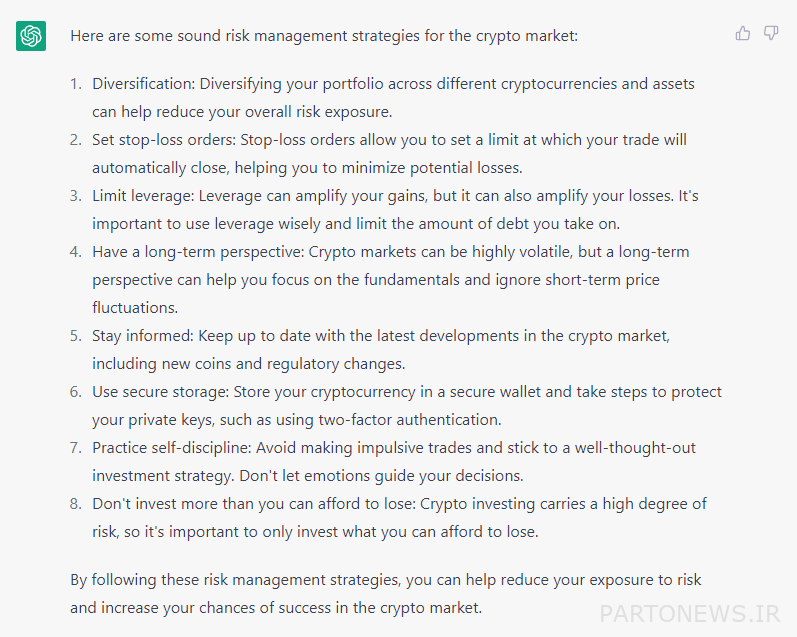

+ What methods are suitable for risk management in the digital currency market?

ChatGPT’s response: Some of the risk management methods in the digital currency market are:

1. Diversify your investment portfolios: Diversifying your investment portfolios by dividing your capital between digital currencies and different assets can reduce the overall risk of operating in this market.

2. Set a loss limit for trades: Applying a stop-loss limit for trades allows you to set a limit for automatic closing of your order and reduce the possible loss of your trade.

3. Use trading leverage in a controlled manner: Trading leverage can increase your trading profit, but on the other hand, it may also increase the loss of your activity. You should use trading leverages in a rational way and keep your debt limit.

4. Take a long-term view: The cryptocurrency market can be highly volatile, but a long-term view can help you focus on the fundamentals and ignore short-term price ups and downs.

5. Stay up to date: Follow the latest developments in the digital currency market, including new currencies, as well as legal changes.

6. Use secure wallets: Store your cryptocurrencies in a secure wallet and take steps to protect recovery phrases. [و همین طور رمز عبور حسابهای مهم] Do it yourself, one of which can be the use of two-factor authentication.

7. Practice self-discipline: Avoid impulsive and mindless trading and instead stick to a logical trading strategy. Don’t let your emotions influence your decisions.

8. Don’t invest more than you can afford to lose: Investing in cryptocurrencies carries a lot of risk, so you should invest only the amount you can afford to lose.