Why should not digital currency traders care about changes in inflation in the United States?

Many analysts believe that the unprecedented high inflation in the United States is affecting the acceleration of the digital currency market, and there is even a certain correlation between the performance of Bitcoin and other financial markets. However, the comparison of the available data shows the opposite of this theory and violates any long-term correlation.

To Report Kevin Telegraph, analysts and market experts, whenever important economic data is published, they try to relate it in some way to the performance of prices in the financial markets, which of course is also common in the digital currency market.

Traders were quick to find a significant correlation between this data and the price of digital currencies after the US Bureau of Labor Statistics reported a 7.5 percent increase in the Consumer Cost Index (CPI) on February 10. However, the correlation of different indicators in recent years shows that investors should carefully examine the relationship between bitcoin and the main economic indicators.

Given that most assets are not traded 24 hours a day, experts usually advise traders to ignore daily fluctuations in their investments.

Most importantly, the Bitcoin order book in various exchanges has a smaller volume compared to gold, the “WTI” oil index and the “S & P500” index. Even if we consider stable coin trades, the 7-day average of bitcoin trades is $ 7 billion, compared to about $ 54 billion for the three largest S&P 500 funds.

In short, the inflow of capital from a large corporate order can easily affect the digital currency market in the short term; But the impact of this amount of money on oil, S & P500 and gold indices is less.

Is it possible to predict inflation with the price of Bitcoin?

Bitcoin fell to $ 43,200 after the news of a 7.5 percent increase in the US Consumer Expenditure Index, one of the main tools for measuring inflation in the United States; An incident that led CNBC experts to link the two events.

Cyanobci had correctly assessed market conditions at the time; But it is better to use a longer time frame to analyze economic data. In addition, Bitcoin is likely to have no price correlation associated with this index, and such a hypothesis certainly needs to be tested.

The long-term comparison of bitcoin prices and inflation in the United States provides a misconception of correlation and correlation, especially when using logarithmic charts.

In any case, Bitcoin forecast this economic data about three months earlier. Bitcoin climbed above $ 11,000 in September 2020, while inflation figures remained below 1.5 percent and later rose in May 2021.

After that, the growth of bitcoin stopped and could not break the resistance level of $ 60,000, while the growing trend of the consumer spending index, two months later in July (July) stopped at 5.4 percent.

For those who rely on mathematical formulas, the correlation coefficient between the price of Bitcoin and inflation in the United States has fluctuated between positive 95% and negative 94% over the past 12 months. Therefore, from a statistical point of view, linking them does not seem very logical.

Is Bitcoin Really Correlated with Other Financial Markets?

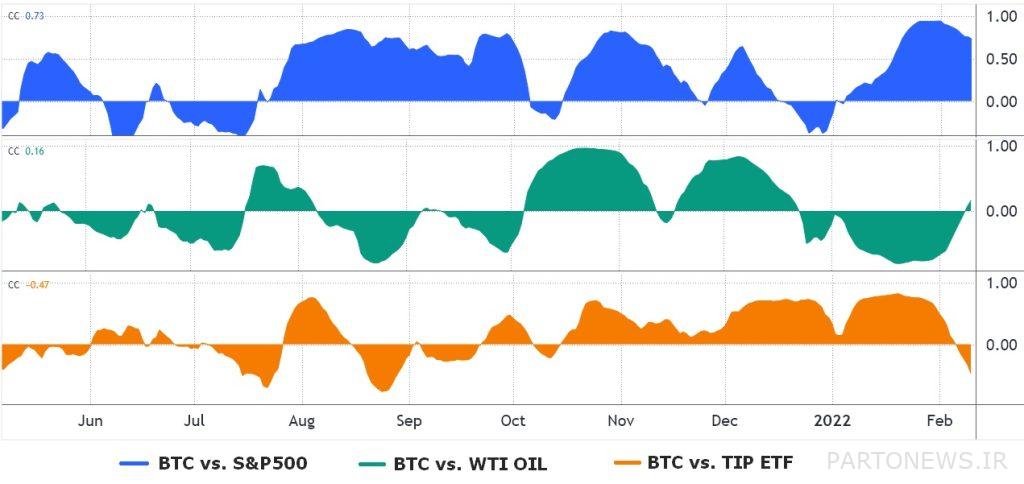

Another common misconception among digital currency traders is that bitcoin is correlated with other assets. In a one-year period for several months, the correlation of these indicators may have been 65% (positive or negative); But different data at different time intervals show something else.

For example, between August and September (September to September) 2021, the S & P500 correlated with Bitcoin averaged 65%. However, talking about this data is a kind of aggregation of information; Because longer time periods show no evidence of correlation.

To date, no price link has been found between Bitcoin and other major assets such as oil and iShares inflation-free bond ETFs. These assets follow an index consisting of US Treasury anti-inflationary bonds.

Various data show that investors should ignore daily price movements after the release of economic data; Because sometimes, data creates a false picture between correlation and causality.

Although inflation or other data affect the short-term price trend, they may not necessarily affect the main trend. Comparing the correlation chart of Bitcoin with traditional markets almost assures us that Bitcoin is a special asset and follows its trend.