10 predictions for 2024 digital currencies; $80,000 Bitcoin and Taylor Swift’s NFTs!

The American asset management company Bitwise (Bitwise), which specializes in digital currencies and is considered one of the largest American groups active in this sector, recently unveiled its 10 predictions for 2024 for the digital currency market in a report. The breaking of the historical record of the price of Bitcoin in the coming year is among the predictions of the experts of this institution.

The article you are reading below is a translation of an excerpt from Report “10 Cryptocurrency Predictions for 2024” is from Bitwise Institute.

2023 was a great year for digital currencies. Prices recovered from the bottoms of 2022, and major currencies such as Bitcoin and Solana have returned 128% and 495%, respectively, since the beginning of this year. In addition, a number of major financial institutions in the world, including BlackRock, Fidelity and Franklin Templeton, made their presence in this market stronger.

For us, the future looks brighter than this. We recently gathered Bitwise experts to take a look at the year 2024 for digital currencies. Our final take is this: We believe that we are now at the peak of the era of “digital currencies becoming mainstream”; A period in which digital currencies come out of the shadows and establish their place in the real world for a long time.

10 Crypto Predictions for 2024

More precisely, what do we predict for 2024? In the continuation of this report, you will read 10 predictions of Bitwise experts about the events of 2024 in digital currencies. These items are all predictions and informed estimates of our experts, but note that there is no guarantee of their occurrence. The future is complex and achieving these predictions depends on many factors. So, none of the things you read below are investment recommendations. These 10 predictions are:

- Bitcoin price crossing 80 thousand dollars

- Launch of the first Bitcoin Cash ETF

- Doubling the income of the Coinbase exchange

- Overtaking stablecoins from Visa

- Tokenization of a fund by JP Morgan

- Doubling of Ethereum network revenue

- Release of Taylor Swift NFTs

- Acceptance of digital currencies by artificial intelligence tools

- Welcome to cryptocurrency-based prediction markets

- A sharp drop in fees on the Ethereum network

Bitcoin passing 80 thousand dollars and breaking the historical record

Bitcoin has outperformed all major asset classes in terms of price growth in 2023, experiencing a 128% growth. Meanwhile, in this time period, the S&P500 index, gold and bonds have yielded 22%, 12% and 2%, respectively.

Two drivers will help Bitcoin reach the price level expected in this forecast. The first case is the launch of the first bitcoin cash ETFs in the United States, which is expected to happen in early 2024 and can lead to the entry of a new wave of micro capital as well as large institutional capital into the market and thus increase the demand for this digital currency. The second case is the halving in front of Bitcoin, which will happen in April 2024 (April 1403) and will reduce the supply of new Bitcoin units by half. At current prices, this change equates to a $6.2 billion reduction in new units entering the market each year.

More demand? Less supply? Calculate yourself.

Launching the first bitcoin cash ETFs in America and recording the most successful launch of exchange funds in history

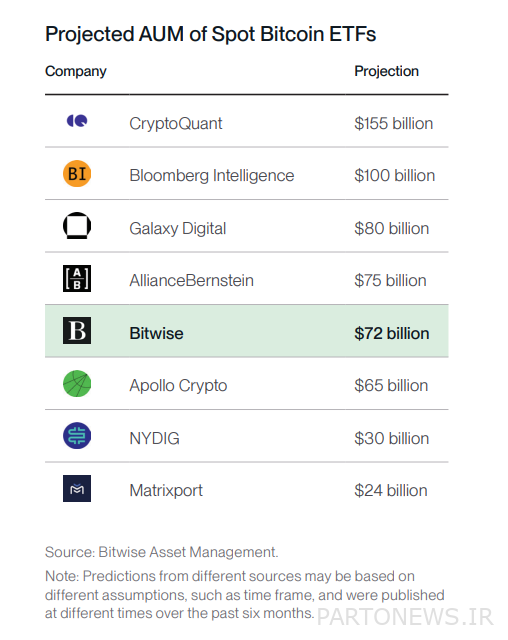

Bloomberg analysts say there is a 90% chance of launching America’s first bitcoin cash ETF in 2024. Of course, Bitcoin ETFs need to do more than launch and attract significant capital if they are to make a serious impact on the market. Our studies show that Bitcoin cash ETFs can capture 1% of the $7.2 trillion US stock market over 5 years, which is equivalent to $72 billion. The interesting point here is that our estimate of this share in the future is among the lowest available estimates.

[گفتنی است بیتوایز خود جزو شرکتهایی است که برای راهاندازی یک ETF نقدی بیت کوین در بازار بورس آمریکا درخواست ثبت کرده است.]

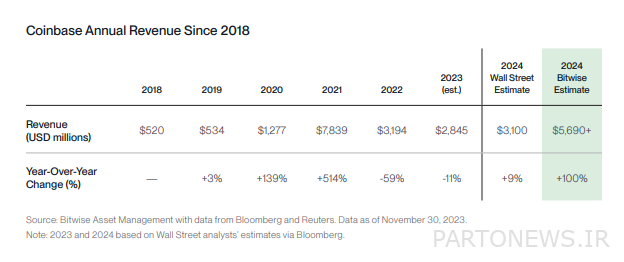

Doubling the income of the Coinbase exchange

The income of the American digital currency exchange Coinbase in 2024 will be double that of 2023. The percentage of revenue changes of this trading platform in 2024 compared to the previous year will also be 10 times the Wall Street forecasts.

The increase in the volume of Coinbase transactions during the bull market, the launch of new products by the Coinbase team, including special products for trading in the futures market, Base layer 2 network, On-chain identity and the role of Coinbase as a custodian. (Custodian) Most of the Bitcoin ETFs are all among the things that Wall Street did not pay attention to in its forecast.

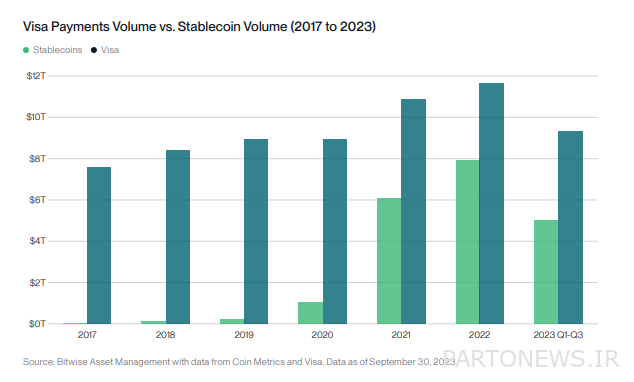

Overtaking stablecoins from Visa

The amount of money transferred with stablecoins will surpass Visa. This may seem a bit strange, but statistics show that we are closer than you might think.

Tokenization of a fund by JP Morgan

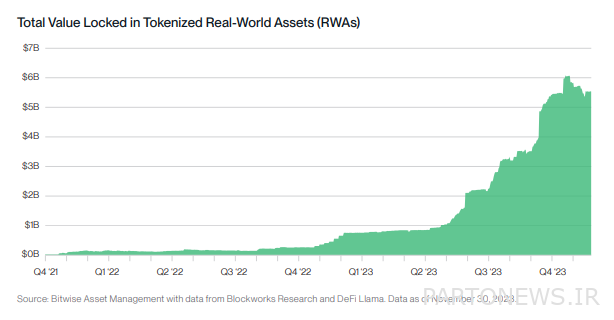

American bank JP Morgan will tokenize a fund, and Wall Street will turn to tokenizing real-world assets. Currently, 5.5 billion dollars of real world assets such as goods, shares, real estate, etc. have been tokenized on the platform of blockchain networks. The Global Financial Markets Association (GFMA) also predicts that the market value of real-world tokenized assets will reach $16 trillion by 2030.

JP Morgan, as the largest American bank, has been active in this field for the past years and has recently tested tokenized portfolios on the Avalanche network. Tokenizing a fund in 2024 will allow them to take advantage of the efficiency of blockchain assets and simultaneously tap into a market that is growing exponentially.

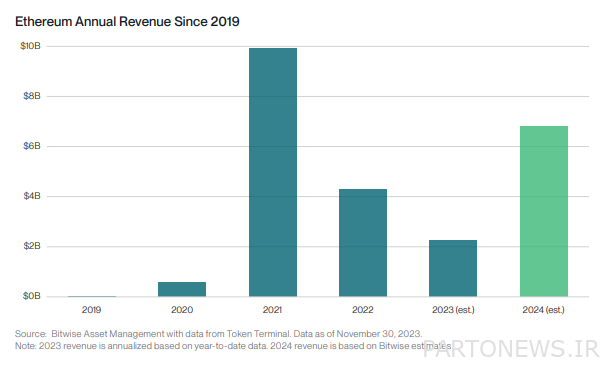

Doubling of Ethereum network revenue

Ethereum network revenue will double to $5 billion by 2023, and more users will be attracted to decentralized applications. The Ethereum network’s revenue from fees will be around $2.3 billion by 2023 and is expected to at least double in the coming year as decentralized applications become mainstream, making Ethereum one of the best large-scale platforms in the world. Convert growth rate.

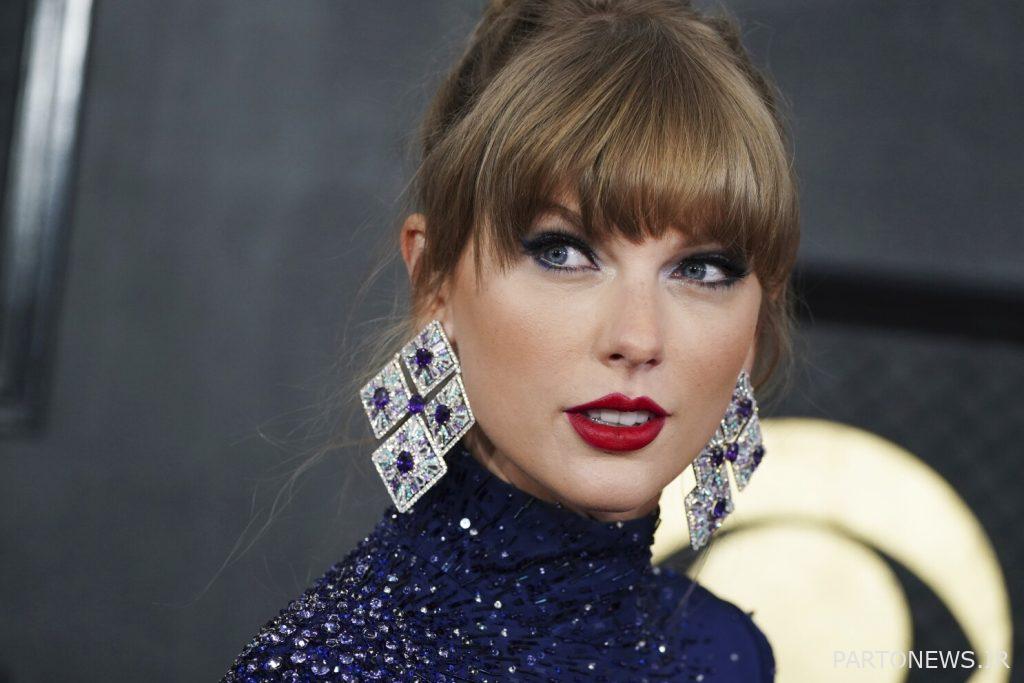

Release of Taylor Swift NFTs

Taylor Swift, the star of the American music industry and one of the most popular artists in the world, is known for innovation and exemplary interaction with her fans. In 2023, he recorded more than 26 billion streams on Spotify, more than any other artist. Spotify is now testing music playlists that require users to have a specific NFT to listen to. But could Taylor Swift be launching her own NFTs? Nothing like this can make NFTs a global trend.

Acceptance of digital currencies by artificial intelligence tools

Artificial intelligence-based tools will start accepting digital currencies to sell their services online. We imagine that the developers of these tools will prefer Internet-native digital currencies to traditional currencies. Of course, we expect this to happen on a small scale in 2024.

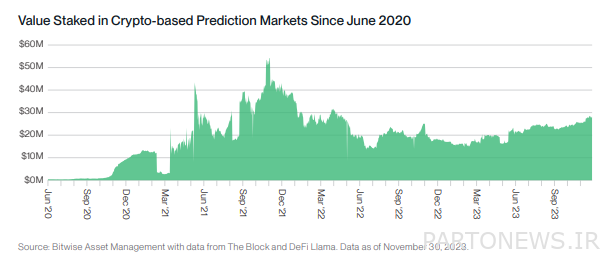

Welcome to cryptocurrency-based prediction markets

Currently, you can bet on events such as the outcome of the US presidential election or the approval date of Bitcoin Cash ETFs in certain prediction markets, such as Polymarket, which operate using digital currencies. Prediction markets have been around for a long time, but digital currencies have brought these platforms to a new level, which is borderless, not dependent on the permission of a central authority, as well as automating processes such as paying rewards to winners and charging fees to losers.

We envision decentralized prediction markets to flourish this year and become a popular place for users to make predictions based on expected events as well as traditional prediction models such as sports betting. So that the value of assets bet on these platforms will exceed 100 million dollars.

A sharp drop in fees on the Ethereum network

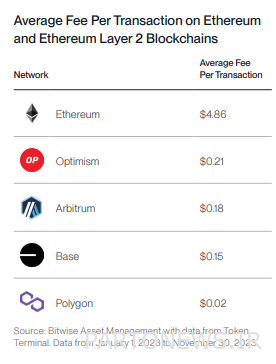

A major update will reduce the average Ethereum network layer 2 protocol fee for processing each transaction to below $0.01, paving the way for more use of the blockchain as a mainstream trend.

The update we’re talking about is EIP-4844, which is primarily aimed at reducing transaction fees on the Ethereum blockchain. Currently, the average transaction fee between Ethereum layer 2 networks is about $0.14, and this plan can reduce this figure to less than $0.01; This event, in our opinion, will greatly increase the variety of activities that can be done on this network, and will make it possible to develop ideas such as special tools for micropayments, social networks and large-scale gaming platforms.