16 government currency policy to stabilize the currency market and curb inflation

According to Iran Economist, the currency market and the price of the dollar passed its third month of calmness and stability. Every year, during such times, the market fluctuates due to the need of Arbaeen pilgrims for travel currency, but this year, not only the market fluctuates. It was not By adopting the policy of de-dollarization of the currency basket of Arbaeen pilgrims and replacing the dinar instead of the dollar, we saw a decrease in the price of the dinar in the market and the relative stability of the dollar price.; Field investigations show that during this period the currency price fluctuated in the range of 49 thousand tomans.

* Currency stabilization policy

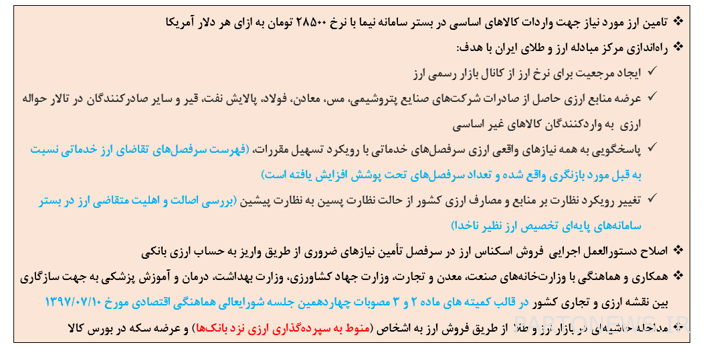

In order to further examine the dimensions of this issue, we examined the developments that occurred in the field of foreign exchange. Since the beginning of this year, the central bank has taken a series of measures in the field of curbing inflation and making the economy more stable and predictable for economic operators, with the focus on controlling the exchange rate, and issuing instructions for facilities. Banki put the control of banks’ overdrafts from the central bank’s resources and the reform of the government’s relations with the central bank on his agenda, which resulted in the policy of stabilizing the currency market. (Image number one).

Image number one

Foreign exchange market policy and regulation

* Setting up a currency and gold exchange center

Currency and gold exchange center with the aim of creating authority for exchange rates from the official currency market channel, providing foreign exchange sources from the exports of companies in the petrochemical, copper, mining, steel, oil refining, bitumen and other exporters in the currency transfer hall to importers of non-essential goods. Responding to all the real foreign exchange needs of service heads and individuals with the approach of easing the regulations, changing the approach of monitoring the country’s foreign exchange resources and expenses from posterior monitoring to prior monitoring has been launched, which will play an important role in the implementation of the exchange rate stabilization policy.

The biggest action of the central bank in the field of foreign exchange is the discussion of the currency and gold exchange market and the transfer of foreign exchange operations to this center, the creation of a currency stabilization fund, the issuance of derivatives to stabilize the exchange rate, which can provide the necessary tools to stabilize the exchange rate and plan currency management for exporters. and providing importers is one of the central bank’s measures in this field.

The connection of the export market to the import market, where the optimal allocation of currency in trade is one of the main programs, including the measures of the central bank in the field of balancing the gold and coin market, and reducing the coin bubble, was the physical supply of coin precursor bonds, which, when these coin bonds matured It will be physically delivered to buyers.

* Improving the conditions of currency stabilization policy

Last year, 65 billion dollars were provided in the currency needed by the devices, and this year the supply of the currency needed by the devices has grown by 6.8%; In the first five months of this year, more than 23 billion and 822 million dollars were provided in foreign currency, while in the same period last year this figure was 22 billion and 305 million dollars.

In the field of foreign exchange, until the end of last year, the total supply of foreign exchange made by the Central Bank was about 65 billion dollars, of which 16 billion dollars were for agriculture, 3.5 billion dollars were in the health sector, and 45 billion dollars were in the industry sector.

According to the investigations in the export sector, the statistics of the export sector were about 90 billion dollars, of which 53 billion dollars were non-oil exports and 38 billion dollars were oil and gas concentrates, the period of return of foreign currency from exports last year was considered to be four months, which recently The duration has been reduced from 125 days to 80 days.

According to the planning done this year, it is predicted that the return of the currency will be much higher, and the rate of return will reach 90% from the average of 75%, which promises to improve and stabilize the currency in 1402.

* Compilation of foreign exchange budget

Amending the executive instruction for the sale of foreign currency notes in the heading of providing essential needs through depositing in a foreign currency bank account and cooperation and coordination with the ministries of industry, mining and trade, the ministry of agricultural jihad, the ministry of health, treatment and medical education in order to be compatible between the country’s currency and commercial map In the form of the committees of articles 2 and 3 of the fourteenth session of the Supreme Council of Economic Coordination, he mentioned other measures taken in order to stabilize the exchange rate.

In the last quarter of last year, the central bank prepared the country’s foreign currency budget, and this measure has been designed for the year 1402 by separating the first market of basic goods, agriculture, and medicine, and the currency allocation meetings are held continuously with the presence of the ministers of the relevant institutions, centered on The central bank is held.

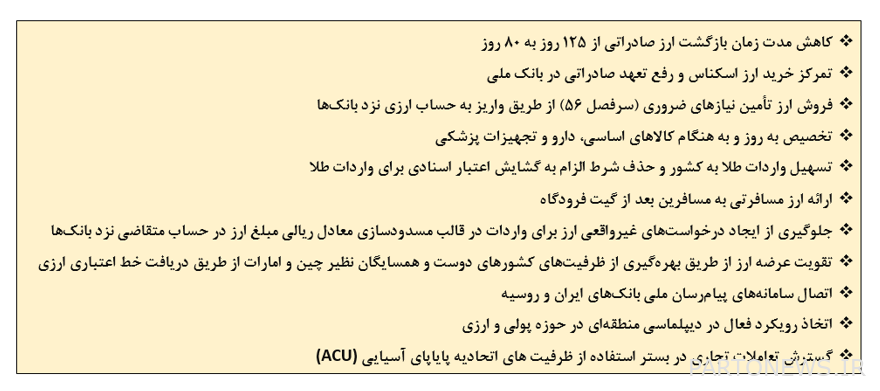

In this regard, the central bank has asked the banking network to prepare a foreign currency balance sheet in addition to preparing a Riyal balance sheet by determining a base year, and based on that, a foreign currency audit will also be performed and prepare a statement of assets, liabilities and foreign exchange operations, all purchases and sales. Foreign exchange accounts should be prepared from the bank itself, foreign exchange branches and exchange offices, and a foreign exchange audit report should be prepared by the trusted institutions of the Central Bank. (Picture No. 2)

Picture number 2

* Forming a committee to deal with monetary and currency violations

Based on the plan made in the central bank, a committee to deal with monetary and currency violations has been formed, and relevant institutions including representatives of judicial authorities, economic security police, the Ministry of Information and other relevant institutions are present in this committee, and they have all the capacity to identify the violators. The currency market operates in two areas: exchanges and exchange customers.

The central bank and the field of supervision of exchanges are more carefully and obsessively exercising their supervision in the field of exchanges, and in the past year, the central bank has used the capacity of independent auditors to implement the audit of exchange companies based on the 4-layer defense standard, and implemented the rating system of companies. exchange, creating and announcing the same accounting coding, moving towards offline monitoring based on financial systems online through web service (in line with monitoring and intelligent monitoring of exchanges) and checking the performance of exchange companies in the field of recording Rial transactions corresponding to foreign exchange transactions, in addition to Hundreds of in-person inspections have monitored the activities of exchanges.

Some of the most important violations that have led to the cancellation or suspension of the license of some exchanges are withdrawal of exchange capital, use of personal accounts in exchange operations, long-term inactivity, failure to sell currency within three working days, failure to register exchange operations in the systems The central bank pointed out the refusal to buy and sell currency, very little activity and failure to provide the information required by the central bank inspectors, also receiving amounts in excess of what is considered as the official rate in the currency systems has happened in some exchanges.

* Monitoring the fulfillment of foreign exchange obligations of exporters

One of the important goals of exports in the current sanctions situation is to bring currency to the country’s economic cycle in order to provide the currency needed for the import of goods, services and the implementation of the country’s infrastructure projects. As a result, the non-return of the currency causes disruptions in the realization of the above, the growth of capital outflows, disruptions in the market. The currency will be used to finance the smuggling of goods, etc., which will obviously lead to negative effects in the management of the country’s foreign exchange reserves.

In the same direction and with regard to the obligation stated in Note (6) of Article (2) of the Law on Combating Smuggling of Goods and Currency, stating that “all exporters are obliged to sell their foreign currency to the Central Bank” and referring to the provisions This executive letter, under the mentioned note, it was necessary for the central bank to have the necessary powers to play the role of regulation, supervision and to apply punishment and incentive tools in order to optimally implement the above tasks, and without appropriate powers in this context, the implementation of the prescribed tasks will not be possible in an optimal way. Therefore, in this regard, the central bank received special powers from the government to fulfill this obligation and legal duty.

* Providing foreign exchange for the import of basic goods

One of the actions of the central bank in order to stabilize the market was to provide the currency needed for the import of basic goods under the Nima system at the rate of 28,500 tomans per US dollar, although some compare this issue with the currency of 4,200, while at that time the bank The Central Bank buys the currency at a much higher price and sells it at the rate of 4200, but this issue does not exist at the moment and the purchased rate of the currency for the supply of basic goods is less than 28500 Tomans, and therefore this program leads to an increase in the monetary base of It does not include net foreign assets.

Also, in line with the stabilization of the exchange rate, marginal intervention in the foreign exchange and gold market through the sale of foreign currency to individuals (subject to foreign currency deposits with banks) and the supply of coins in the commodity exchange, reducing the return period of exported foreign currency from 125 days to 80 days, focusing on purchasing Banknote currency and clearing the export obligation in the national bank, sale of foreign currency to meet essential needs (chapter 56) through depositing in a foreign currency account with banks, up-to-date and timely allocation of basic goods, medicine and medical equipment, facilitating the import of gold into the country and eliminating The requirement to open a letter of credit for importing gold, providing travel currency to passengers after the airport gate, preventing the creation of unrealistic requests for foreign currency for import in the form of blocking the equivalent of the amount of foreign currency in the bank account of the applicant, strengthening the supply of foreign currency by using the capacities of the countries He pointed out that friends and neighbors such as China and the UAE have received a foreign currency credit line, connecting the national messaging systems of Iranian and Russian banks, expanding business interactions in the context of using the capacities of the Asian Exchange Union (ACU).

* Active regional diplomacy

Adopting an active approach in regional diplomacy in the field of money and currency has been one of the important current and developable programs of the government and the central bank in line with economic stabilization in line with currency stabilization policy.

According to the Governor General of the Central Bank, the liberalization and access to the country’s blocked foreign exchange resources with a figure of more than 100 billion dollars abroad, which was not possible to access due to the cruel sanctions, has gradually come to fruition by relying on the policy of active regional diplomacy. and we are witnessing the release of blocked resources in South Korea and Iraq, and this process continues to make unavailable resources available.

* Reducing the coefficient of exchange rate changes

The coefficient of exchange rate changes is very high and for example, it changed by 30% in 2017 and 19.5% in 2011 and it became 28.4% in 2011, while with the implementation of stabilization policy during the last few months, the amount of changes The exchange rate in the informal market in the first quarter of 1402 has decreased sharply and is equal to 2.5%.

* Future actions of the central bank in the field of currency

Reforming foreign exchange buying and selling policies, developing Iran’s currency and gold exchange center, improving operational supervision of the activities of trusts and active management of the central bank in this field, strengthening and developing interactions and negotiations with neighboring countries and business partners to use their capacity in facilitating The financing of exchanges between the two countries is one of the actions of the central bank in this field.

end of message/