3 key points that show the planboy model is not reliable for predicting the price of bitcoin

The flow accumulation model, or “S2F” invented by PlanB, has become very popular in the last few years. A recent quantitative study was published on the website Planbtc.com, which predicted a bitcoin market value of up to $ 100 trillion based on the accumulation model. Under such circumstances, it was obvious that digital currency activists would be fascinated by the logic of this model and the prediction that the price of Bitcoin would exceed $ 100,000 in early 2021.

The accumulation-to-flow model is based on the assumption that there is a significant relationship between the annual extraction rate of a precious metal or the same flow and the amount previously extracted or the same accumulation.

For example, the amount of gold extracted annually is less than 2% of the gold in circulation held by central banks and individuals. Given the current rate of gold mining, it will take more than 50 years to double its supply; This makes gold a rare commodity.

Since bitcoin is considered by many to be digital gold, Planby also assumes that this relationship between working-class supply and annual extraction rates can be applied to bitcoin as well. In this model, a Cartesian coordinate system with logarithmic axes “X” and “Y” is introduced in which the growth of bitcoin price over time follows a trend that can be described by the statistical model of linear regression and power distribution relationship.

Almost once every 4 years, the bitcoin price rises due to the Hawing process or the halving of the extraction bonus per block. The bitcoin protocol actually halves the miners’ reward for extracting each block from the network after extracting every 210,000 blocks.

Probably when Satoshi Nakamoto, the anonymous creator of Bitcoin, invented the Hawing phenomenon, he thought that the price of Bitcoin would double every four years. Planby, however, showed that in the first 10 years of Bitcoin’s existence, the price of this digital currency has moved around an exponential function, and with each hawing, its price has increased 10 times instead of doubling.

What you have read so far and read below is translation Note From the Coin Telegraph website, there are three important points that can call into question the validity of the planbia flow accumulation model for predicting bitcoin price trends.

Also read: What is Bitcoin Hawing and how does it affect the price?

Reason number one; A 10-fold jump in price does not make sense at all

Can you really imagine that the price of Bitcoin is going to reach $ 1 billion by 2039 (1417 solar)?

$ 1 billion per bitcoin means that the market value of this digital currency will reach about $ 20,000 trillion; A figure that is 130 times the current value of stock markets. Needless to say, the price of bitcoin is expected to rise 10-fold in the coming years, according to forecasts for this model.

As the chart below shows, this is clearly unimaginable for the next two stages of the bitcoin leap; Where the price of bitcoin reaches $ 1 million before 2030 and $ 10 million a few years later!

Reason number two; Ignoring the important factor of demand

Another problem with this model is that it does not take into account the demand factor and merely points to the scarcity of bitcoins. It should be noted that Bitcoin is no longer the only digital currency on the market. Bitcoin dominance is declining, as investors are somewhat distracted by the emergence of new projects, and this will be inevitable.

It is precisely this disregard for the effect of demand that causes the accumulation model to flow incompletely; A scarce asset becomes valuable if people want to buy it. The painting of an anonymous artist, even if it is eye-catching and belongs to a limited collection, will have no value if one does not want to buy it.

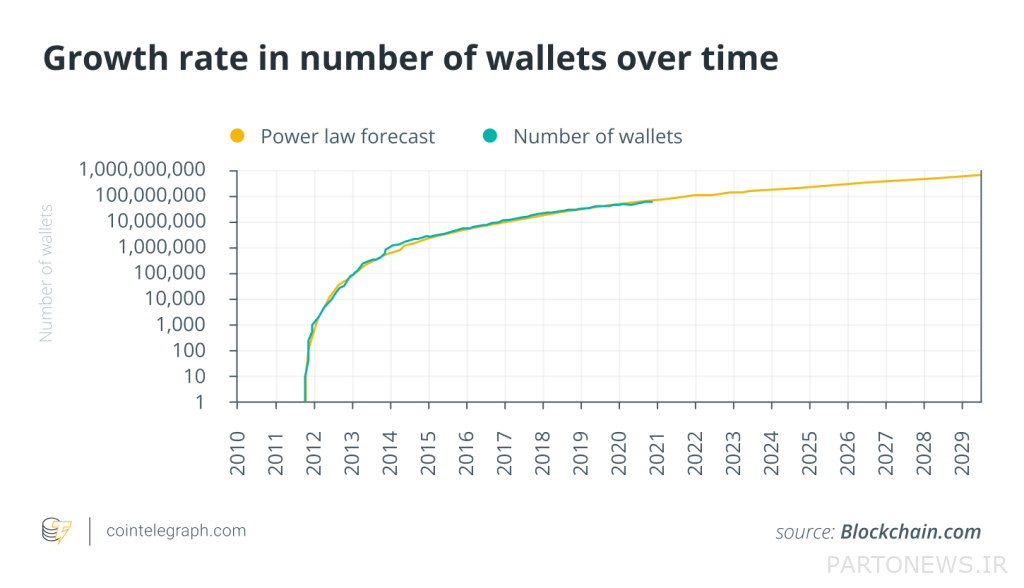

DANIELE BERNARDI, an analyst at the Kevin Telegraph website, has introduced a model that considers demand rather than supply. According to this model, in order for the price of Bitcoin to reach $ 1 billion, there must be about 4 trillion wallets with inventory, which is a completely impossible scenario.

Also read: Bitcoin accumulation model in combination with multiple assets

Reason number three; Controversial statistical structure and incorrect predictions

The third reason is related to the general structure of the flow accumulation model. If, instead of using regression from the beginning to the present, we did so at the end of each Howing cycle, the regression result would always be different.

If we had calculated the accumulation-to-flow ratio at the end of the first hawking, the predictions were that the bitcoin market value would reach the diamond market value in September 2016. On the other hand, by performing these calculations at the end of the second Hawing in August 2016 (August 1995), the linear regression showed that the market value of Bitcoin will reach the value of the gold market in 2021; While now is the year 2022 and only 10% of this route has been completed.

The following video uses a modified version of the accumulation model to flow; That is, the accumulation-to-flow ratio is calculated from the beginning to the present, after each Hawning period. As you can see, the resulting curve tends to smooth over time.

Therefore, the bitcoin path in a Cartesian coordinate system with a dual logarithmic axis designed by Planby can most likely not be considered as a straight line; Rather, it is a curve with a mathematical description that has not yet been studied and tends to smooth out over time. This practically invalidates the overly optimistic prediction of the planbia accumulation model.