3 reasons for the stock market fall / Hope to climb next week increased

According to the economic correspondent of Fars News Agency, the stock market did not go well in recent weeks. This issue is largely related to the outflow of money from the capital market.

The government’s contractionary policies to offset the budget deficit, control inflation and reduce the dollar in the open market have been among the reasons for the stock market’s decline in recent weeks.

In the fourth week of November, the stock market trend was a fluctuating move, which showed that shareholders are turning away from index shares. The negative return of small market symbols that show themselves in the total homogeneous index was much lower than the return of the total homogeneous index. In other words, last week the capital market had a downward trend and the lowest weekly return of the total stock index was recorded in the last 5 weeks.

The overall index in the fourth week of November, although faced with a negative return; But it seems The index at the resistance point formed in the channel 1.4 million units can more easily follow the uptrend.

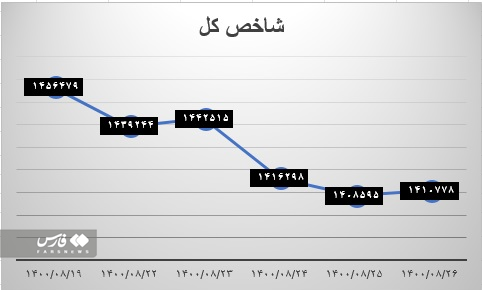

A drop of 3.1% in the total index

The overall stock index fell in the fourth week of November and recorded a negative return of 3.1 percent. On the first day of the week, the total index fell by more than 17,000 units and on Sunday, it grew by 3,271 units.

But on Monday, the trend of the overall index fell again and fell 26,174 units, which was the biggest drop in the index in the fourth week of November. On Tuesday, the index recorded a decrease of 7,716 units.

The total stock index climbed more than 2,000 units on the last working day of the last week and rose to the level of 1,410,000 units to escape falling into the lower channel this week. Last week, the index was 45,701 lower than the previous week.

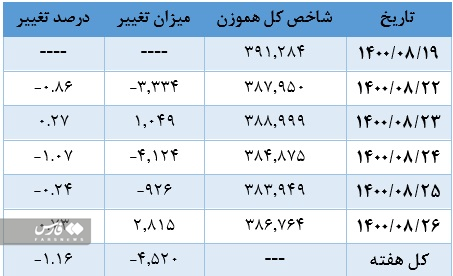

Smaller drop in total homogeneous index than total index

In the fourth week of November, the trend of changes in the total homogeneous index was similar to the total index. It fell on Saturday, then rose on Sunday, and the next two days fell, and on Wednesday it had a growth of 2,805 units.

The total equity index decreased by 4,529 units at the end of the week compared to the previous week and reached 386,764 units, recording a negative return of 1.16 percent, which is a significant decrease compared to the 4.5 percent growth of the previous week.

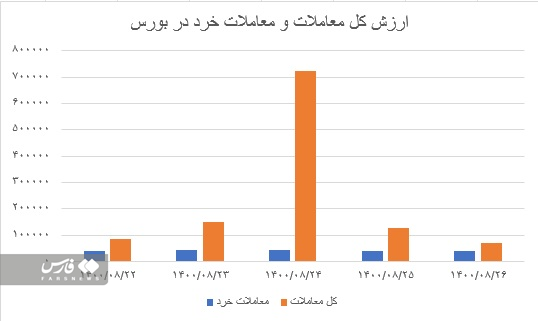

The same trend applies to the total value of transactions and the value of retail transactions

In the fourth week of November, as in all previous weeks, open market operations have been carried out on the stock exchange. On Monday, the total value of stock market transactions was very different from other days due to the growth of the value of bond transactions. On Monday, the total market transactions had a value equal to 72 thousand and 565 billion tomans, which was the highest figure of the week. The average value of the total transactions of the week was 23 thousand and 165 billion Tomans, which has decreased by 4.45% compared to the figure of 23 thousand and 611 billion Tomans of the previous week.

This week, the average value of small stock exchange transactions was 4,166 billion tomans, which has decreased by 19% compared to the figure of 5,169,000 billion last week.

Increase sales queues and decrease purchase queues

The average value of sales queues in the fourth week of November was 231 billion tomans, which was 96 billion tomans more than the average of the previous week and has grown by 71%. The highest figure of the week was 462 billion Tomans, which was recorded on Saturday, and the lowest figure goes back to Wednesday, which was 62 billion Tomans.

The average value of shopping queues last week was 254 billion tomans, which was 147 billion tomans less than last week’s average. This week, the average value of shopping queues has dropped by 37%.

Withdrawal of money from the stock market continues

In total, 1,208 billion tomans of real money was withdrawn from the stock exchange during the whole week, and the average daily outflow of real money was 246 billion tomans, which has increased by 623 percent compared to the previous week.

in other words Capital outflow has increased 6.5 times and in the fourth week of November compared to the previous week, one thousand billion tomans more money has left the capital market. The highest outflow of real money dates back to Monday, when 534 billion tomans of real liquidity left the stock market.

In the current state of the capital market, the formation of a resistance point in the channel of 1.4 million units, can give traders hope for the future of the stock market. It seems that next week the index will start moving from this point of resistance, and of course this path can be upward. Given the behavior of traders in the past week and the growth levers, the market is likely to start moving forward more calmly on the demand side at the resistance point.

End of message /

You can edit this post

Suggest this for the front page

.