8% loss of “Shepna” shareholders due to violation of refining and distribution company – Tejaratnews

According to Tejarat News, the shares of Isfahan Oil Refining Company, which is traded under the symbol Shepna in the group of “oil products, coke and nuclear fuel”, were on a high margin in the past week. On the other hand, the capital market, which has always been looking for an excuse to drop more, made the most of this opportunity and decreased by more than four percent in the last two days.

Shepna’s contradictory letters

But the story begins when Isfahan Oil Refining Company published a letter on the Kedal website on the 14th of July, announcing the increase of 17 tomans in EPS of Shepna.

In a part of this letter, it was stated: The declaration issued by the National Oil Products Refining and Distribution Company regarding the interest income and currency conversion fee for the export of petroleum products was received by the National Iranian Oil Company for the years 2017-1400 in the amount of 38730 billion Rials. The receipt leads to an increase in the specific profit of each share by about 170 rials.

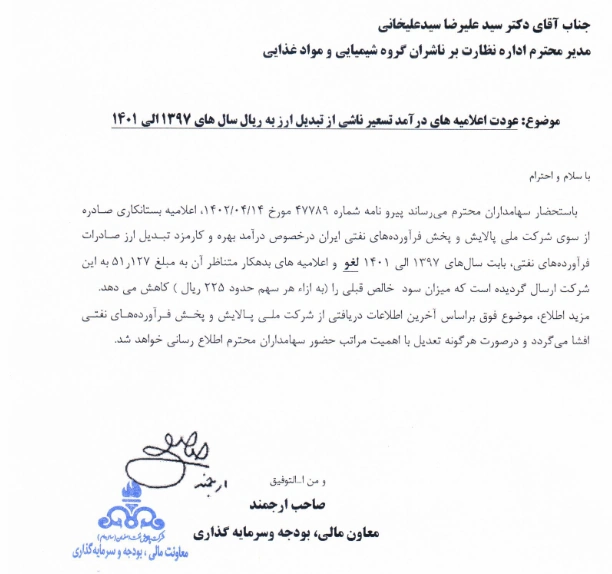

But 6 days after that, on the last day, Tehran Oil Refining Company announced the cancellation of receiving 3,873 billion Tomans by publishing a new letter. Also, to the utter disbelief, according to the letter of the 20th, Shapna not only had no income from interest income and currency conversion fee for the export of oil products, but also owed about five thousand and 112 billion tomans. This would reduce EPS by 225 riyals.

Uncertainty of fee income

But the letter of Shepna’s games did not end and today Isfahan Oil Refinery published a new letter in this regard. According to this letter, Shapna’s income from the exchange rate is still unknown. Also, this company said in today’s letter: After the matter is confirmed and in case of inclusion, this income will be applied in the fiscal year 1402.

Minor shareholder losses

But it should be checked what will happen to those who bought Shepna shares based on the first letter and hoping for the profit of this company. In the afternoon of the 14th of July, when the letter of Shepna’s profit increase came, the stock market was closed. But on Saturday, July 17th, if someone buys the company’s shares at the price of 890 Tomans according to the first letter and the profit growth, until the second letter (July 20th) which corrected the first letter, he has suffered a loss of almost seven percent. Also, the fee for buying and selling Shepna shares for this person is equal to 1.25% of the total value of his transaction.

This means that the letter of Shepna Games left more than eight percent losses on the hands of the buyers of this share.

Objection of the chairman of the stock exchange organization

This caused Majid Eshghi, head of the Tehran Stock Exchange Organization, to protest in a letter to the country’s attorney general about the delay in disclosing information or providing false and misleading information.

In a letter to the Attorney General of the country, the head of the Stock Exchange Organization complained to the Attorney General about the negative adjustment of the profit per share of “Shepna” from the National Refining and Broadcasting Company. In a letter to Mohammad Jaafar Montazeri, the story of the entire country, Majid Eshghi announced: Oil refining companies are among the companies registered with this organization, which include all types of shareholders, including equity shareholders (about 49 million people), refining fund investment funds, First, small shareholders and… are present

He further stated: According to the Securities Market Law and the guidelines approved by this organization, registered public companies are required to prepare and publish audited financial statements and information for the financial year no later than 10 days before the annual general meeting. do Failure to release information within the stipulated time will make the managers of the above companies subject to the penalties stipulated in Chapter 6 of the Securities Market Law.

Eshghi added: With this introduction, unfortunately, the National Company for Refining and Distribution of Petroleum Products of Iran, from the companies under the Ministry of Petroleum, despite the legal obligation to provide crude oil invoices and product sales in recent days, with a delay of several years, information related to interest income and The currency conversion fee resulting from the export of oil products related to the years 2017-1400 was announced to the refineries and subsequently this information was reflected to the shareholders through the Kodal system, while this company was obliged to announce the relevant information to the refineries at the same time. reflect in the financial statements of the same year and report to the assembly.

He continued: In addition to this, the aforementioned announcement information a week later, i.e. on 04.19.1402, was considered false by the same company, and different information was presented to the market. For example, Isfahan Oil Refining Company announced on 04.14.1402 during the announcement published in the Kodal system.

According to Eshghi, the declaration of interest income and currency conversion fee of petroleum product exports has been published by the National Iranian Oil Company for the years 2017 to 2018 in the amount of 38,730 billion Rials. Further, the company announced again on 04.20.1402, through the announcement published in the Kodal system, that the previous credit notice was canceled and the corresponding debtor notice was sent in the amount of 51,127 billion Rials. Unfortunately, according to the received information, the company’s recent announcement has also been completely canceled.

The head of the Securities and Exchange Organization continued: With regard to the above, on the one hand, the announced adjustments are related to previous years, and due to the changes in the shareholding during the period of time, providing different and unreliable information can cause the transfer of interests between the shareholders. On the other hand, the publication of misleading information as described in the above-mentioned example leads to affecting the stock prices of these companies, providing unreliable and irrelevant information, and finally violating the rights of the shareholders of those companies.

Eshghi emphasized: In this way, there is a suspicion of committing crimes under Chapter 6 of the Securities Market Law and violating the public rights of investors in this matter. Therefore, he calls on that authority to order, while providing the necessary reminders to the relevant authorities, to take immediate and decisive action on the issue.

Read more reports on the stock news page.