A look at the futures market and bitcoin options; In which direction will the price move?

The situation in derivatives markets has shifted from neutral to declining following the announcement of a ban on digital currency trading in China, which pushed the price of bitcoin to $ 40,600.

to the Report Coin Telegraph, China has banned bitcoin again, as in previous years. The People’s Bank of China issued a statement on September 24 (October 2) containing a new set of measures to increase coordination between different sectors to impose restrictions on digital currency-related activities.

The purpose of these measures is to cut off payment channels and deal legally with websites and mobile applications related to digital currency.

The $ 3 billion in bitcoin and $ 1.5 billion in Atrium’s one-month option contracts expired just hours before the announcement of a digital currency ban in China, which is likely to have been lost altogether. Molly, a former employee of Bitcoin Magazine, said the remarks by Chinese officials were first published on September 3.

However, if we assume that some traders intended to take advantage of the negative price fluctuations, it makes sense to publish this news before the expiration of trading at 8 am (global time) on Friday. For example, a $ 42,000 sell-off contract registered for risk management became worthless, as the expiration price on the Deribit trading platform was $ 44,873. The holder of the contract had the option to sell the bitcoin at $ 42,000, but if the bitcoin expires above that level, it is no longer valid.

Those who think this is a conspiracy should note that the expiration of bitcoin futures on the Chicago Mercantile Exchange is the average price between 2 and 3 pm (global time). As a result, potential $ 340 million open contracts were settled near the $ 42,150 level. Open contracts are those futures contracts that have not yet been settled.

In the futures market, buyers (long positions) and sellers (short positions) always match, so in practice it is impossible to guess which side has more power.

Despite falling $ 4,000, just under $ 120 million has been leveraged in the futures market. This data should be very worrying for sellers, because it shows that buyers do not have too much self-confidence and do not use maximum leverage.

Also read: What is a Futures Contract? + Familiarity with Bitcoin futures

Professional traders are currently neutral

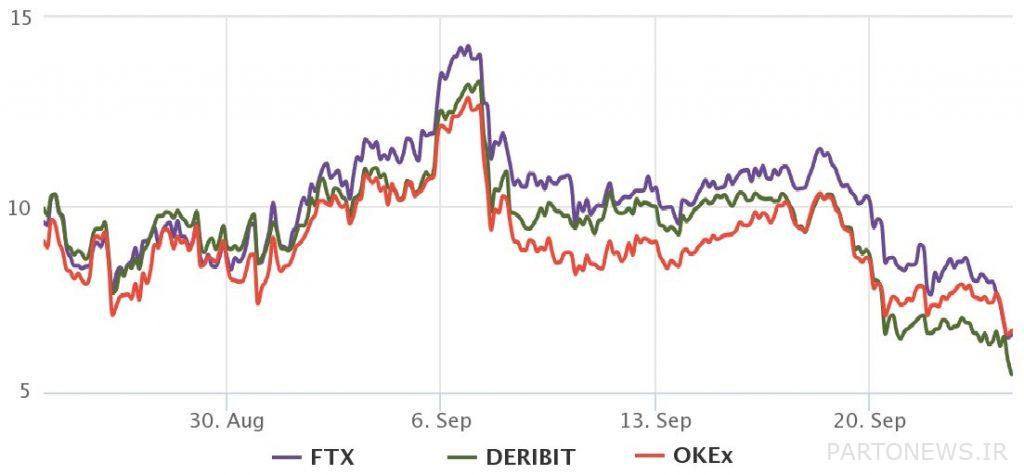

To find out if professional traders have an uptrend or a downtrend, one should look at the premium or base rate of futures contracts.

This index measures the price difference between long-term futures and the immediate market. In a healthy market, the annual premium is between 5 and 15 percent, and this condition is known as contango.

The reason for this price difference is that sellers are asking for more money to avoid long-term settlements, and whenever this indicator fades or is negative, a red warning is seen, which is known as “inversion”.

Notice how the 9% price drop on September 24 (October 2) pushed the annual futures premium to its lowest level in two months. The current 6% index is below the neutral range and has ended a mild uptrend that lasted until September 19 (September 28).

To confirm whether this move was only for this index or not, the market of option contracts should also be examined.

Option traders are entering a fear zone

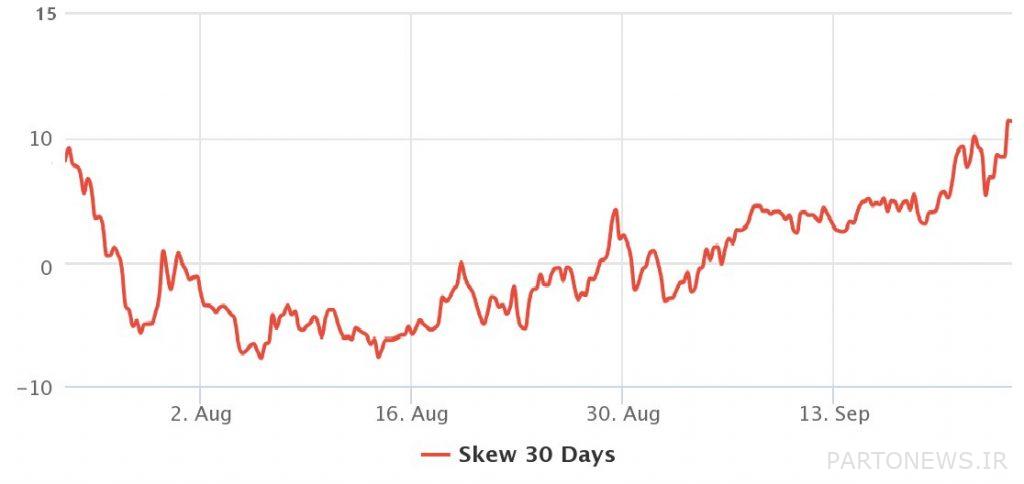

The Delta Skew Index compares 25%, Call Option and Put Option similar contracts. This criterion becomes positive when fear is prevalent in the market, because the premium of option contracts that are registered for risk management is higher than the option contracts with the same risk.

Conversely, this happens when market makers are bullish, causing the Delta Deviation Index to enter the 25% negative territory. Between 8% negative and 8% positive, the neutral zone is considered.

The Delta Index has been fluctuating 25 percent since July 24 in the neutral zone, but rose to 10 percent on September 22, indicating fears from traders. After a quick re-test of the 8% neutral level, recent Bitcoin price movements have pushed the index above 11%; The level was last seen two months ago and is very similar to the situation in the Bitcoin futures market.

Although there is no sign of a decline in the Bitcoin derivatives market, the fall of two days ago below $ 41,000 has pushed professional traders into the area of fear. The result is that futures traders are reluctant to open leveraged buying positions, while the futures market shows the risk management premium contracts.

Sellers are likely to benefit from the current panic of investors, unless Bitcoin shows strength over the weekend.