Analysis of the stock market trend / What factors made the stock market fall?

According to Tejarat News, in the past week, the stock market recorded a drop of less than one percent and reached the level of 1 million 502 thousand units from the range of 1 million 513 thousand units.

Alireza Mohammadi, a capital market expert, told Tejarat News: “The prices are valuable and most of the activists expect returns from the stock market.” But the market again suffered from the problem of last year’s autumn and winter days and the value of transactions fell.

He continued: lack of money in the stock market and a significant drop in the volume and value of transactions caused the market to be stagnant in the second week of summer. In fact, we did not see much movement in the video games. The total index of the Tehran Stock Exchange has grown by only one thousand points this week and we are witnessing the maintenance of the important support of one million and 500 thousand points.

Mohammadi added: The equal weight index also had similar conditions. The price of this week’s transactions, however, had a downward trend compared to previous weeks. Like last week, real shareholders are more willing to leave the market. The root and reasons of this decision depend on the market conditions and factors affecting the macroeconomic environment and foreign markets.

Risks facing the stock market

Mohammadi further explained: Currently, the stock market, which has been waiting for spring season reports, is facing new risks. This issue causes the company’s optimal performance (according to the monthly reports of the companies’ activities) to be neglected. Although, since last week, the probability of reaching a nuclear agreement has faded again, and the impact of this issue on the currency market and exchange rate developments has been palpable. But in recent days, the news of global markets has also increased the risk of the stock market. This issue can be a background for selling pressure in the coming weeks.

This capital market expert continued: In fact, this week world prices entered the correction phase on the eve of the Federal Reserve meeting and the possibility of an interest rate increase by this institution in order to control the American inflation. Of course, the jump in the dollar index has not been unaffected in this inflammation. One of the hopes of the global market is the price of oil, which is likely to see a further drop after the $100 level is lost.

The impact of global prices on the market

He explained: In any case, export-oriented industries have made a big contribution to the stock market. On the other hand, due to the fact that domestic companies have always sold their products at a lower price than the global price in order to maintain their share of the global market and under the pretext of sanctions, mainly by providing price discounts. The risk of falling global prices in the stock market is well understood. It seems that the lack of transactions this week was related to this issue.

Mohammadi clarified: Of course, the macroeconomic issues of the domestic economy have not been in favor of the market in recent days. Because it has been discussed internally and in economic circles that the government and its economic advisers are seeking to increase the interest rate in order to control inflation and prevent its increasing acceleration. Although this policy will be a temporary cure for inflation, it is one of the problems of the stock market and its implementation will hit the market.

He explained: Once again, we are witnessing the intervention of economic policymakers in the logical path and mechanism of the stock market. Although many times the stock market activists have asked the officials and economic and industrial policy makers not to disturb the market process. But this week, we saw the comments of the Deputy Ministry of Safety regarding the price of cement and setting a maximum rate of 50,000 Tomans per bag.

Mandatory pricing is the bane of the country’s economy

This market expert explained: In fact, the issue of mandatory pricing is one of the pests of the country’s economic policy. Every time in an industry, it has created certain issues and problems and in the end it has been for the special benefit of the consumers and to the detriment of the shareholders. This point of view and the fact that companies’ sales rates are not safe from nightly orders and directives is one of the basic issues that, while increasing the risk of investing in the stock market, makes shareholders run away from this market and ultimately encourages speculation in non-productive markets.

He mentioned the rights of the shareholders and said: Majid Eshghi, the head of the Securities and Exchange Organization, wrote a letter to the head of the Islamic Council this week, demanding the withdrawal of the plan to regulate the market of goods subject to the obligation to be offered on commodity exchanges from the agenda of the parliament and refer this plan to The Economic Commission and its addition to the plan to amend the law of the securities market after fundamental reforms and the removal of ambiguities. Also, according to Article 18 of the “Law on the Development of New Financial Instruments and Institutions in order to facilitate the implementation of the general policies of Article 44 of the Constitution”, the government is obliged to remove the goods accepted in the stock exchange from the pricing system.

What are the top companies on the stock exchange?

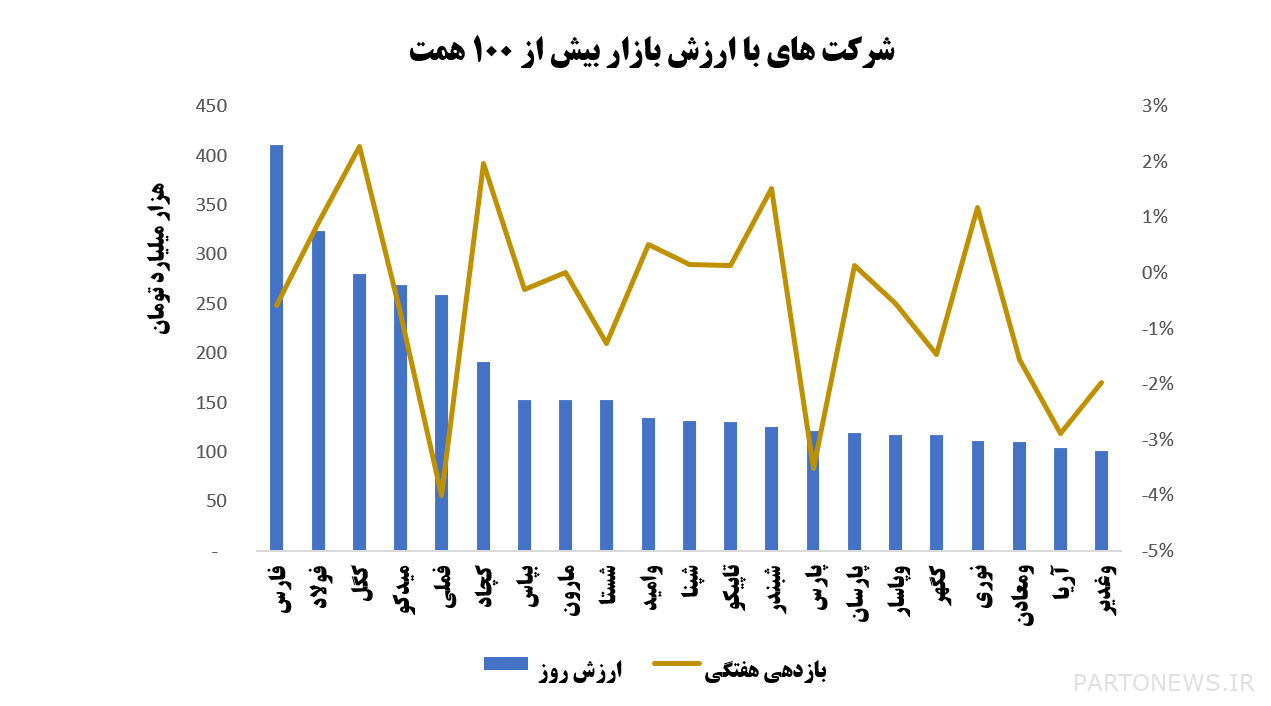

Referring to the top market groups, this capital market expert said: The classification of symbols with a market value of more than 100 thousand billion tomans indicates that 21 companies have a total of 48% of the market value of the stock exchange and over-the-counter. The largest market value belongs to Persian Gulf Holding, which is approximately 411 thousand billion tomans.

Mohammadi stated: Ghadir Investment Company is also the last member of this category with a market value of 100 thousand billion tomans. These 21 companies recorded an average negative return of one percent last week. The total value of the market has experienced the same drop this week.

Read the latest capital market news on Tejarat News Stock Exchange page.