Anchin’s analysis: The return of balance to the Bitcoin market with the continuation of price growth in the past month

While On-Chain’s analysis of the reasons for the increase in the price of Bitcoin in the past month indicates the return of balance to the market and the improvement of traders’ sentiments, it seems that maintaining and continuing the trend still requires the entry of more investors into the market.

According to Aruzdigital, based on the latest Anchina weekly newsletter Glasnoddigital currencies continued to grow last week and the price of Bitcoin reached $23,919 on January 29 (9th of Bahman), its highest level in more than 5 months.

With a growth of more than 38% since the beginning of the year, Bitcoin recorded its best monthly price performance since October 2021 (October 1400). Bitcoin price reached its highest level since August 15, 2022 after rising 6.6% from its low of $22,400 last week.

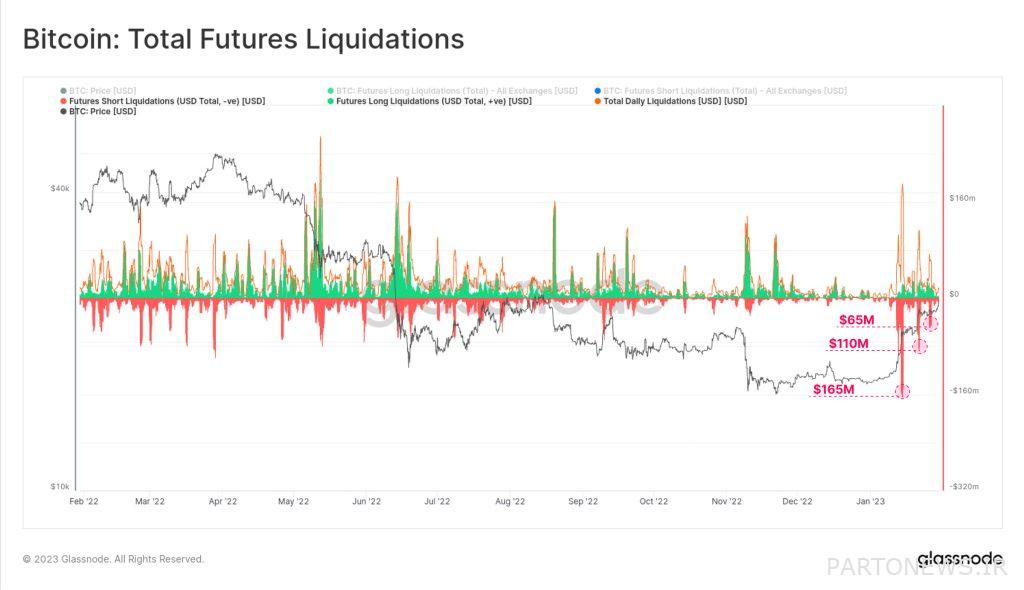

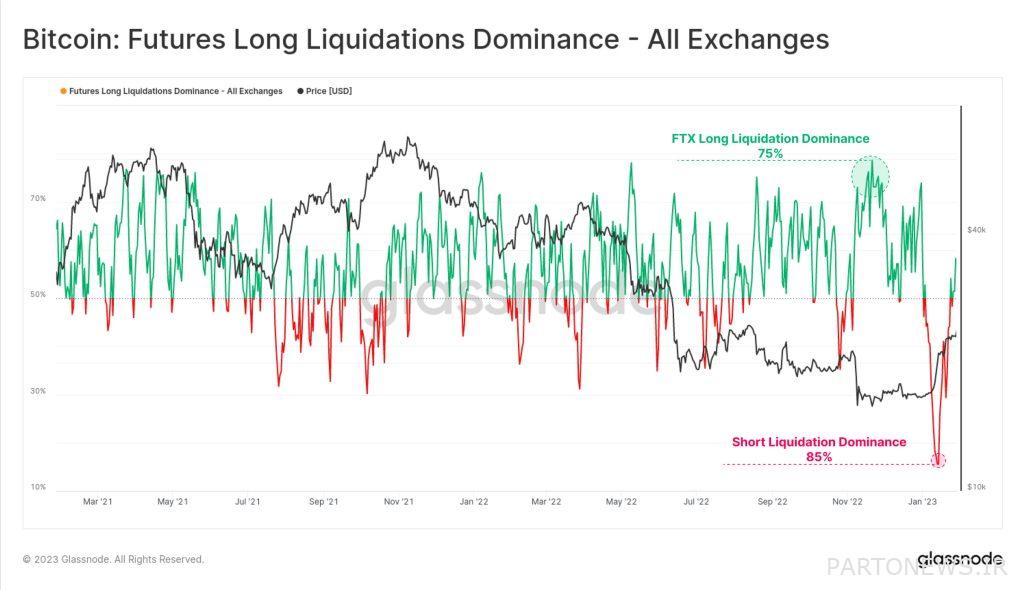

After the painful market experience of 2022, the new year began with a significant reversal in the downtrend in January (Dec). Such spikes are often fueled by levels of short squeeze in derivatives markets, according to analytics platform Glassnode.

From the beginning of 2023 until now, more than 495 million short trading positions were liquidated in 3 stages.

As you can see in the chart above, in the first wave of short selling pressure in mid-January (late December), in a historic event, 85% of short positions were liquidated. This figure was even greater than the 75% proportion of liquidated long positions at the time of the FTX collapse, indicating that a large portion of traders were caught by surprise.

Also, during this period, we saw a 36% drop in the value of open Bitcoin futures contracts, along with a significant reduction in the leverage used in these transactions. Glassnod notes that this potentially represents a reduction in covered short positions in the near term, which could underline the role of spot trading as a key driver in the current market structure.

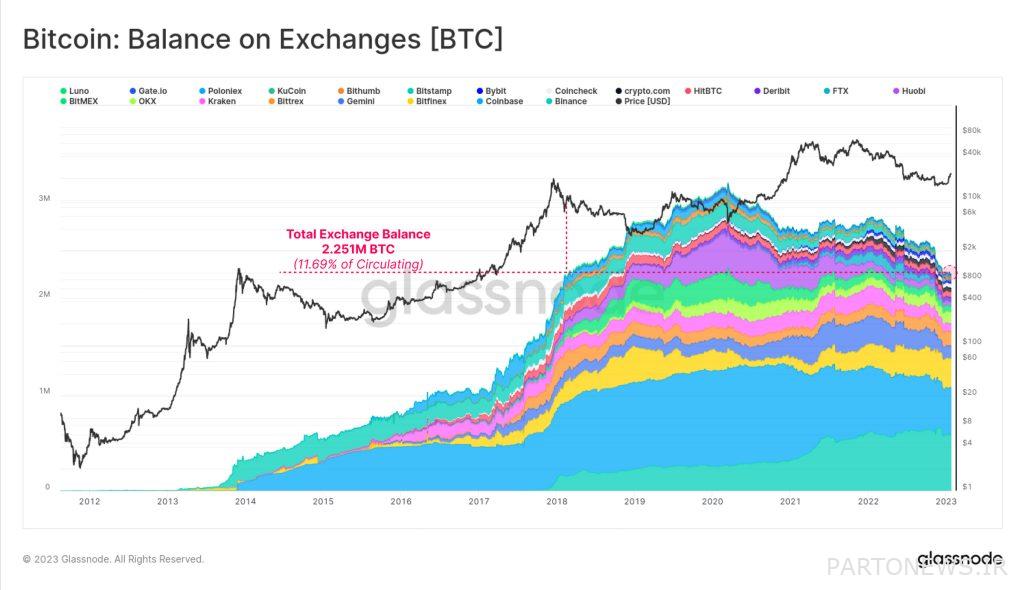

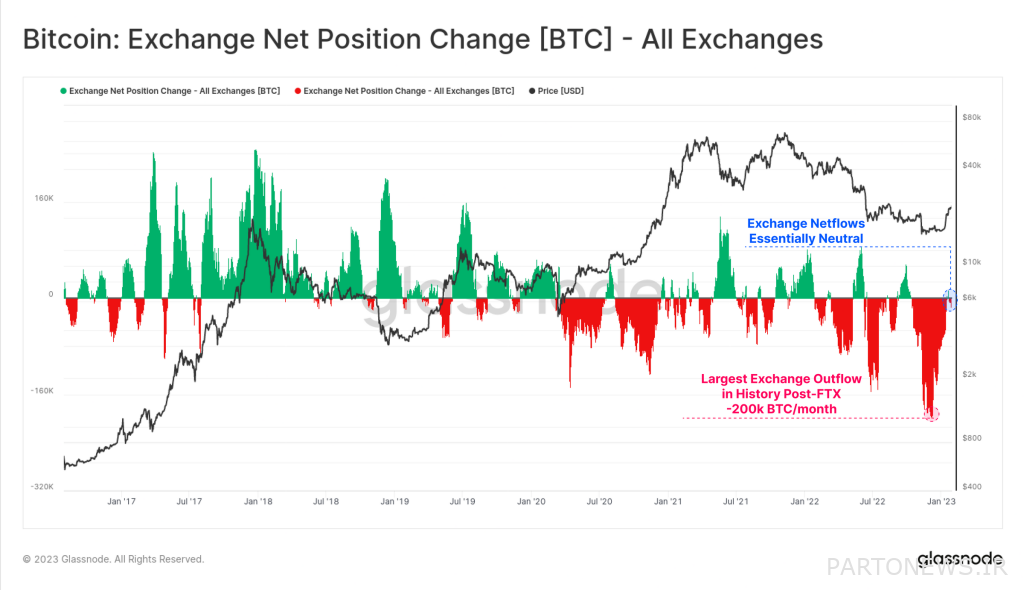

According to this report, currently, the total stock of exchanges is about 2.251 million Bitcoin units, which constitutes 11.7% of the circulating supply. This figure is the lowest level we have seen since February 2018. While the net capital outflow from exchanges in January (December) reached about 20 million dollars per day, in November and December (Aban and Azar), we saw periods of daily withdrawal of 200 to 300 million dollars of Bitcoin from exchanges.

Glassnode notes that currently the net capital movement of exchanges has returned to neutral conditions, which indicates a decrease in the volume of outgoing bitcoins. This event, along with the 38% increase in the price of Bitcoin, can indicate a decrease in the growth rate of demand in the market.

The volume of Bitcoin transactions has decreased drastically since November. Usually, as investors and traders become more active, the power of the market increases along with the increase in the volume of transactions of exchanges. However, we are witnessing a downward trend in the volume of exchange transactions, which can be a sign of a decrease in traders’ interest in entering the market.

In the end, Glassnode concludes that the significant growth in the price of Bitcoin in the last days of January (D) was the result of the historical growth of demand in the spot trading market, as well as a sequence of borrowing sales pressures. This surge has brought a large portion back into the profit zone.