Announce the details of the purchase of housing meters

According to Tejarat News, the Stock Exchange and Securities Organization has recently made it possible to sell housing meters from the issuance of standard parallel futures.

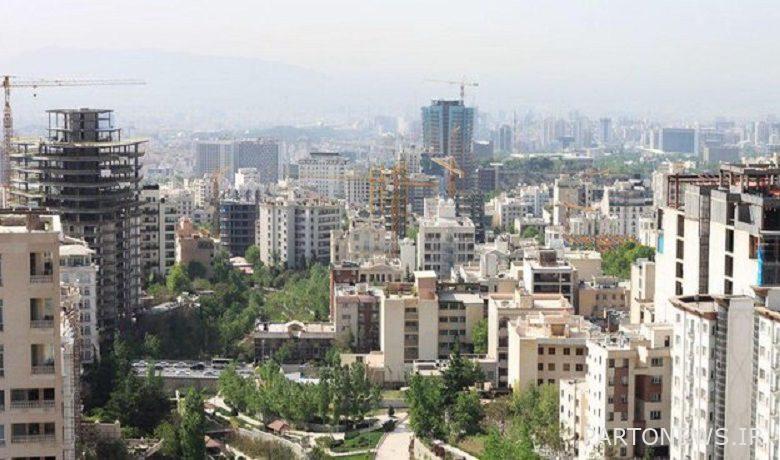

This is while according to the latest report published by the Central Bank, the average price per square meter of a residential unit is 32 million tomans, which has made it impossible for many households to buy housing through conventional routes.

On the other hand, due to some loopholes in the building pre-sale law, many households are reluctant to accept the risk of investing in a home pre-sale.

Therefore, due to the transparency of the capital market, the possibility of investing in the purchase of housing is provided both in the form of payment over time and that will help maintain the value of family assets as capital market growth.

Regarding the details of this plan, it is said: Given that many people can not afford to buy a full housing unit, but at the same time do not want to lose investment in the housing sector, so buying a meter of housing will help different segments of society to Enter the housing market with the small savings they have.

Housing bonds, which are the same as buying in meters, help people to buy a certain area of a house. This plan has been well received by the Exchange Organization and especially the Commodity Exchange, and we hope that its instructions will be implemented soon.

Mass Builder: Buying housing meters over time with standard parallel futures

Yaser Emami, CEO of Anbouh Saz Company affiliated to the Bank of the Housing Sector, said that the applicant can buy a few meters of a building and an apartment in proportion to his inventory and assets. To reach a ceiling of 80 meters in three years.

The CEO of a company active in housing investment, referring to the latest status of the issuance of housing meter purchase bonds, said: Standard parallel futures bonds can determine the purchase of housing meter meters in the context of the capital market; However, with the necessary permits, the definition of these papers has begun and the steps of the jurisprudential committee are underway and general approvals have been received.

He added: the necessary promissory note for the use of this tool has been prepared and the relevant articles of association have been prepared and we are waiting for the final approval of the Stock Exchange and Securities Organization for the issuance of these securities.

He explained: “In fact, given that many people are not able to buy housing in the current situation due to rising prices and inflation in this sector, these bonds can help housing applicants in the market; Especially since the pre-purchase of housing is not reliable in the current situation.

Emami said that parallel futures for a project have been issued by the publisher, which is currently a housing investment, and that a person can buy a few meters of a building and an apartment, depending on the amount of his inventory and assets. Of course, at the time of purchase, the location of the apartment is not clear and the person can buy different areas for consecutive years to reach a ceiling of 80 meters in three years.

He added: “After announcing the builder, the apartment will be ready for delivery to the applicants and the applicant can receive it from the residential units of this project based on the documents he has; This means that the person holding the bonds, in proportion to the amount of his assets, can choose the unit, but if his assets were less, he can pay the difference to the manufacturer and become the owner of the unit; But if he does not find any of these conditions appropriate, he can hand over the bonds to those who apply.

Source: stamp