Atrium prices; Traders are optimistic professionals

Unlike Bitcoin, which has performed well in recent days, Atrium has failed to record a good performance of Bitcoin. However, many traders are optimistic about Atrium’s good performance in the short term and the passing of this digital currency over $ 4,000.

to the Report Bitcoin Telegraph, Bitcoin performance has been 13% better than Atrium since the beginning of this month; But it should not be forgotten that Atrium has grown by 274% in 2021. Traders are now questioning whether Atrium can successfully implement the stock consensus. With the full launch of Atrium 2.0, we will greatly reduce network problems such as high fees and prolong transaction approval.

On the other hand, the fact that platforms such as Solana and Olench have become serious competitors to Atrium in the field of smart contracts has raised the concerns of traders.

An important issue that has resurfaced in recent days and weeks is the possibility of the Bitcoin Securities and Exchange Commission (ETF) being approved by the US Securities and Exchange Commission (SEC). Bitcoin traders look at this with a positive attitude. The US Securities and Exchange Commission is set to announce its decision in the coming weeks. Of course, there is a possibility that the announcement of this decision will be postponed.

Status of Professional Traders

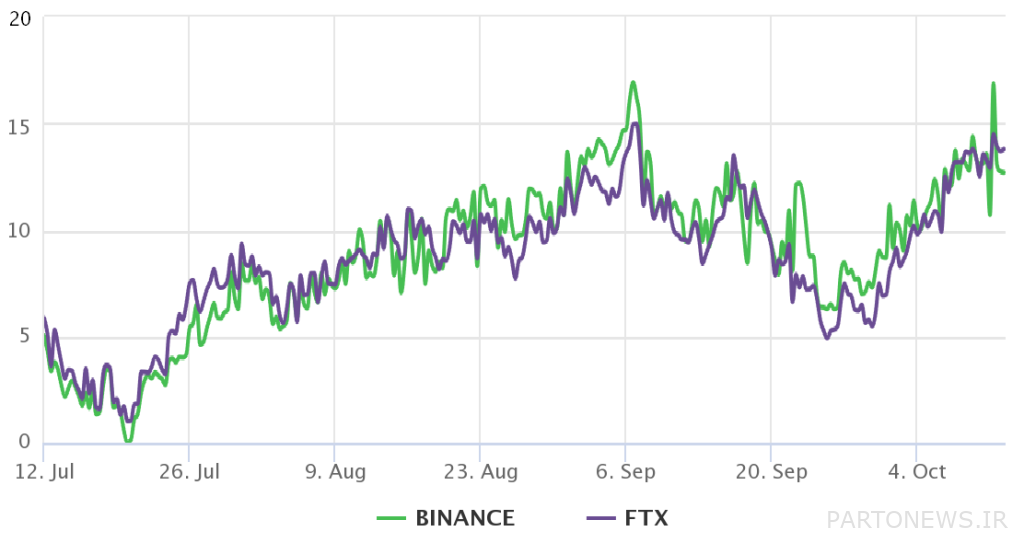

To understand how marketers feel about the market, we need to look at futures contracts. Premium futures is an indicator that calculates the difference between the price of futures and the price of assets in current markets.

Quarterly futures contracts are a favorite tool of whales and arbitrators. These types of contracts seem complicated for ordinary and micro traders due to their maturity date and price difference with futures markets. However, their main advantage is their low volatility funding rate.

Quarterly futures are usually traded at an annual premium of 5 to 15 percent. This figure changes in line with the stable coin lending rate. When the due date of a contract is delayed, the seller demands a higher amount to sell the contract, which causes a price difference.

As you can see above, Atrium’s failure to break the $ 3,600 resistance has not changed the sentiment of professional traders, as the premium rate has remained in the 13% range. This shows that there is currently no excessive optimism in the market.

Micro traders

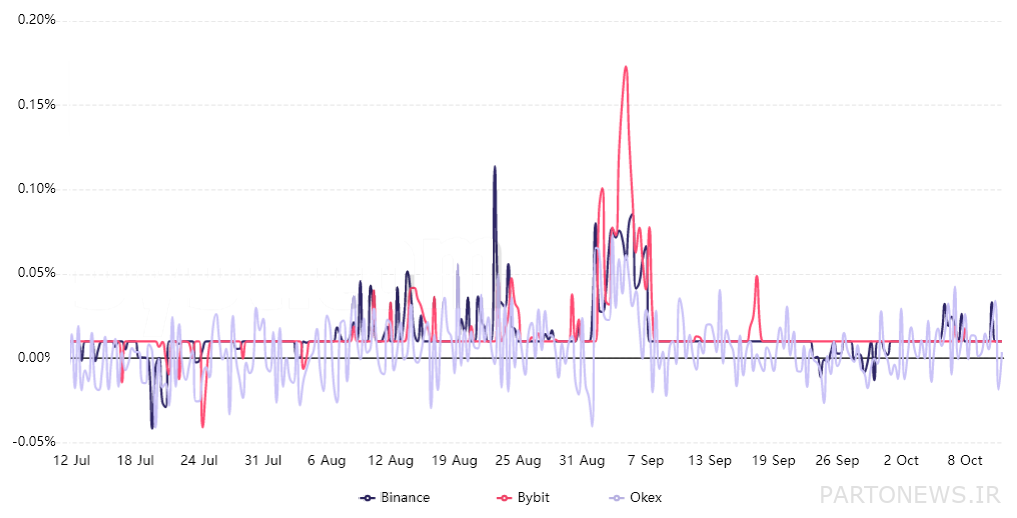

Retailers are usually more inclined to use overdue contracts. In such contracts, the contract fee is changed every eight hours to meet demand. To find out if there has been an emotional sell-off in the market, we need to look at the funding rate of futures contracts.

In a neutral market, this rate varies between 0 and 0.03%. The fee is 0.6% on a weekly basis. In this case, the fees are paid by the holders of long-term contracts.

It has not been possible to determine the uptrend or downtrend of traders since September 7 (September 16). This state of equilibrium shows that in addition to traders being less inclined to create long positions, there is not much emotional selling in the market.

Derivatives market data show that Atrium investors are not worried about the digital currency performing worse against Bitcoin. In addition, the lack of high leverage after a 274% growth this year is a positive factor.

Overall, Atrium traders are now hoping for a uptrend and breakout. In the meantime, obtaining licenses for tradable funds on the Bitcoin exchange can act as an accelerating factor.