Banks’ hounding has flourished against the youth law of the population/marriage loan sale – Mehr news agency Iran and world’s news

Mehr News Agency, Provinces Group – Maria Al Barzi: The “Population Youth” law prompted the government to oblige the Central Bank to facilitate the provision of marriage loans so that applicants can be delivered in the shortest possible time.

Despite the numerous news from the beginning of this year about the provision of loans Al-Hasna Getting married in less than a month or easy for banks to get guarantors has been heard, but the reality shows that these news have heated up the market of buying and selling this loan and the force of the notes of the youth law has not reached the banks.

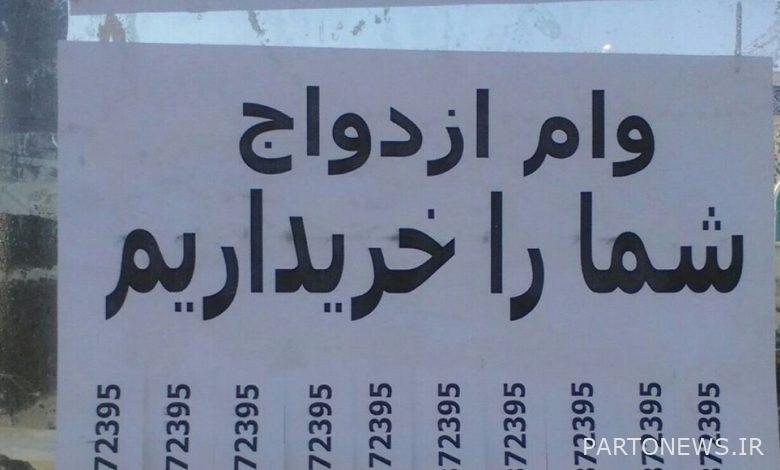

These days, we see the buying and selling of marriage facilities on many sites, and many couples are willing to sell this loan easily and with amounts of about 15 to 20 percent.

this Issue It also exists in Golestan, and the walls of the city and cyberspace are filled with announcements of buying and selling marriage loans.

Why some couples are granted loan facilities Al-Hasna or who are the buyers of these loans? Or the task of the needy couples who are still standing behind the receiving queue are what if? It is one of the questions that this report tries to answer.

Mr. Jahantigh was one of the sellers who sold his and his wife’s loan for 40 million Tomans on one of the social networks. It is better to have million without debt than to get 240 million tomans and remain in debt to the bank for seven years!

Karimi, one of the other marriage loan sellers, told Mehr reporter: My family and my wife are from Gorgan, and thanks to several years of work, we were able to buy a portable house, the marriage loan was our right, and we have no problem with the guarantor, but since we didn’t need it, We decided to sell it!

I can’t repay

Zaroozhi Another marriage loan seller who sold a loan for 30 million also told Mehr reporter: I cannot repay this loan, I am a daily wage worker and I am afraid that I will not be able to pay my debts to the bank.

Most buyers of marriage loans are brokers who have guarantors and easily buy and sell loans. He added: “My wife’s family has taken over the payment of dowry installments and we can start our good life with contentment. On the other hand, my family is not an employee and I am not ready to ask for guarantees from family and friends.”

Zaroozhi Noted: Most buyers of loans Al-Hasna There are brokers who have guarantors and these loans are sold very easily on different sites.

With these interpretations, the sellers of marriage loans can be divided into two categories, they sell this economic opportunity either out of necessity or out of necessity.

Not knowing how to invest or not having a stable and safe job are some of the things that lead couples to sell loans.

Legal problems that arise

Regardless of these issues, the transfer and sale of loans in the future will lead to legal problems, and this is also the case with some sellers Issue confirms

A legal expert regarding the purchase and sale of marriage loans told Mehr reporter: Even if there is no legal prohibition, buying and selling loans is wrong and immoral because the legislator intends to protect the couple, but the one who turns this legal opportunity into money In the first place, it prevents this loan from reaching the needy people, and in the second place, it destroys the goal of the legislator.

Reza Soleimani added: Some buyers try to get the consent of the couple by giving a promissory note and a notarized commitment, but this also causes many legal problems.

He continued: Some buyers have paid the first few installments, but after that they are not responsible, and as a result, the bank makes the main borrower a party to the lawsuit.

Soleimani is particularly hard get Banks in the affairs of guarantors, contrary to the law of the youth of the population, said: most of the loans that were given in the past have not yet been returned, and what should the bank do to collect them?

He clarified: Some borrowers cannot pay installments and some do not intend to repay at all. In these cases, the bank should think of a solution to collect the facilities it has given.

Soleimani by saying that the problems on the way to marriage with increased loans and easy law get The guarantor cannot be solved, he said: If the law says that the loan installments should be deducted from the subsidy, it is bypassing the needy person because that person receives the subsidy for being needy and now he has to pay for the basic needs of his life in installments.

He said: The government should follow the example of developed countries and support couples in another way. For example, he offered a 50-meter house to a needy couple with an 80-year repayment period and low installments so that the couple would be comfortable with the shelter.

Less than 50% of applicants received their marriage loan

The Deputy of Youth Affairs of Golestan General Directorate of Sports and Youth, while presenting the statistics of payment of marriage facilities from the beginning of this year to the end of November, told Mehr reporter: During this period, we had 35 thousand 692 people registered, of which 17 thousand 119 people were successful. Loans have been received and eight thousand and 95 people are waiting in line.

Hamed Molhasni by saying that according to the law for a loan Al-Hasna One guarantor is sufficient and he must not be an employee, he added: the law even allows banks to deduct marriage loan installments from the subsidy of individuals, but Unfortunately Banks act according to taste.

He clarified: In addition to insisting that the guarantor be an employee, some banks validate them, and in this regard, we see the difference in performance among state banks.

Mullahsani noted: People’s lack of knowledge about the law has caused banks not to submit to the law, while public opinion should demand their legal rights from the banks.

Stating that Golestan’s marriage loan payment rate is below 50%, he emphasized: “We had regular meetings with banks, but our legal tools are not enough to oblige banks, and banks refuse to facilitate the payment of marriage loans with various instructions.”

Molhasni said: The marriage loan for couples over 23 years old is 120 million tomans and for those under 23 years old it is 150 million tomans, the repayment of which is seven years and the installments are under two million.

Molhasni stated: “The government’s focus is on the correct implementation of the law on the youth of the population, and the banks have a duty to provide maximum support in this matter.”

According to Mehr’s reporter, hard get Banks in verifying the guarantor, the inability to repay the installments and the couple’s ignorance of the legal problems in the continuation of the work, have caused some couples to sell their marriage loans, so it is necessary for the authorities to implement a plan so that this loan can easily reach the real applicant. .