Banks’ reluctance to connect ATMs to the fishing system and the plight of some businesses

According to the economic correspondent of Fars News Agency, after the approval of the new Czech law in December 1397, the Central Bank had until the beginning of 1400 to provide the necessary infrastructure for the full implementation of this law.

Although from 1397 to 1400, over time, these duties of the new Czech law were implemented and some law enforcement infrastructure has been provided, but some of these legal duties still remain and some of these necessary infrastructures have not been completed.

* The role of the new check law in reducing bounced checks is obvious

As mentioned, since 1397, some of the duties of the new check law have been implemented, for example, in the early days of the adoption of this law, registration of non-payable checks in the central bank integrated system, receiving the tracking code and entering it in the certificate by the bank Also, the payment of the amount in the issuer’s account and the issuance of a certificate of non-payment for the deficit of the check amount was enforced.

According to these duties, in case of return of a check, on the one hand, the processing time of check claims in the judiciary is significantly reduced, and on the other hand, in accordance with Article 5 of the new Check Law, the issuer of returned checks has restrictions up to The time of elimination of the effect of this returned check is applied, and the performance of these tasks has played a significant role in reducing the volume of returned checks.

* The effects of the new Czech law

Hojjatoleslam Nasrullah Pejmanfar, Deputy Chairman of the Parliamentary Article 90 Commission, says about the effects of the new Czech law according to the latest statistics of the Central Bank: January 1400 and in the category of new checks is equal to 6.2 percent, while this ratio is equal to 8.6 percent in all exchanged checks, both new and old checks.

According to him, the total number of checks exchanged during this period was about 73 million checks, of which about 6 million checks were returned. Also, the total checks registered in the Sayad system were more than 38 million checks, 15 million of which matured. And after returning to the banks, they were either returned or passed, and the remaining 23 million have not yet matured.

The Deputy Chairman of the Article 90 Commission says: out of 15 million checks whose duties have been determined, only 925,000 items have been returned and the rest have been passed, which means that the rate of return of checks in the category of new checks was equal to 6.2 percent; This is while this ratio has decreased by 44% compared to the same period of 2017, ie the year before the implementation of the new Czech law.

According to Hojjatoleslam Pejmanfar, the use of new checks in the market has reached 52% of the total number of exchanged checks, which shows that the share of new checks in exchanges has increased over time.

* The need to expand the ways of access to the fishing system to register and confirm the check

Despite the positive effects of the incomplete implementation of the new check law, the need for full implementation of this law by the central bank is now felt more than ever because parts of this law are still not implemented while the volume of people using the new checks is increasing.

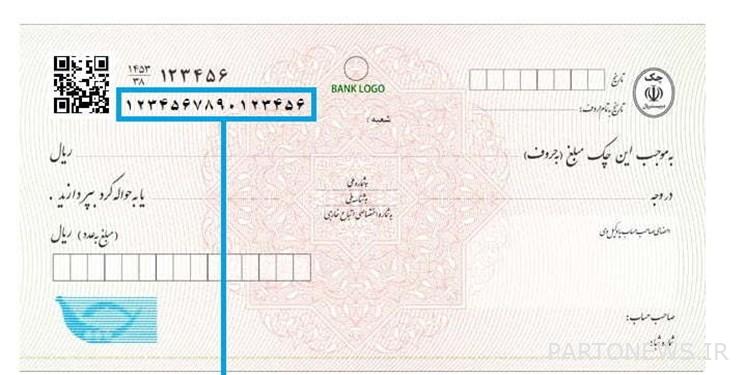

From the beginning of 1400, all new checks that are issued must be registered in the fishing system of the Central Bank by the issuer and approved by the recipient because if new checks are not registered and approved in the fishing system, according to Note 1 of Article 21 of the new Check Law, banks Obliged to refuse to pay checks.

However, Some business owners, especially in deprived areas, due to lack of access to smartphones and the Internet, can not register and confirm new checks in the fishing system through mobile banks and commercial applications. Therefore, to solve the problem of this group of people, it is necessary for banks to register and verify checks through ATMs and SMS systems that are available to everyone.

* Some banks are delaying in connecting the ATM to the fishing system

Hojjatoleslam Hassan Shojaei, the head of the Article 90 Parliamentary Commission, says in this regard: The Article 90 Commission held a meeting in November with the head of the Central Bank to decide on the implementation of the problems of the new Czech law. In this meeting, it was decided that all banks will be able to register and confirm checks in the fishing system through ATMs and SMS by the end of January 1400.

He added: “Despite the expiration of the deadline, this case has been implemented by only a few banks and other banks continue to cooperate in providing this service and facilitating access to the fishing system to register and confirm checks, especially for those who do not have access to smartphones and the Internet.” They do not need to say that this requires serious follow-up by the central bank.

Emphasizing the importance of registering checks via SMS and ATMs in the Sayad system, Shojaei said: “The trend of using new purple checks in the market is increasing, so to avoid confusing people, various methods should be used as soon as possible to register checks in The fishing system is agreed and operational. Of course, banks should also take the lead in discussing education and public information of the new rules and regulations of checks so that people do not receive checks that are not registered in the fishing system.

* Make it possible to register and verify checks with an ATM

Thus, the report, although in the last meeting of the Article 90 Parliamentary Commission with the Governor of the Central Bank, a schedule was set for the full implementation of the new Czech law, the banking network is still assisting in the implementation of the law.

However, it is necessary to commit to the approvals of the last meeting of the Article 90 Parliamentary Commission with the officials of the Central Bank and its implementation before the deadline, ie by the end of this year.

End of message /

You can edit this post

Suggest this for the front page