Bitcoin falls to $ 38,000; What will be the market situation in the next 30 days?

The market situation in May of previous years has been mainly upward. This year, however, the market is experiencing different conditions, and bitcoin returns have been negative since the beginning of 2022. With that said, will the good price performance in May of previous years be repeated this time?

To Report Bitcoin Desk started a new downtrend yesterday from its high of $ 40,200 following the fall of prices in the global stock market.

Most of the market-leading instruments have performed worse than bitcoins in the last 24 hours, which shows that as risk fluctuates in the market, investors’ risk appetite has also decreased. Atrium, for example, has fallen more than 5 percent in the past 24 hours, and Olench has fallen 6 percent; Bitcoin, meanwhile, has lost about 4 percent of its value over the same period.

The S & P500 index also fell on Friday and is now on the verge of its worst annual start at $ 1942. Meanwhile, the price of gold in world markets has risen in the last 24 hours and the 6% jump in the last six months remains unchanged.

Bitcoin lags behind the stock market and gold this year

Bitcoin has outperformed the S&P 500 and gold since the beginning of 2022. However, as the chart below shows, this digital currency has outperformed US Treasury bonds over the four-month period. Financial markets have generally been in a risky environment since the beginning of 2022, stemming from rising tensions between Russia and the West (over the Ukraine war) and macroeconomic factors.

In periods when investor confidence is waning, market participants are reducing the share of risky assets such as digital currencies and stocks in their portfolio. In such cases, an increase in bank interest rates usually leads to a decrease in bond yields. On the other hand, gold and other assets that are considered “commodities” often become more valuable as inflation increases.

The price trend of Bitcoin since the beginning of this year has been volatile and without a clear direction, and the middle axis of these fluctuations is the level of $ 40,000. Despite the negative return of bitcoin since the beginning of this year, the price of bitcoin is still 16% higher than the $ 33,000 floor that was recorded on January 24th. The S & P500 is now at its lowest level since the beginning of 2022.

The bloodbath of digital currencies in the past month

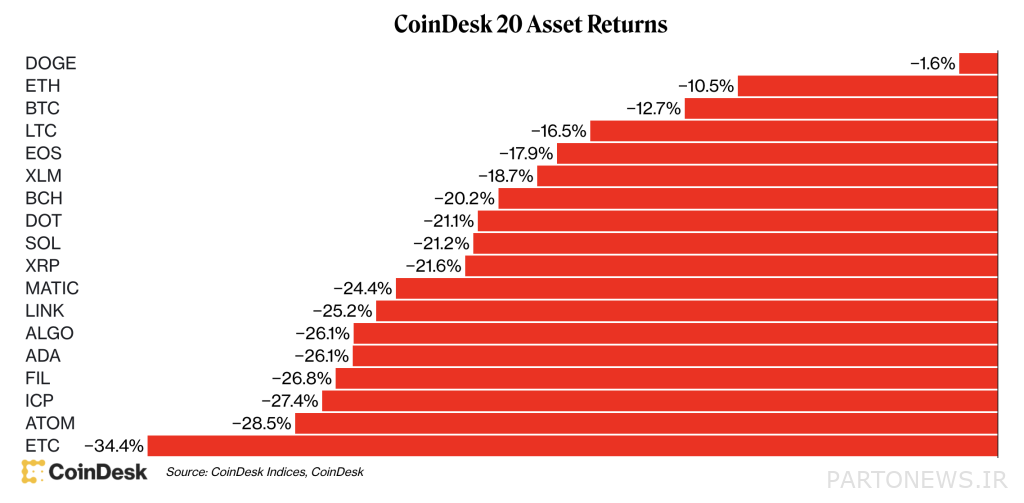

The chart below shows the returns of the 20 digital currencies on the market in the last 30 days, which is negative for all currencies on this list.

The index, called CoinDesk 20, measures the status of thousands of digital currencies based on market value, trading volume, and several other metrics, and its output is a group of 20 of the most important market currencies. 99% of the trading volume of the 8 largest exchange offices in the world is dedicated to these 20 digital currencies.

In the last 30 days, Dodge Quinn has had the best performance among the 20 currencies on this list, the main reason being the 20% jump in the price of this token last week; The leap occurred after accepting Ilan Mask’s offer to buy Twitter. This Meem Quinn has already reformed much of its recent growth; But it still performed much better than Shiba Inou, who experienced an 18% price reduction during this period.

Atrium Classic, the digital currency that emerged after Atrium Network split in 2016, has the worst performance on the list. This digital currency had the best performance among 20 currencies in this list in March.

Atrium and Bitcoin experienced lower selling pressures in April compared to other market currencies. Altcoins tend to perform worse in declining markets because they require more risk-taking than bitcoins. Therefore, it can be said that the risk of market participants has decreased in this one month.

May has been a good month most of the time

The question that has been on the minds of traders as the beginning of May approaches is whether a fall in prices in April could lead to a boom in the market in May.

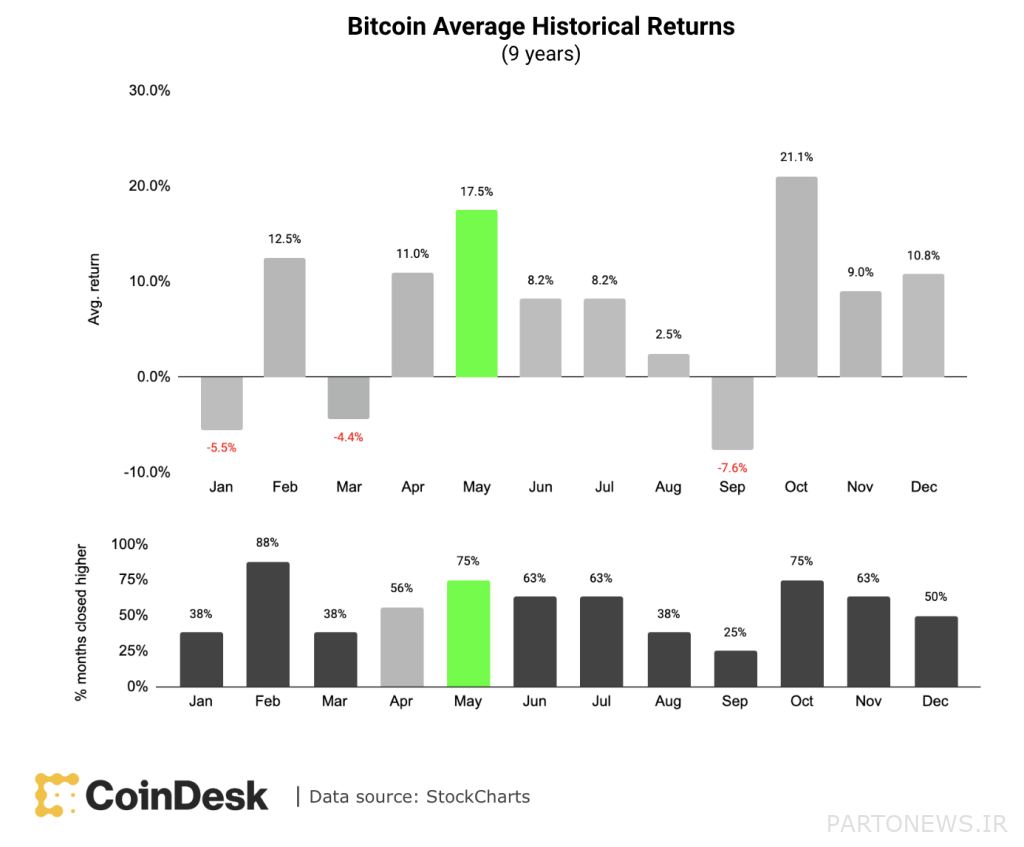

The upper part of the chart below shows the average monthly return of bitcoins throughout history. The bottom of the image also shows how much bitcoin has returned positively each month over the past nine years.

Bitcoin has historically had an average return of 17% in May each year. The historical performance of the stock market has also been strong in May of previous years, and this issue can encourage buyers to re-enter the market after 3 months of limited price fluctuations.

It is very important to note that price performance in previous years cannot be a guarantee that the same thing will happen again in the future. For example, technical indicators indicate the continuation of transverse fluctuations and price stabilization in the future, which, of course, may be accompanied by a limited price increase. At the same time, the feelings of traders in derivatives markets are not the same.