Bitcoin fell to $ 38,000; Where is the next price support?

The bitcoin price fell to $ 38,000 a few hours ago after breaking the key support of $ 40,000. As can be seen from the in-chain data, market whales have been inactive for some time, expecting prices to fall to lower levels as they prepare to buy new units.

To Report Crypto-briefing While market whales appear to have been inactive for some time, Bitcoin is trying to find new support to prevent further price falls.

Bitcoin, which recently lost key support at $ 40,000, fell to $ 38,000 today. The decline appears to be partly influenced by the activity of traders in leveraged markets. On the other hand, as it turns out, market whales are also waiting for prices to fall to lower levels so that they can start re-accumulating new units at lower prices.

Currently, about 67.7% of the total accounts active in the futures markets of Bainance Exchange are in long positions (buying) bitcoins. New data also shows that investors are overconfident about Bitcoin price performance in the future, while the ratio of long positions to shorts (sales) in the Bitcoin / Tetra market reached a one-month high of 2.08. it is arrived.

Such optimism of investors often leads to increased borrowing pressure; Something that seems to be happening in the market right now. Borrowing is a situation in which investors exit their long trading positions and sell in order to prevent further losses. If the whales do not re-enter the market and accumulate new units, the chances of increasing the borrowing pressure increase.

As can be seen from the in-chain data, wallets with between 100 and 100,000 bitcoins in stock have performed almost no activity in the past month. These market participants, who are among the richest addresses, are not interested in buying more bitcoins at current prices; Probably because they are waiting for the price to fall to lower levels.

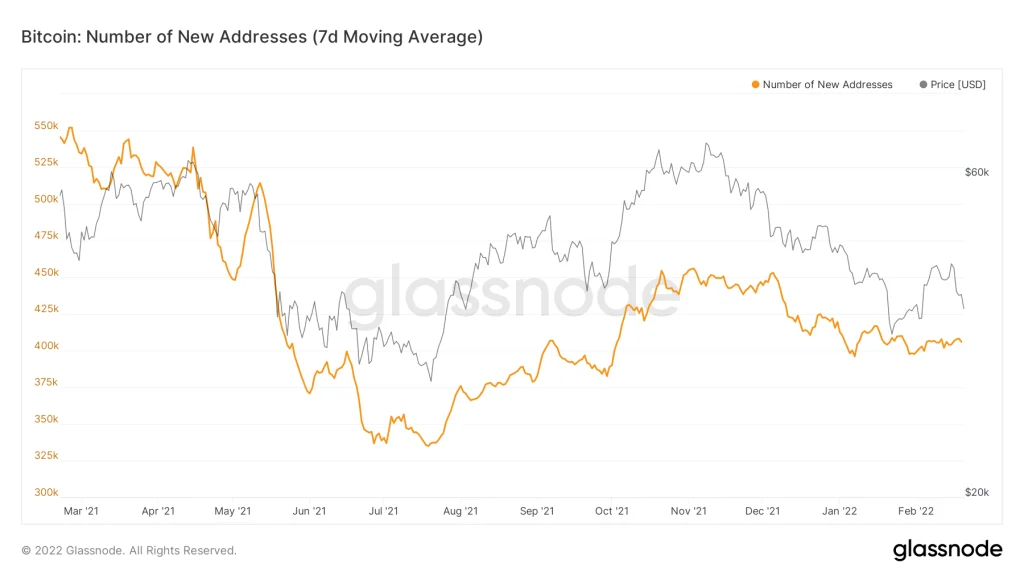

Lack of interest in buying bitcoins can be seen in the number of addresses that are added to the network on a daily basis. Despite a 40% recovery in the price of Bitcoin over the past three weeks, in-network activity has not grown much during this period. As the data from Golsnod shows, the number of addresses added to the Bitcoin network has recently remained stable at 400,000 a week.

Given the high correlation between prices and the increase in intra-net activity, it seems reasonable to expect the jump in this index to be a confirmatory chain to continue the upward trend in prices. Until that happens, however, Bitcoin is likely to test support for the 200 Kendall moving average, which is at $ 37,000 in the 3-day market view. It is also possible that the price will continue to follow the forecast of Tom DeMark, a well-known financial market analyst, and test the flat trend line at $ 33,500.

If buyers continue to fail to keep prices above this crucial support area, large volumes of trading positions in liquid futures markets will be liquidated and more downward pressure is likely to push the price to lower levels.