Bitcoin is on the verge of registering its first one-year bearish covering candle; Expect a big crash?

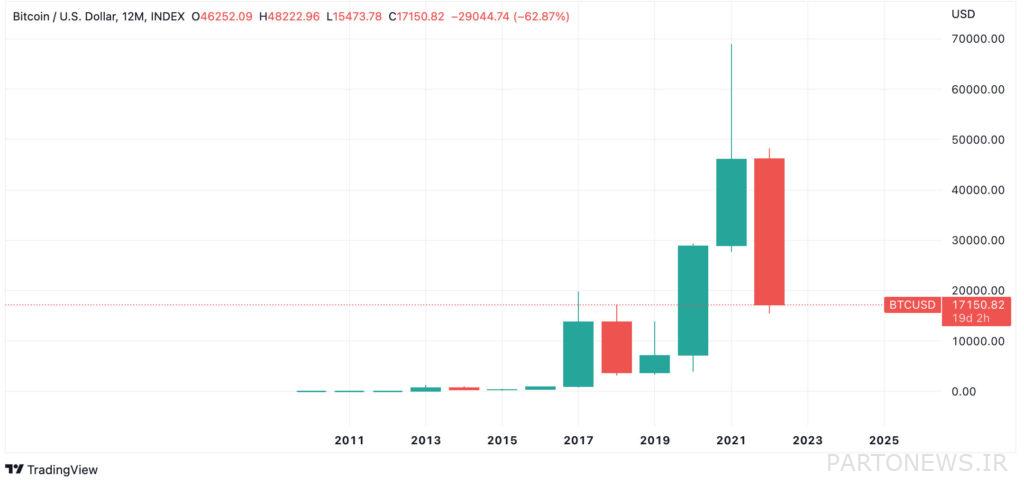

On the one-year chart of Bitcoin, a bearish sign can be seen, the likes of which have never been seen in the market. Bitcoin now has less than 3 weeks to prevent the formation of this bearish pattern by jumping to higher levels.

To the report Blockworks, Bitcoin is less than 20 days away from registering its first bearish covering candle on the 1-year view. This pattern is formed when two candlesticks of opposite colors (one bullish and the other bearish) are placed in a row, so that the body of the second candlestick completely covers the body of the first candlestick.

Because Bitcoin does not have a long life as an asset, it is difficult to extract price trends from its annual chart. Of course, we witnessed a new event in the weekly chart of this digital currency, which is considered a relatively shorter-term view; For the first time in history, the price fell below the peak of its previous bullish cycle.

As can be seen from the weekly chart of Bitcoin, $19,800 was the peak of the bullish cycle of this digital currency in 2017, and it took a year for this cycle to find its price floor at $3,100; It means an 83% drop from the peak of that time. In the current cycle, however, Bitcoin has fallen from a peak of $69,000 to around $16,000, which represents a 75% drop in the price of this digital currency in an almost identical period (one year). What we are seeing now is the Bitcoin weekly candlestick swing below the 2017 price peak for the fifth week in a row.

Also read: What is price action? Learning to trade with Price Action

The market battle this week could be to break the $17,400 resistance. In addition, the US inflation rate for the previous month is today and the new bank interest rate is going to be published tomorrow. Expectations for a 0.50 percentage point increase in interest rates in this period and increasing concerns about facing an economic recession have left a gloomy picture of the future of digital currencies and other risky assets.

Mike McGlone, chief strategist at Bloomberg, says:

Bitcoin, as the most liquid trading instrument in the world, found a new position as a leading indicator in 2022, and in a situation where the risk appetite of investors became less and less. [بخشی از] lost its value. However, this digital currency could become a more volatile version of gold or US Treasuries.

Bitcoin’s 260-day volatility is currently 4 times that of gold. Meanwhile, in 2018, the volatility of Bitcoin was 10 times that of gold.

Hany Rashwan, the CEO of 21Company, believes that the decrease in investors’ desire to take more risk, which was already seen in the market, did not affect the Bitcoin market as much as expected.

He said about this:

The current situation clearly shows the risk aversion of investors, and this issue is not only related to the digital currency market, but to all industries. In fact, this limited and neutral volatility of Bitcoin in a certain price range calmed the market.

Some traders hope to improve market conditions in the near future; But Bitcoin has less than 3 weeks to grow by 40% from the current levels and get to the point where the annual bearish candlestick formation is ruled out.

CoinShares analysts wrote in their latest report:

Bitcoin-specific investment funds saw $17 million in new capital last week. It can be said that market sentiments have been steadily improving since mid-November, and since this date, a total of $108 million has been invested in Bitcoin investment funds. This amount is equal to 2.1% of the total assets under management of these funds.

Kevin Shears’ report also states:

This improvement in sentiment towards Bitcoin coincided with negative sentiment towards the performance of the dollar in global markets, which once again illustrates the inverse relationship between the two. In addition, short bitcoin investment products (in the direction of price reduction – selling) have seen capital outflows for the second consecutive week and have lost a total of 3.9 million dollars in these seven days.