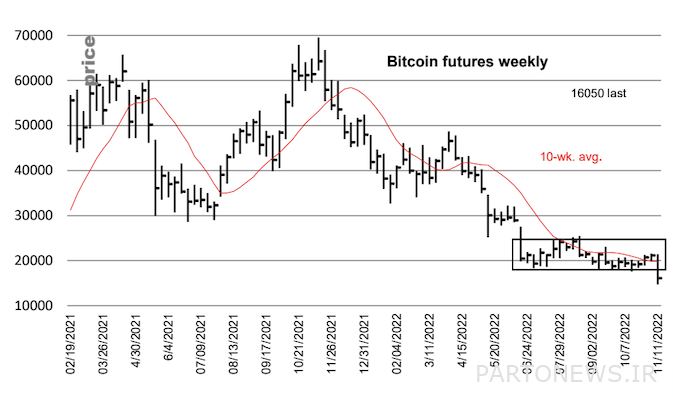

Bitcoin price analysis: The next support is near $13,000

Following the bankruptcy of the FTX exchange and the decrease in investor confidence, the price of Bitcoin fell by 22% last week and reached its lowest value in the last 2 years at $15,600. This price drop will likely cause the price to fall further to a new low by breaking the multi-month market trend of Bitcoin’s range in the $18,000 range.

to report CoinDeskAmerican financial services company Morgan Stanley strategists wrote in an analysis for their clients on Friday:

From a technical analysis perspective, Bitcoin price has now dropped below $18,000, which was a support zone in recent weeks. $13,500, the 2019 high, and $12,500, the Q3 2020 high, are the next support levels to consider.

Breakout of a range or breakout trend is usually accompanied by a sharp drop or rise in price. According to the theory of technical analysis, a lot of potential energy accumulates in an asset during a period of price stabilization, and this energy is eventually released in the direction of breaking the suffering trend. The longer the price stabilization period, the more stored energy and the larger the price movement after the breakout. Therefore, experienced traders avoid trading in the opposite direction of the price break or breakout in this situation.

Delphi Digital analysts also wrote in a note sent to their subscribers on Friday:

First, think of the price stabilization range as a spring that is compressed over time and filled with potential energy. Each successful return from the support area or failure to break through the resistance area increases this potential energy. When this suffering trend finally breaks, the price jump can be very intense; Just like the unwinding of a compressed coil spring.

Technical analysis patterns may sometimes not work properly. However, a breakout of Bitcoin’s current bearish trend will cause the price to fall further; Because the adverse macroeconomic conditions and the FTX crisis will most likely reduce the risk-taking of investors.

Noting that Bitcoin’s support range will be somewhere between $16,000 and $14,000, Delphi Digital analysts added:

This price failure has been accompanied by one of the worst cryptocurrency market movements to date, affecting investor sentiment and the asset’s price. Combine this stimulus with the FTX and Alameda crisis; And with a dark background of macroeconomics that has not changed fundamentally. [در نتیجه بیت کوین] Contrary to the path of price increase, it continues this downward trend with the least resistance.

Michael Oliver, the founder of Momentum Structural Analysis, said that the fall of the price of Bitcoin to the bottom of the current range is likely to be the beginning of the formation of the price floor; Although the market may not find its bottom anytime soon.

Oliver wrote in his weekly analysis:

A drop above the hypothetical support of $18,000 could be a prerequisite for a new bottom. However, the price falling below the current range will probably cause the formation of the next price floor; A process that has begun.

He added:

Based on various indicators, we think the price is likely to decrease. This market may find a reliable price floor before December. So in the current situation, let it happen.