Bitcoin reaches the middle of the Hawing cycle; What should we wait for?

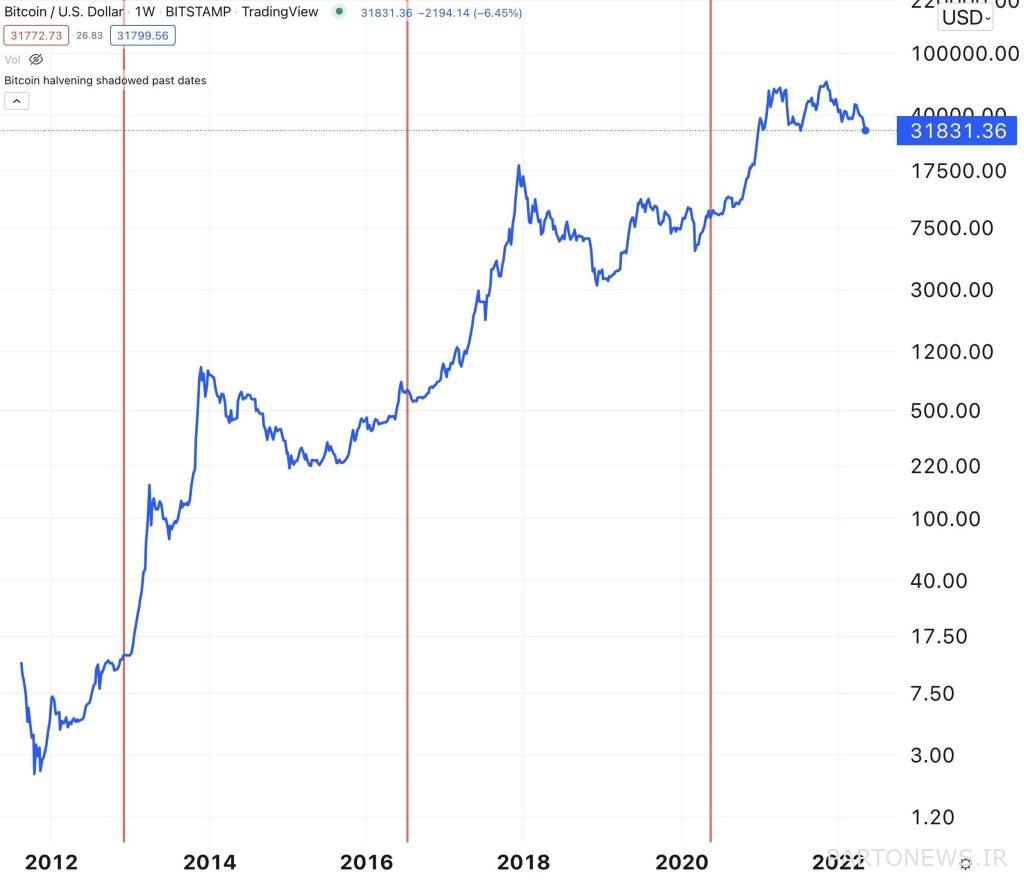

Half of Bitcoin’s four-year cycle has just passed, and analysts are already trying to predict the reaction of the bitcoin price to the next hawing. However, history shows that this is more difficult to predict than it seems.

To Report Crypto News, the next biting of Bitcoin is scheduled to run around March 30, 2024 (April 11, 1403). Hawing happens every four years, during which the block reward paid to the miners of this digital currency network is reduced by 50%. On that date, the reward for bitcoin blocks is halved and reduced from 6.25 points to 3.125 bitcoins per block extracted.

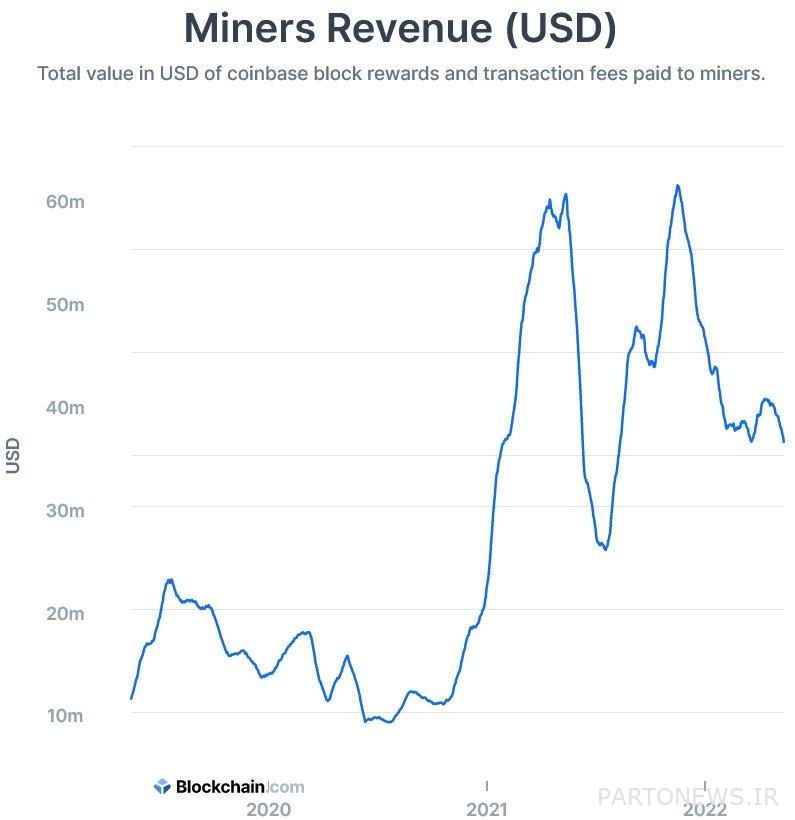

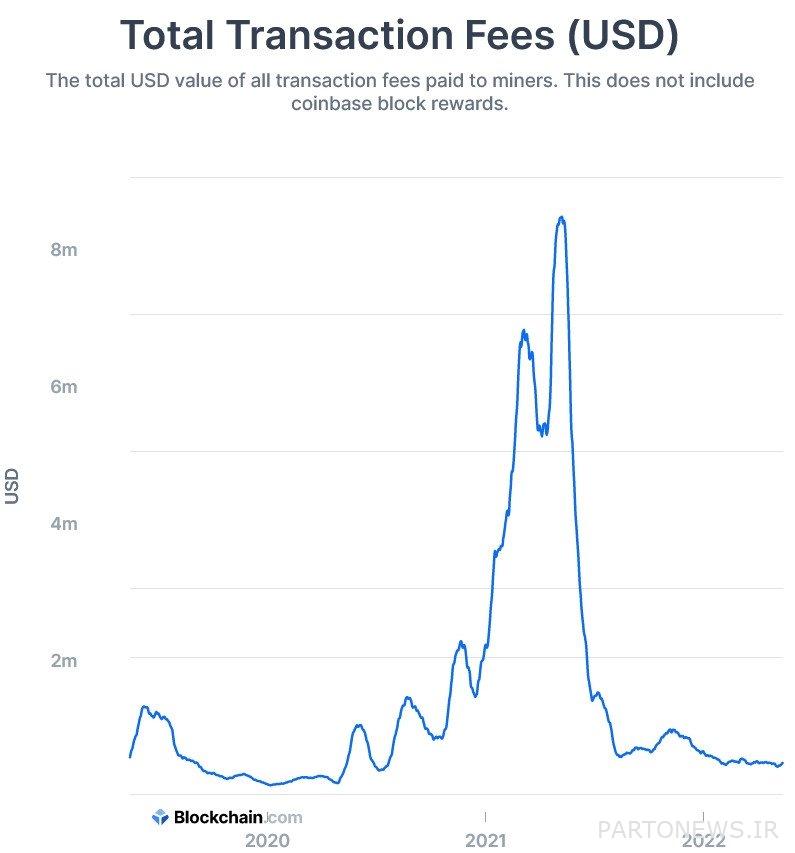

At present, 900 bitcoins (about $ 27,000,000) are mined daily, and after the next hawing, this number will be reduced to 450 bitcoins.

The previous bitcoin howling took place on May 11, 2020, after which the bitcoin bonus reward increased from 12.5 to the current value of 6.25 bitcoins. However, the reaction of the Bitcoin price to this event was not what some expected (and probably hoped for). Although the price of bitcoin fell slightly on this day and after the event, some digital currency market experts believe that this was one of the drivers of the big uptrend in bitcoin in the next two months.

This upward trend continued until April 2021 (April 1400) and brought Bitcoin to the peak of $ 60,000. Then, a major correction halved the price of this digital currency in almost 100 days, paving the way for its next uptrend. The second uptrend also pushed the price of Bitcoin to its all-time high of about $ 69,000 in November 2021 (November 1400).

However, we still do not know how the market will react to the next bitcoin move. All we know is that miners’ rewards are halved, and in order for bitcoin mining to continue to be profitable, its price must increase.

Also read: What is Bitcoin Hawing and how does it affect the price?

Given that many experts, including Satoshi Nakamoto himself, the anonymous creator of Bitcoin, believe that the cost of producing a new bitcoin acts almost as the price floor of this digital currency, it makes sense to increase its price after each hawing cycle. In addition, we do not yet know whether bitcoin usage will increase sufficiently in the future and whether transaction fees will exceed block rewards.

The price of bitcoin usually reacts to Hawing late

Examining previous hawings, it can be concluded that it is rare for bitcoin to react immediately to its new hawing. Of course, this does not seem strange given that Hawing is a well-known event and the market must determine its value.

However, the Bitcoin chart shows that the price of this digital currency has risen significantly in the last three periods and shortly after the Hawings took place.

Third Hawking Bitcoin

Prior to the previous hawking, experts predicted that the event would have no effect on the price of bitcoin. Some expected the supply of miners to increase as a result of the selling pressure of this digital currency, and traders to adopt a “buy with rumors and sell with news” strategy. A number of experts also expected the price of this digital currency to rise as more new bitcoins are to enter the network cycle.

However, when this hawing happened, the first prediction came true and initially had almost no effect on the price of bitcoin for a while.

The second bitcoin hawing

After the launch of the second bitcoin howling in 2016, the price of this digital currency initially dropped, much to the surprise of many holders who were waiting for its price increase. However, after a while, the upward trend of bitcoin resumed and introduced this digital currency into the big upward market, which continued until the end of 2017.

Richelle Ross, an active consultant in digital currencies and computer science, was one of the people who correctly predicted the rise in bitcoin prices at the time. In December 2015, he predicted that the price of bitcoin would reach $ 650 after Howing 2016. At that time, the price of bitcoin was about $ 400.

Although Ross’s conservative forecast came true, the price of this digital currency not only rose, but reached $ 1,000 by the end of 2016.

The first bitcoin hawing

The first bitcoin howling happened in 2012. Atrium founder Vitalik Butrin was the author of Bitcoin Magazine at the time. In one of his articles, he explained that the bitcoin community was roughly divided into two groups before its first hawing. The first group argued that bitcoin hawking would cause a supply shock (reduce supply due to reduced bonuses) and double its price. The second group also believed that bitcoin hawing was a well-known event for the market and did not affect its price.

Given this, we can conclude that what really happened was largely a combination of the views of both groups, and the same was true for the next two hawings.

In general, on the one hand, it is true that Hawing has always been a well-known event and has no immediate effect on the price of bitcoin; But on the other hand, the lower supply of this digital currency and the fact that all miners need higher prices to make a profit, has caused the price of bitcoin to rise after all three moves and in the medium and long term.

So, although we do not know what will happen after the next biting of Bitcoin in the first half of 2024, it is probably reasonable to expect its price to rise. It should be noted that this event is likely to start another price cycle in the bitcoin market.