Bitcoin returns from the 6-week price floor; What is the next move?

With Bitcoin jumping from its 6-week low, many traders expect the uptrend to start at current levels. However, some market analysts and economists have differing views, warning of growing fears among investors and a further fall in bitcoin.

To Report Coin Telegraph The bitcoin price returned to the top of the $ 39,000 area on April 27 after falling to its lowest level since mid-March (late March).

At the time of writing, the world’s largest digital currency has fallen 3.5 percent in value over the past 24 hours and is now hovering near $ 39,100.

Bitcoin faced new challenges following the start of trading on the US stock market on April 26 (May 6), and once again followed the downward trend of the stock market, even hitting the level of $ 37,700 twice.

Although analysts had previously seen the area around 37,700 as an opportunity to increase buying pressure (support), some still did not accept that the selling pressure was over at this level.

Kaleo, a popular digital currency trader and analyst on Twitter, has said that the current growth will not last long and that the main problem will start when the bitcoin’s uptrend slows.

He said on Twitter:

The selling pressure that will form after the current jump is over will be terrible.

“Michael Telegraph’s analyst Michaël van de Poppe said:

Currently, the price performance of Bitcoin does not indicate an upward trend. It is difficult to detect an uptrend; Because bitcoin has experienced a downward trend after each jump.

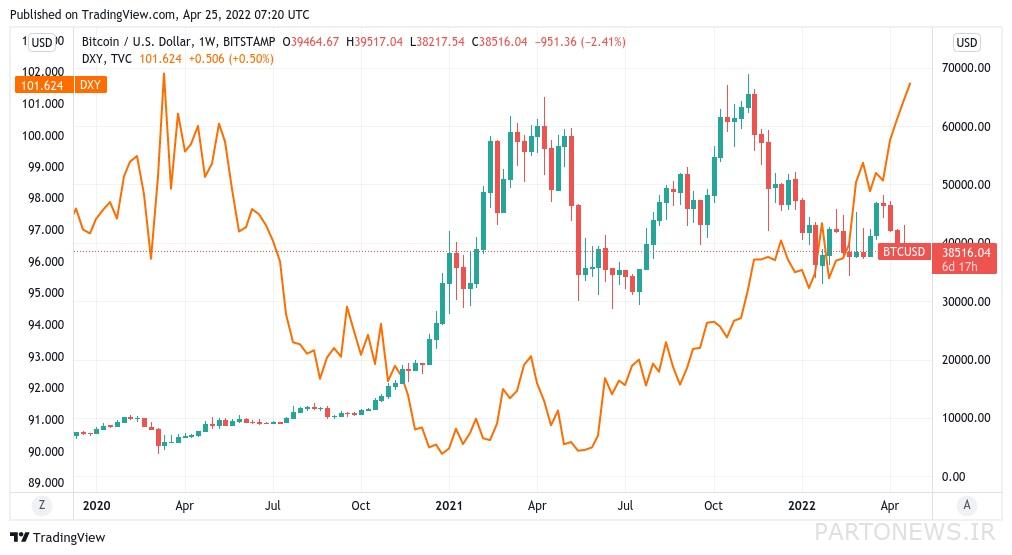

The US dollar did not show any signs of ending its uptrend over the past week, which increased the selling pressure on the digital currency market. The dollar index (DXY), which compares the value of the US dollar with other major world currencies, has now reached near the peak recorded in March 2020.

Lyn Alden, an economist and founder of an investment firm, tweeted:

The US dollar index has grown more than I could have imagined due to the unexpected decisions of policymakers. Therefore, we need to be aware of the market problems that occur when this happens. This is not a good thing; That is, the US will not increase buying pressure in the stock market by raising bank interest rates, but all assets will be damaged.

Traders of digital stocks and currencies have felt the danger

Traders in traditional financial markets and digital currencies alike are well aware of the negative sentiment.

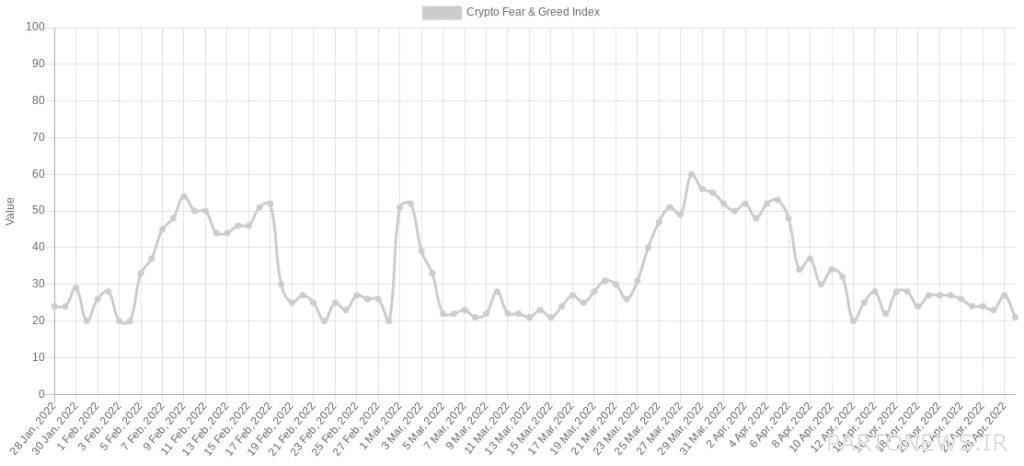

The digital currency fear index has reached its lowest level since April 12, at around 21 out of 100, indicating a strong fear among investors.

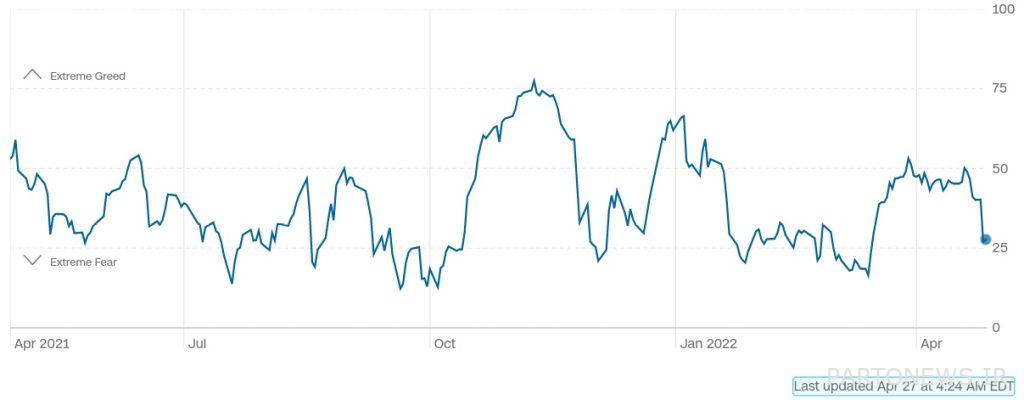

The stock market fear and greed index, which until recently remained neutral in the “neutral” region after falling behind digital currencies, shows 27 out of 100 strong fears among traders on April 27 (May 7).