Calculate staff overtime using the overtime formula

This article deals with various topics such as overtime formulas, payroll software as well as its features and the introduction of a payroll software for calculating overtime.

What is overtime?

Employees are required by law to work 7.33 hours per week, which is 24 hours a month. Now, if they spend more than this hour, it is called overtime, whose salary according to the labor law in these overtime hours is 40% more than their hourly wage.

In the specialized definition of overtime, the amount of work specified by the employer to the employee, which is done outside of working hours, is called overtime.

Is overtime mandatory for all staff?

To do overtime, the employee or worker must be satisfied. If the manager or employee is dissatisfied, overtime should not be done.

Overtime formula in 1400

In order to be able to get overtime in 1400, you must first know the hourly wage of the Ministry of Labor and calculate the amount according to the salary, the amount of overtime and using the overtime formula. There are two ways to calculate hourly wages, which are:

– Dividing the monthly wage of the worker into the working hours of the month

– Divide the daily wage of the worker by 7.33 (this number is the same as the number of hours worked during the day.)

In the first method, which divides the worker’s monthly wage by the number of hours worked during the month, it can be just the worker’s basic salary or the sum of the basic salary along with other individual benefits, which is called the calculation basis and is determined by the employer.

Once the basis for calculating overtime has been determined by the employer, the basis for calculation should be divided by the number of hours worked by the employee per month. So far you have been able to get the amount of wages per hour of labor. Now you have to multiply the number you get by 1.4, and finally multiply the number you get by the overtime hours the employee has. The number obtained is the amount that must be paid to the employee or worker for overtime work.

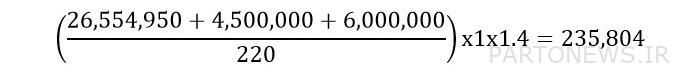

The formula for overtime in 1400 is equal to:

Overtime formula according to the law of the Ministry of Labor

In order to be able to work overtime according to the law of the Ministry of Labor, you must first have information in the field of basic rights of the labor law, the right to voucher, the right to housing of an employee or worker. In this section, we have included the amounts of benefits mentioned for the year 1400.

– The basic salary in the Ministry of Labor in 1400 is equal to 26,554,950 Rials.

– The right of bin is equal to 6,000,000 Rials.

– The right to housing in the Ministry of Labor is equal to 4,500,000 Rials.

– The monthly years of the employee or worker is equal to 1,400,000 Rials.

– The right of children to have each child is equal to 2,655,495 Rials.

The employer can also calculate the basis of one hour of overtime based on the following formulas, depending on the type of contract he makes with the staff.

Calculate the amount of one hour of overtime using basic salary:

Calculate the amount of one hour of overtime using the basic salary and the right to housing:

Among the rules that exist for overtime are:

– Overtime must be agreed between the worker and the employer.

– The cost of overtime with a precise worker must be calculated and paid.

– Overtime hours should not be more than 4 hours per day, except in special circumstances

– The network worker should not have overtime.

– Overtime of teenagers is illegal.

– In hard and harmful jobs, workers should not work overtime.

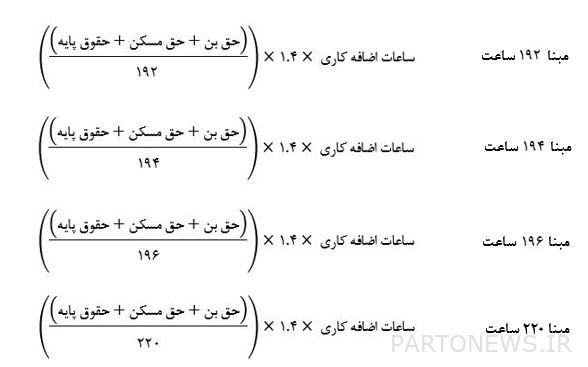

Overtime formula according to the basis of working hours

Overtime formula Depending on the working hours of the employees, it is different. These working hours are in 4 modes, which are:

– 192 hours

– 194 hours

– 196 hours

– 220 hours

The overtime formula of these different hours is equal to:

Familiarity with payroll software

One of the most important parts of any company is the payroll; Due to the sensitivity of this section, the managers of each business must have precise control and management in this section. Staff also expect their salaries to be paid on a timely and regular basis.

Due to the great importance of accurate and regular work in the payroll unit, the use of a high-performance payroll software is necessary to calculate the payroll of personnel.

.jpg)

Important features of payroll software

As the number of payroll software on the web or Windows has increased, a new challenge has arisen for buyers as to which one is better for their business.

It should be noted that most of these softwares have the same features, but some of their features such as database type, high speed, good user relationships, good support, etc., have made some of these softwares look better and more welcomed. And use business managers.

In order to have a good software for our business, we need to know the features of a good payroll software.

In this section, we have introduced the most important features of the best payroll accounting software, which include the following:

– Ability to calculate salaries with complex factors

– Ability to prepare a salary tax list

– High security software

– Ability to prepare a list of salary insurance

– Possibility of issuing real verdicts on a floating basis

Ability to calculate salaries with complex factors

Certainly, every business defines different legal factors for the benefits and deductions of its employees, the more these factors are, the more complex it is to calculate salaries. So it must be possible to calculate salaries correctly with complex factors. Also a proper payroll software in addition to calculating salary, should have the ability Calculate years And also have Eid.

Possibility to prepare a salary tax list

Salary tax is one of the most important issues in accounting, which is calculated according to the rate set by the tax authorities and the amount of salary that the employee or worker has. Therefore, a suitable payroll software is software that prepares the tax list according to the standards of the tax office. The amount is paid.

High security software

Because profiteers are always looking for abuse, the software must be secure enough to prevent this, and not everyone can access the software and use personnel financial information.. So the software must be able to encrypt only authorized users.

Possibility to prepare a list of salary insurance

All managers are required to calculate and pay their employees’ premiums every month. It is also important to know that the amount of insurance for each person is determined according to the salary he receives. Providing insurance diskette is one of the important features of payroll software.

Possibility of issuing legal rulings on a floating basis

Each company, depending on the working conditions and type of employment of each person, considers certain benefits for them. Also, the possibility of registering various legal rulings for personnel is another feature that should be considered when purchasing payroll software.

Introduce a payroll software to calculate overtime

With a payroll software, you can easily and quickly calculate the salaries and benefits of employees. Fardad payroll software is one of the accounting software that has the ability to calculate overtime and register overtime formula for automatic calculation of overtime. You can visit the page Payroll software, Get acquainted with the features and facilities of Fardad payroll software.

To work with payroll software and calculate overtime in it, a legal agent and an agent for overtime are defined using the salary and performance factors section. Finally, in the factors section of the formula, the overtime formula is registered and with each salary calculation, this software automatically calculates the amount of overtime personnel and adds that amount to the salaries received by employees per month.

Conclusion

As mentioned, if a person spends more hours at work in addition to the required working hours, it is called overtime. Workers and employees can work overtime for up to 4 hours a day with the consent of themselves and their employer, and receive 40% more pay for each hour of overtime.

In this article, the overtime formula and how to calculate it according to the law of the Ministry of Labor is mentioned. It also introduces one of the best payroll software that helps business managers be able to earn employee salaries automatically along with overtime. If you have a comment or question about this article, leave us a comment.

.