Deposition of 100 hemti of liquidity in the banking system

The open market has become more dangerous than before. In addition to unprecedented expansions in open market There is an index whose growth directly increases the monetary base and can continue swelling bring fertility in the country. This index has crossed the 100 mark for the first time in history and is 38% higher than the previous year.

Unprecedented record expansion of 130 Hemat money

The volume of transactions in Interbank market It has reached incredible levels. The unprecedented record expansion of 130 hemats of money in the last week is not only considered a dangerous event in the economy, but also has consequences that some critics believe can swelling Bring great fertility.

One of the most important dangerous indicators of the transactions of this market is the liquidity balance in financial institutions, which is considered a more important variable than the weekly expansion of money in these transactions.

Recording the cash balance of banks

In bazaarbaz transactions, banks borrow money from the central bank with the collateral of bonds, and in the following week, they must return this money to the central bank, taking into account the interest rate and the known maturity date.

In other words, in open market repo transactions, every week, apart from the money they borrow from the central bank, banks must also return an amount to the central bank in exchange for their previous week’s borrowing. This event leads to the formation of an index whose name is net liquidity injected in open market Is.

For example, in the last week, when the central bank’s money was injected into the banks, according to the last week’s borrowing, the banks had to return 105,420 billion tomans to the central bank. This incident led to the net liquidity injected by the Central Bank in the banks in the last week equal to 24 thousand 580 billion Tomans. This is the highest level of this figure in the last eleven weeks. But what is more important than the net expansion of central bank money in banks is the aggregation of this figure in consecutive weeks. The net amount of money expansion in banks somehow shows how much money is now deposited in banks?

100% deposit of open market liquidity in the banking system

The net sum of liquidity injection in the open market can be achieved since the beginning of September last year, that is, the beginning of the government’s serious activity in this market. In that period of two consecutive weeks, there were no transactions between banks and the central bank, and the volume of transactions in this market was equal to zero.

Therefore, the net total of the performance of the central bank from that date until now shows how much of the operation has been deposited in the banks’ coffers and how has this figure changed in recent weeks?

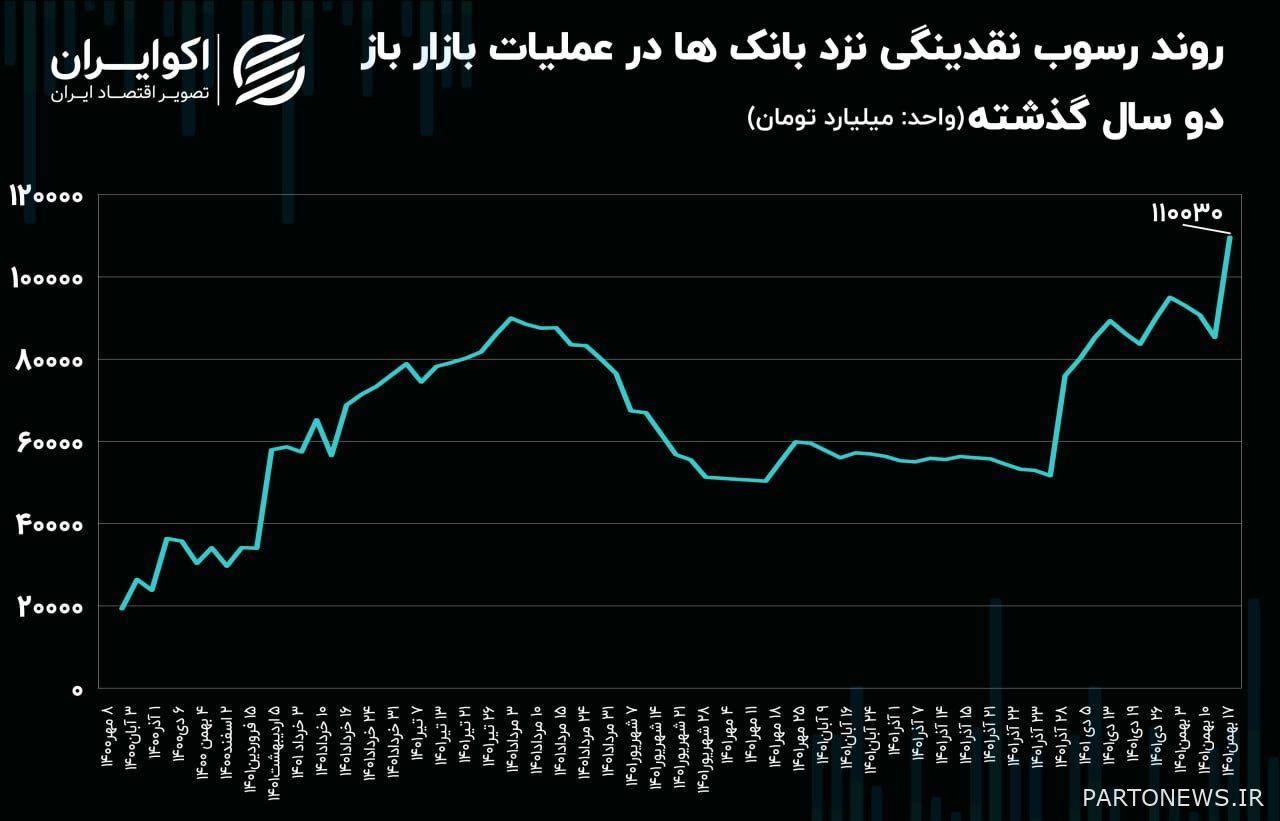

In this regard, Central Bank statistics show that in the week ending on February 18 of this year, the cash balance in banks reached 110,30 billion tomans from open market transactions, and it has increased by 28% from the previous week. This is the highest level experienced in the history of the open market.

A point-by-point comparison, that is, a comparison with the same situation last year, also shows that 38.8% has been added to this index during this period. According to the mechanism of this market, the above index is the most important index, which seems to be hidden from the eyes of this institution in the weekly injections of the central bank, because the 38.8% growth of this variable, in other words, is the increase of one of the most important components of the monetary base, which can have an increasing effect on have swelling