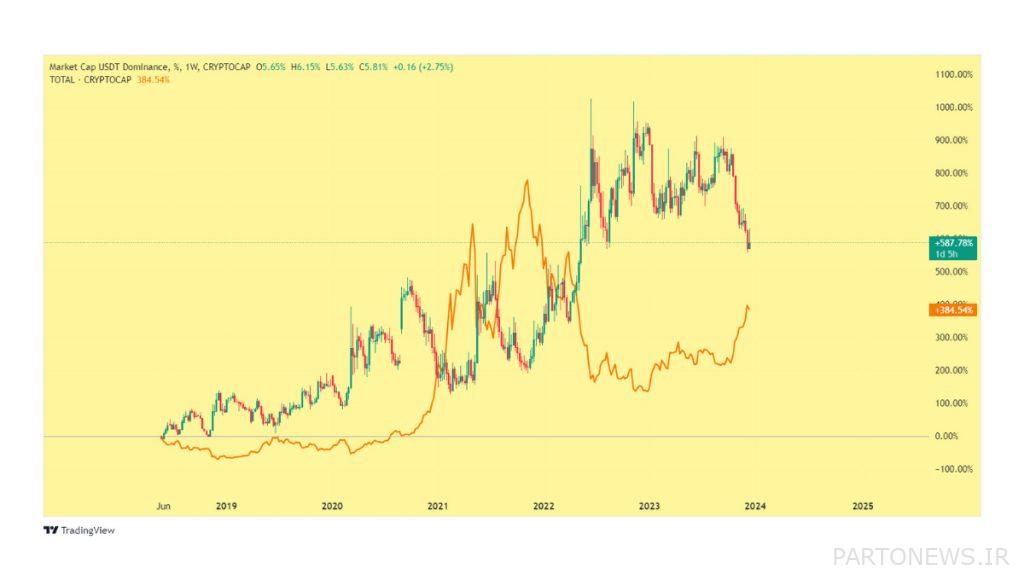

Dominance Tether (USDT) Moment Chart

Momentary Tether dominance chart

Dominance Tether For an analyst or trader in the cryptocurrency market, it acts as a light on a dark road. Imagine yourself analyzing Bitcoin, Ethereum or the entire digital currency market; Without knowing the answer to this question What is Dominance Tether? After hours of staring at the chart, you’re getting nowhere and even confused.

Tether After Bitcoin and Ethereum, it has the most dominance Dominance It is on the market of digital currencies and is in the third place in terms of market value. However, remember that dominance is different from market value; So, join us in this practical article to examine the concept of Dominance Tether and its importance in the market, as well as how to influence this important indicator and its performance.

What is Dominance Tether?

dominance Or Dominance Tether (Tether Dominance) is the share ratio that this Stablecoin Compared to other digital currencies in the market, it has and represents infiltrate And influence This currency is in the market. In addition, this indicative mastery Condition Tether compared to its other competitors as well as the rate effects That door Digital currency market Is.

Given the global acceptance of Tether as a stablecoin, it is possible that Tether’s overall dominance will remain at high levels at different times. The stable nature of Tether’s price movements and its lack of volatility to the extent seen in many digital currencies has made Tether a preferred stablecoin for transactions around the world.

Read more: What is Tether (USDT)?

Dominance Tether also helps in better understanding and deeper understanding of trends and price movements in the digital currency market. If Tether dominance is high, it may indicate that the overall cryptocurrency market is in recession And the descent and investors have converted their digital currencies to Tether. Also, the decrease in Tether’s dominance indicates the decrease in Tether’s influence in the market; That is, digital currencies such as Bitcoin and Ethereum Growth have started and investors have converted their Tethers into these currencies.

What is Tether?

Tether with symbol USDT, one unit Digital money It is due to the fact that its price is always one dollar, one Stablecoin it counts. This stablecoin is created with a stable price and its price is set by traders usually in the amount of one US dollar. For this reason, Tether is also known as a “dollar-based stablecoin”. Each unit of Tether is traded with a value of one US dollar and the equivalent of one dollar is available to the holder.

However, this stablecoin, like other digital currencies, works on the basis of blockchain technology and is operating under the management of the Tether Foundation. This point shows that Tether as a currency can be used in any country and used in cross-border transactions.

Learn more: On which network should we buy Tether? Tether TRC20 or ERC20 is better?

Tether stablecoin transactions are carried out in various blockchain networks such as: Polygon, Ethereum, Tron and other networks, which provide decentralized and high-security Tether storage in these networks. Also, Tether has the ability to make fast and easy transactions around the world.

What is dominance?

Idiom Dominance Or “dominance(Dominance) in the digital currency market refers to the percentage of the total digital currency market that is dominated by a specific digital currency. In simpler terms, dominance indicates the volume and influence of a digital currency in the entire digital currency market.

Dominance in the digital currency market can have a great impact on market behavior and investor decisions. If the dominance of a digital currency is very high, it means that this currency is very important and influential in the market, and its price changes may overshadow the price of other digital currencies.

At the same time, changes in dominance may reflect changes in market preferences and investments. An increase in the dominance of a currency can indicate the strengthening of its position or status; While the decline of dominance may indicate more diverse ways of distributing capital in the digital currency market.

What role does Tether play in the digital currency market?

Tether (USDT) plays an important role in the digital currency market with its special features that distinguish it from other stablecoins. Below we describe the main roles of Tether in the digital currency market:

- Stability and stability in price: Tether is designed as a stablecoin that has a fixed price of one dollar. This feature allows traders to experience Tether transactions with the least price volatility and avoid the extreme fluctuations that exist in other digital currencies.

- A means of preserving value: Tether acts as a means of preserving value against market fluctuations. Many traders and investors use Tether as a tool to preserve capital value and choose it as a “parking lot” for their investments in critical times of the market.

- Facilitate transactions: Tether is a digital currency that can be traded in many domestic and foreign exchanges. With this role played by Tether, traders can easily be present in the digital currency market and perform their transactions.

- International transactions: Due to the creation of Tether on various blockchains and the ability to transfer it quickly and securely, it can act as a means of conducting international transactions in global financial markets.

Learn more: The best Tether wallets in 2024; Introducing 6 of the best Tether wallets

What is the difference between Dominance Tether and the total market cap of USDT?

Dominance and Total Market Cap are two different concepts that refer to different aspects of the digital currency market. Above we introduced the nature of dominance. In this part, we will learn about the value of the whole market and its difference with Dominance.

- Total Market Cap: It refers to the total value of investments (market cap) in all digital currencies. This value represents the total value of digital currencies.

- Computing: To calculate the total market value, the market cap adds all digital currencies together.

- Dominance difference with total market value:

- Dominance It shows the influence and share of a particular currency in the market.

- Total market value It represents the total value of digital currencies in the market. For example, if Bitcoin dominance is equal to 50%, it means that Bitcoin constitutes half of the entire digital currency market. But the total market value shows the total market cap of all digital currencies in the market.

Factors affecting Tether dominance

Factors affecting Tether dominance (Tether dominance in the digital currency market) can be diverse and related to different market conditions and even the economy. In the rest of the article, we mention some important factors that may affect the dominance of the Tether:

- Global usage and acceptance: The wide use and acceptance of Tether in the world is considered as one of the main factors of Tether’s dominance. The more Tether is used in international trade and commerce, the more Tether’s dominance increases.

- Market confidence: The market’s trust in Tether and the financial foundation that supports it plays an important role in increasing or decreasing the dominance of this stablecoin. The more trust in Tether, the stronger its dominance will be.

- Trading in exchanges: The presence of Tether in centralized and decentralized exchanges and various trading platforms can affect its dominance. If Tether is present in most exchanges and users convert their digital currencies to it, its dominance will increase greatly.

- Advancement in blockchain technology: The creation and deployment of Tether on different and new blockchains plays an important role in increasing the dominance of this currency. Mastering advanced technologies and up-to-date facilities increases the trust and popularity of Tether in the market.

- Legal developments: Legal and regulatory changes that may happen in the field of digital currencies and Tether can affect the dominance of Tether. Compliance with standards and legislation can increase society’s trust in Tether and work on its dominance.

All these factors simultaneously and interactively can contribute to the formation of Tether dominance and determine its status in the digital currency market.

Dominance Bitcoin and Dominance USDT

The relationship between Bitcoin dominance and Tether dominance shows the distribution and influence of these two currencies on the digital currency market. In fact, Dominance Bitcoin and Dominance Tether, like two main and important indicators, help us to understand and identify the future movements of digital currencies.

- Determining the impact of Bitcoin dominance: Bitcoin Dominance shows the share and dominance of Bitcoin in the digital currency market. If the dominance of Bitcoin is high, it means that the investor has preferred this digital currency to other currencies. If dominance is low, it means that the investor withdraws his money from Bitcoin and invests in altcoins or Tether.

- Tether’s dominance in the market: Tether’s dominance shows the share and importance of Tether as a stablecoin in the digital currency market. If Tether’s dominance is high, it means that in critical times, users have preferred this stablecoin to other stablecoins, and other digital currencies are also in their bear phase.

- The relationship between the two dominances: Determining the relationship between two dominances is of special importance. If Bitcoin Dominance and Tether Dominance are both high, it may indicate the strength and influence of both currencies in the market, and changes in one of them may lead to changes in the other.

- Forecast trends: The simultaneous analysis of Bitcoin Dominance and Tether Dominance can help us predict trends and developments in the digital currency market. An increase or decrease in the dominance of one of these currencies may have significant effects on the market.

What does Tether Dominance mean for the digital currency market?

Tether Dominance, as one of the main indicators in the digital currency market, refers to the degree of influence and presence of Tether (USDT) compared to other currencies. This measure is a percentage of the total market of digital currencies and stablecoins that is formed by Tether and shows the penetration of Tether as a stable unit in transactions and exchanges in the crypto world.

In determining Tether dominance, the concept of market cap is used. The market cap of Tether is the total market value of Tether, which is multiplied by the number of Tethers in the market. This value is then divided by the total market cap of existing digital currencies (÷) and displayed as a percentage of the total digital currency market.

The advantages of Tether as a stablecoin prevent large price fluctuations in transactions. This feature attracts the trust of traders and investors to Tether; Because the value of each Tether is equal to the value of one US dollar. For this reason, the increase in Tether’s dominance indicates the market’s preference to use Tether as a stable unit in transactions.

Frequently asked questions

Generally, when Dominance Tether goes up, investors have sold their digital currencies, which means the market is in a slump.

Yes; Dominance Tether can be used as a good analytical indicator along with other indicators.

Tether’s dominance in November last year reached 8% of the total digital currency market and recorded its historical record.

Summary

Tether dominance is an important indicator in the digital currency market that shows the degree of influence and presence of Tether compared to other currencies. This index, as a stable unit in transactions and exchanges in the world of digital currencies, plays an important role in determining the market trend.

An increase in Tether dominance may indicate an increase in the influence and use of this currency in transactions, which, as a result, will lead the market towards the use of a more stable stablecoin. This information is very important for investors and traders in financial decisions and market analysis.

On the other hand, the decline of Tether’s dominance may indicate a change in market behavior and trends and an increase in the influence of other digital currencies. In this case, investors may prefer to transfer their capital to other currencies and not use Tether as a tool to preserve capital value.

Overall, Dominance Tether is an important indicator that can help investors and traders in financial decisions and market analysis.