How much do miners cost to produce each bitcoin? Impact of costs on price

One of the concerns of bitcoin investors is that miners will decide to sell, and as the selling pressure increases, the price of this digital currency will fall again. However, new data show that at current prices, miners are not only losing money, they are also making a profit, and they have increased their accumulation.

To Report Coin Telegraph, bitcoin mining is more profitable than ever at current prices, and according to new data, miners are less likely to decide to collectively increase the selling pressure of this digital currency.

On January 14, a user named VentureFounder took to Twitter to point out that even the $ 42,000 price of bitcoin is 20 percent more than miners pay to extract a single bitcoin.

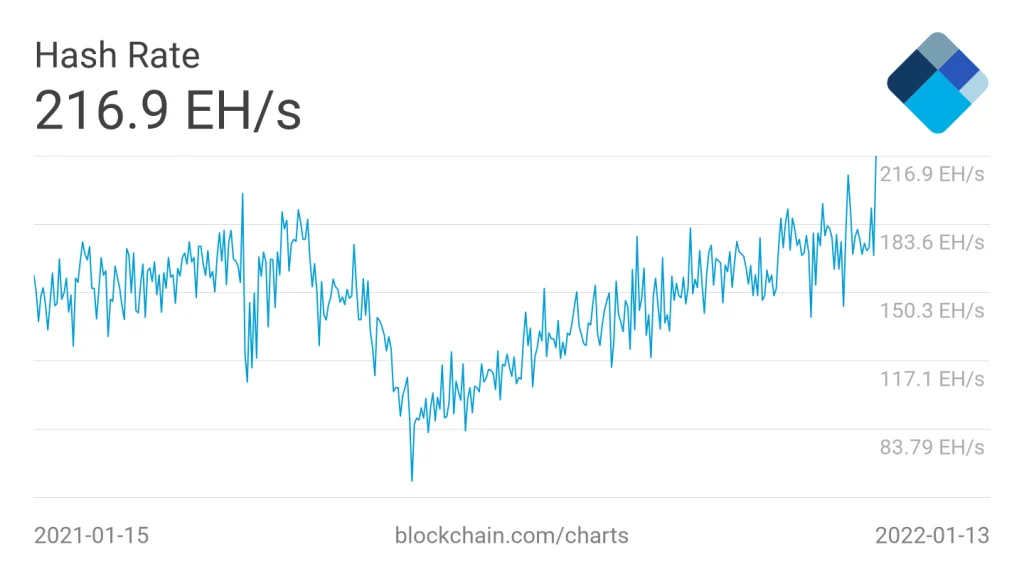

Although the price of Bitcoin is currently $ 27,000 lower than its recent historical high, this digital currency has become more attractive to miners than ever before, and its hash rate has reached a new high this week.

On the other hand, some were worried that the miners would increase their selling pressure by lowering the price of Bitcoin again; But these people have calmed down a bit by looking at new data that show at what price miners’ profits and losses are skyrocketing.

Venture Funder, referring to the “Bitcoin Production Costs” index, confirmed that the current per capita price of bitcoin for miners is $ 34,000.

He said on Twitter:

The surrender of miners has always been the main reason for the worst bitcoin losses in December 2018 (December 97) and March 2020 (April 99). If the price of bitcoin is less than the cost of producing it, there is a risk that the miners will want to sell. In May 2021, when the price of Bitcoin fell below $ 30,000, the market was at risk of selling miners. Now, however, the cost of producing bitcoin is $ 34,000; That is 20% less than the current price.

As a result, there is no reason for miners to want to sell their bitcoins because of the profitability and prospects of bitcoin.

The creator of the Bitcoin Production Cost Index is Charles Edwards, CEO of Capriole Investment Company. In a post on the Medium website in 2019, he explained that the transaction fee given to miners as a reward is another factor that protects them from instantaneous price fluctuations and does not allow them to spend more than they earn.

He said that as data from the past show, the cost of electricity used to produce bitcoin determines the floor price of bitcoin in the market.

Miners will not follow the immediate changes in bitcoin prices this year

With bitcoin prices hovering below $ 50,000, miners are doing what they can.

In the last two months, most miners have accumulated and stored their bitcoins instead of selling them. Their accumulation during this period was even higher than when Bitcoin was at its peak.

This shows that the miners have a positive balance sheet and will continue to do so in the future; As a result, fears of economic hardship do not currently put pressure on the mining sector.

Well-known analysts, on the other hand, believe that the price of bitcoin in the worst case scenario will not be less than $ 30,000.