How to get a bunch of fishing checks from the bank?

In recent years, despite the important place and role of checks in micro and macroeconomic exchanges, the existence of problems such as returned checks as one of the serious barriers in the business environment, has always been criticized by economic actors. The problem is rooted in the impossibility of inquiring about the credit of the check issuer at the time of issuance of the check and the lack of precise and transparent supervision in the check exchange process. Therefore, policymakers in this area thought of making changes in the Czech law in order to restore the validity of the check in the true sense of the word.

Accordingly, the new check law was implemented in all banks in the country from the beginning of December 2016. In this law, an attempt was made to increase the credit of the check on the agenda. In order to solve the previous problems, it was planned to issue a batch of checks out of the control of commercial banks and to concentrate them in the integrated Sadr check system (Sayad) with the Central Bank. Accordingly, the operating bank was obliged to provide a batch of checks to its customers, only through the integrated check issuance system (Fisherman) with the Central Bank.

The general mechanism of this system is such that after ensuring the accuracy of the applicant’s details and the absence of legal prohibition, to receive a credit report from accreditation systems and in accordance with the received results, calculate the applicant’s authorized credit limit and to each ID sheet Is unique. In this way, bad accountants and fraudsters will not be able to collude with banks to receive checks. Therefore, the mechanism created in the new check law has increased the real validity of the check.

On the other hand, in the context of the new Czech law as well as the fishing system, the need for electronic registration of checks has allayed past concerns about the possibility of forgery or fraud in the physics of checks. In other words, if the physics of the check is lost, it is easier to follow the judicial process than in the past, due to the systematic registration of the check information by the issuer. Another advantage of the new mechanism for registering checks in the Sayad system is the creation of information transparency in the fight against money laundering, which is an effective measure in the banking system.

But the question that may arise for many is how to get a fishing check from the banking network?

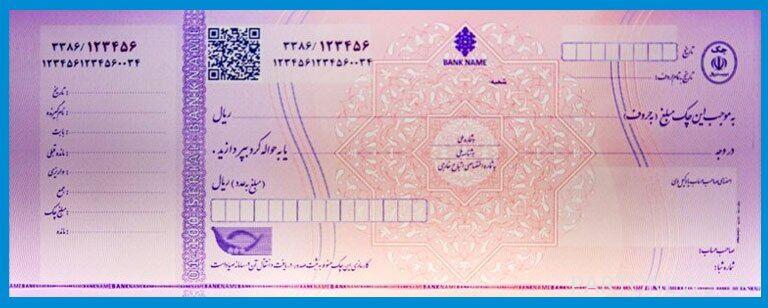

To answer this question, we must first point out the appearance and security features of the new fishing checks. Accordingly, the new fishing checks have the following features:

1. The color of the new checks is purple;

۲. At the top left of each check is a unique 16-digit ID;

3. The phrase “the operation of this check depends on the registration of the receipt, receipt and transfer of it in the fisherman’s system.” It is observed on these drops.

Now, to receive a fishing check, the applicant can apply for a check from the operating bank by visiting the branches of operating banks across the country and opening a checking account with the check and providing the required documents. Meanwhile, after legal investigations and inquiries from the Central Bank for not having returned checks and required credentials, the operating bank will proceed with the process of issuing the physics of the checkbook.

ایبِنا