I am proud of my performance in the stock market / they wanted to empty the stock market

Dejpsand, who served in the Program and Budget Organization during Hassan Rouhani’s first administration and became the Minister of Economy during his second term, spoke of his concerns about regulating the stock market and his advice that the government did not benefit from raising the stock market index. Hemmat also wrote a letter to the shareholders of the stock exchange, saying that they did not know about the letter and did not give him a copy.

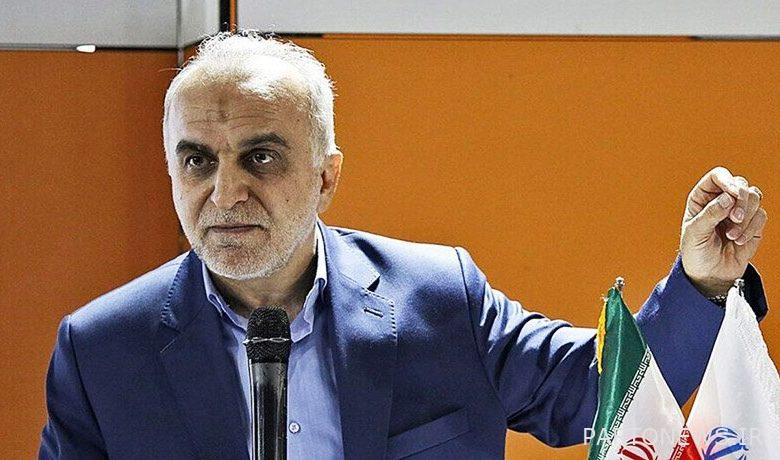

What you are reading is part of the second part of the conversation between Mehdi Norouzian, the editor of the online section of the World Economic Forum, and Farhad Dejpsand, the Minister of Economy of the Rouhani government:

The stock market was not a fortunate individual market

The pressure on interest rates, the pressure on banks to inject resources, the pressure on the central bank and the development fund.

Not at all! No bank injected resources. First of all, the stock market is a market of 50-60 million and the individual market is not fortunate. In order for the stock market to be stable, we must all stand behind it, and secondly, your statement is not consistent with the previous question that the government financed its budget deficit and left the stock market.

The government was behind the stock market until the end

I said it from activists and critics.

That is, it is clear that the Ministry of Economy and the government were still behind the stock market until the end. Third, what did we get from the central bank for the stock market?

National Development Fund talk that pressure…

First, we did not put pressure, and this law was before me, and it was approved in 1994.

It was one percent input. The fund has not had any entries since 1994 and the fund has not had any entries since 1996.

Whenever we have 100 dollars in foreign exchange (from oil exports) at least 20% of it was for the National Development Fund, why did it not have input?

The government was cutting the budget.

It did not take the input, it never took 20%. Input means, for example, if in 1999 we had $ 10 billion in oil exports, that is, the currency was receivable, 20% of it was 2 billion for the fund, it has nothing to do with my period and it was approved in 1994, the only thing All I did was stand up for it.

They sent a message that they are emptying the stock market

The government would come and take 20 percent in one form and borrow the rest, which came to 32 and a half, in the comments in the form of borrowing.

No. It is the opposite, that is, the government took more than 20% in the budget as a loan and did not care about the rest, and if it did, it was as a loan, which was 16%, now I say 20% was 16%, 36% 16% and … That was normal. So it was not one percent of the pressure input of the Ministry of Economy and it was the law that the Ministry of Economy followed to achieve. Secondly, did it happen that you said that you took care of everything? One of the reasons for the sharp decline in the stock market was the resistance to the implementation of this law because the message was given to the market that some people are emptying the stock market and this negative message was given to the market, how much did we use? This is a percentage that you say had or did not have to be calculated, if it did not have what we did not want, we calculated what it had.

Your number was very different from your box number.

It makes no difference at all. The number we mentioned has been approved by the fund and has been announced as a resolution. That it was the power of the Ministry of Economy that stood on the law and said that the law should be implemented, a law that was later approved by the Coordination Council and other higher institutions, and that should have been done. Where did you say that? banks?

Banks, the meetings you had, and a few decrees that required banks to fund and resources…

No, that’s another matter, every publisher should have a marketer, and this was the previous law that the Stock Exchange Council had emphasized and should have given, this is also common in the world, and one thing I do not understand, and here all companies from All banks should have marketers, what are the drawbacks?

The marketing debate was one-sided. The discussion that they insisted on giving these loans and using the banks’ resources was also one-sided.

Marketing with a loan is two different things.

That is, resources should be given to use in the form of marketing. Is this true or not?

This is the first time I have heard this.

That is, use banking resources to support the index.

This is not the case at all, which means that we can not do this legally. The companies affiliated with the Bank of Labor invest, and there the state-owned banks have to answer to me how much they are profitable and unprofitable, and the financial statements are distributed.

For me, what was prestigious was the development of the market, and I succeeded

Did not have a status index for you?

No. Because I did not limit the capital market assessment criteria to the index at all. The index factors are several things, the performance of firms, economic conditions and developments in the stock market, these three groups are the main index factors.

For me, what was prestigious was the development of the market, and I succeeded. In 1999, they had 175 marketers in April, and then it increased to 530 with its implementation, and this is my honor. What was the initial supply, which was in 1997, when I started working, and then reached 5 and a half million people. The last currency of the first of September 1400 has reached 3.5 million people, the stock exchange is evaluated with these, the number of stock exchange codes is evaluated, of course, the index is also one of the evaluation factors and the Minister of Economy has the least share in it, for example Ministry “A” wants to price its products, this index drops that group, is it the fault of the Minister of Economy? This creates a psychological effect and it happens that the Minister of Ministry “B” is doing something else…

You mentioned that it is dangerous to create mass behavior in the capital market and it is necessary to discuss the exit and the concerns of shareholders, on the other hand, they say that this is also dangerous at the entrance, when some amateurs enter the market in high quantity This could be dangerous for the stock market, where the Ministry of Economy praised the stock exchange organization.

It is true. There are two ways to enter the capital market, one direct and the other indirect. It depends on the structure of culture-building that takes place in society, in 1999 we had both indirect and direct leaps. In the direct entry of what the stock exchange organization did was to define and teach promotional activities (via SMS) for the approximately 2 million numbers that were for the new stock exchange codes, I also said that wherever I had the opportunity , I was expressing his sensitive points.

We knew that when these debates became widespread, they had to be trained, or even once the board of directors of the stock exchange approved that they enter into a direct transaction one month after receiving the stock exchange code, they faced pressure there and I do not know now Have implemented or not that this mass…. So this is a debate, but I want to say that one day when some people wanted to get a stock exchange code and said, for example, 100,000 people came and were happy and the system did not allow more than 100,000, now the infrastructure has been prepared in such a way that Up to 1 million people a day can. So this opportunity has been created.

So it is quite true that the two sides must be managed and the other side has been turned, and this side, too, has been driven by emotional and extremist insistence, among other factors, as you know, if I am not mistaken, at the end of December the index will reach 1 million. 550 had arrived and they had re-entered and corresponded, which was spinning and damaging the system, so the stock exchange organization did that, that is, it did both SMS training and indirect persuasion, if you go to other statistics. Look straight ahead has had a significant jump.

I did not put pressure on the banks to support the stock market / the stock market was oppressed

So you did not put pressure on banks to support the stock market?

Certainly not me. It was a meeting in which a number of capital market participants were discussing ways to provide support in the event of a downturn. It was because of a section of the letter that had been issued before, and they said that these restrictions should be removed, and for the period when there was a fall, the brokerages did not take loans for themselves, but were intermediaries, that is, they were intermediaries who lent to the buyer. Reach and they were an intermediary ring.

In order for you to know that we put the most pressure on the stock market itself, this point was missed and the stock market was oppressed. The good management of the stock exchange organization tried to use its resources to regulate the stock market. We had a number of resolutions, for example, we came and fixed part of the stock exchange organization’s commission to the fund, or we extended part of the brokerage commission to the fund (I do not know which one to the stabilization fund and which to the development fund), the stock exchange even profits for the fund He invested and strengthened the Development Fund. Unfortunately, some did not allow that law and regulations to be implemented with irrational resistance, and this seed of despair was sown. I never believe that the success of the stock market is measured by an index and its failure is measured by an index! It is a set of factors and a set of indicators. The example I gave about the P / E index is that I want to give a sign that I happened to answer this question in response to a question that was asked because they said why in a market where profits and losses Is not the index expected to rise? I gave this answer based on it, and again I say that the stock market must be analyzed with a set of factors so that we can examine it.

Source: ECO Iran