increasing fear of exchanges; Bitcoin holders migrate to personal wallets

As the world’s second-largest exchange and a conglomerate that had previously been considered an invincible member of the cryptocurrency industry, FTX’s bankruptcy came as a surprise. However, this collapse proved that the exchange was not too big to be invincible; Especially since he had no reserves to cover his current financial crisis.

To Report CryptoPotito, Over the past week, Bitcoin holders have clearly been withdrawing their holdings from centralized exchanges and transferring them to non-trust (personal) wallets.

According to the Glassnode analysis group’s report yesterday, exchanges have recently witnessed one of the largest withdrawals of capital from their accounts; So that something like 73,000 Bitcoin units have been withdrawn from exchanges in just seven days.

Withdrawal of 106,000 units of Bitcoin from exchanges in one month has previously occurred only in April and November 2020 and June and July this year.

In addition to Bitcoin, more than 1.1 million Ethereum units have been withdrawn from centralized exchanges during the past week, which is considered the largest decrease in the balance of exchanges since September 2020 (September 2019), or the “Summer of DeFi”.

In order to restore users’ trust in their platforms, some major exchanges proposed a plan to report and prove their reserves; But investors are still generally skeptical of centralized exchanges.

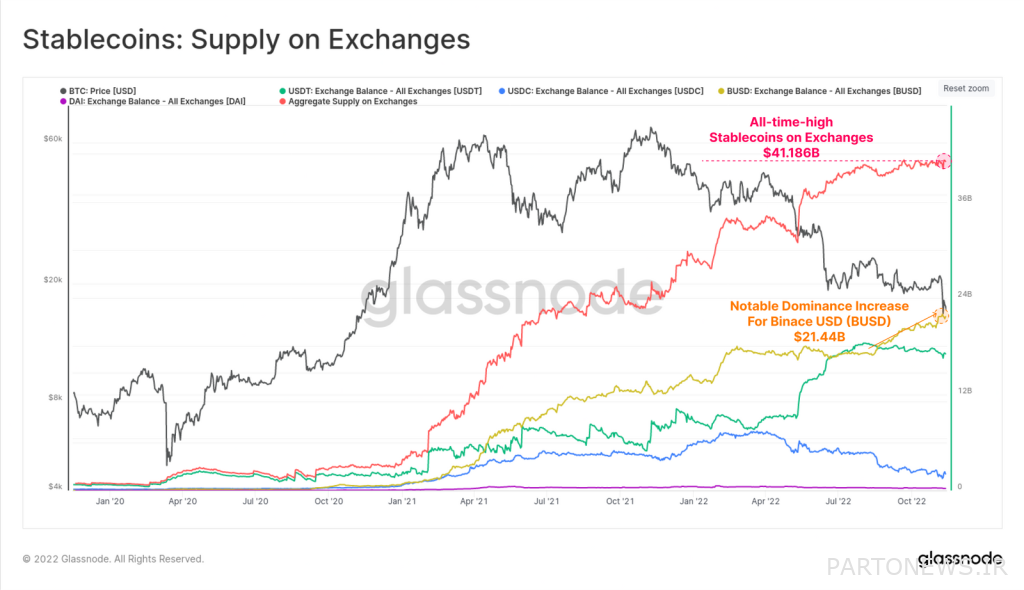

Unlike decentralized digital currencies such as Bitcoin and Ethereum, deposits of stablecoins to exchanges have increased significantly over the past week; So that the total value of stablecoins available in the exchanges during this period reached the highest level in its history at 41 billion dollars.

The value of Tether and USD coin reserves of exchanges has slightly decreased during this period; But Binance USD (BUSD) has faced an increase in the value of its reserves under the influence of the plan to consolidate stable coins in the Binance exchange. Glassnod also said that a large part of these stablecoins that have been deposited into exchanges originated from Ethereum smart contracts and were withdrawn at a rate of 4.63 billion dollars per month.

The Golsnod report states:

This flow shows how much the demand for liquidity in the form of dollars has increased.

The good performance of the dollar itself in global markets has also increased the demand for stablecoins, and digital currencies continue to be traded with these dollar-linked assets.

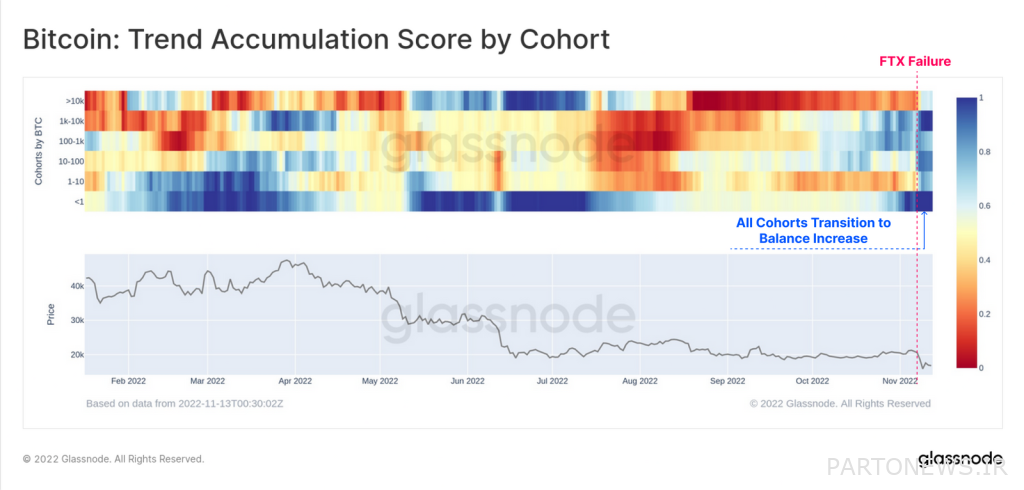

All kinds of Bitcoin holders, from the smallest investors to the big whales, have seen their balance increase during this time.

Over the past seven days, addresses with balances of less than one bitcoin have added a total of 33,700 units to their holdings and purchased 51,400 new bitcoins over the past 30 days, the second largest increase in balances for this group of bitcoin holders. It is considered history.

Since yesterday, the market has calmed down to some extent, and with the decrease in volatility, the total value of the digital currency market has now increased to $850 billion.