Market performance in the last week of May 1402 / The path of the stock market was separated from the financial markets

According to Tejarat News, the last week of May was associated with negative returns for the financial markets. But the stock market on Sunday of the last week was able to make up for the leftovers of the previous days. This week, the path of the capital market was separated from the financial markets and had a positive return.

While the financial markets were in a downward phase since the middle of last week with the drop in the price of the dollar, and the price of gold and coins also followed this trend, some market participants attributed the drop in the stock market as the cause of the price drop in the financial markets. But economic experts consider this approach incorrect. They believe that if the fall of the stock market is the cause of the fall of the dollar and precious metals, why in the second six months of last year, the boom in the financial markets could not bring the stock market along with it?

From the point of view of economic analysts, what has caused the temperature of the financial markets to drop are political maneuvers and events outside this market. On the other hand, the second stage of car pre-sale also coincided with the last week of May and many car applicants sold gold, coins and dollars to secure pre-registration funds. These factors, along with favorable political news, such as the possibility of the Sultan of Oman’s visit to Iran, caused the price of the dollar to drop, and consequently the price of gold and coins.

The last week of May, which still has two working days left, can be considered a disappointing week for financial markets. The price of the coin with a negative return of 6.23% was the highest price decrease in the markets. Gold was next with a negative return of 4.89% and the dollar had a negative return of 3.58%.

Price Dollar

Efficiency check Dollar price From the 21st to the 28th of May, it shows that the American bill has decreased in price by 1,900 Tomans. The yield of the dollar this week was negative 3.58%.

According to traders, the issue of car pre-sale and encouraging people to make deposits by banks in the form of SMS has caused people to sell dollars and make deposits in order to obtain car funds. This is one of the other factors that caused the price of the dollar to fall.

Price gold

In addition to the impact of the drop in the price of the dollar on the gold and coin market, since Monday, the global gold price has lost the $2,000 range, and this had a double effect on the price drop in the precious metals market.

On Thursday, May 21, gold was traded at two million and 638 thousand tomans. On Thursday, May 28, gold was traded at a price of two million and 509 thousand and 700 tomans. In this way, the price of gold decreased by 4.89% in the last week of May and became cheaper by 129 thousand tomans.

It should be noted that the global gold price has reached 1967 dollars at the time of writing this report.

In addition to the drop in global gold and dollar prices, traders in the gold market prefer to stay away from market makers and not trade due to frequent price drops in this market in recent weeks.

Price coin

This week, Imami coin had a negative yield of 6.23%. The share of this piece was a price reduction of two million and 17 thousand tomans.

On Thursday, May 21, the coin was traded at 32,397,000 Tomans, and on Thursday, May 28, it reached the price of 32,397,000 Tomans.

Economic experts believe that every behavior in the dollar market has a direct impact on Price gold And coin has it. They say that this declining trend can be called short-term because the inflationary expectations are increasing and the JCPOA has not happened.

Exchange

The analysis of the transactions of the fourth week of May shows that the total index of the stock market increased by 1.94% from the level of two million and 278 thousand units to two million and 321 thousand units. In this way, the stock market became the leader of the financial markets in the fourth week of May.

Of course, the equal weight index did not grow significantly during this week and reached 765 thousand 187 units from the height of 764 thousand 754 units.

It should be mentioned that the stock market started its downward trend on Saturday with the withdrawal of about 3.5 Hamats of real money. The withdrawal of real money caused the shares of these people to be bought by the legal market, and their shares were so-called at the bottom.

News affecting the market trend

In addition to this, news such as two approvals for depositing 500 billion tomans to the capital market stabilization fund, increasing the time for correcting the portfolio of fixed income funds and increasing the credit ratio helped the stock market return to reduce the intense fever of the market on Sunday.

As a result, the total index was able to grow by 71,881 units on Sunday, equivalent to 3.2%, and returned the green color to the stock market map.

Also, in the rest of the week, despite the market being closed on Tuesday, the index continued to grow on Sunday. Although this growth was not as strong as on Sunday, it helped to improve the market situation to some extent.

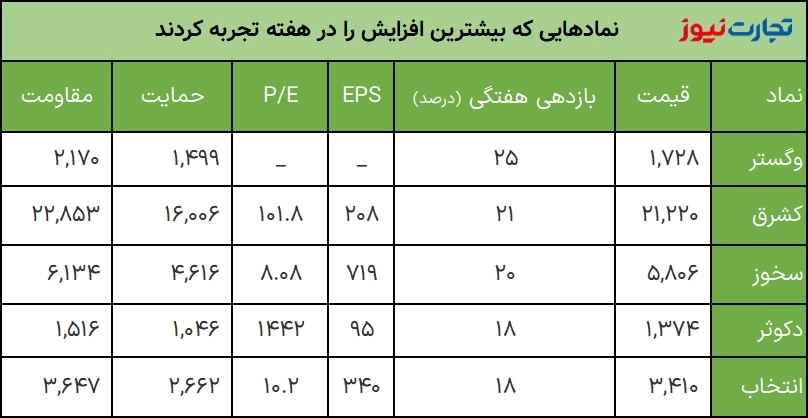

The highest and lowest yield of stock symbols

Investigating the transactions of the fourth week of May shows that Vegstar was able to reach the level of 1,728 Tomans with a 25% growth this week and took the title of the most profitable symbol of the stock market.

Kashregh and Sekhouz also reached the levels of 21,220 and 5,806 Tomans with growth of 21 and 20 percent respectively. The closest support identified for these two shares is the levels of 16,006 and 4,616 Tomans.

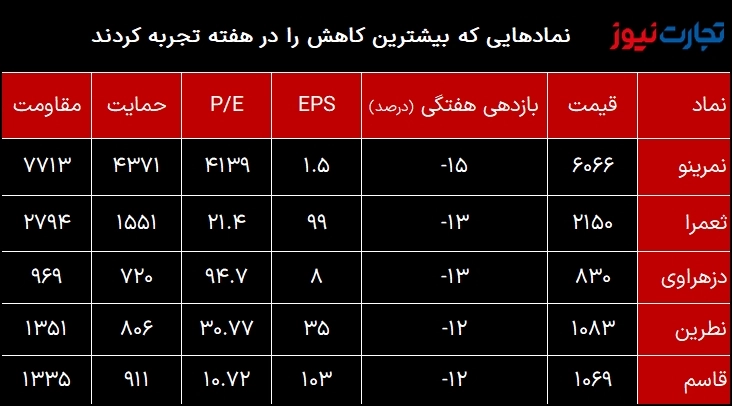

But Nimrino moved closer to his 4371 support with a 15% drop. The annual financial statement of Iran Merinos Company shows that the company has recognized only 15 rials of profit per share. The high share price along with the company’s poor profit making performance led to a strange P/E of 4139 for the share.