Market situation: reducing sales pressure and the volume of leveraged trading positions

The price of Bitcoin fluctuated around $ 41,000 yesterday, and the return of the last seven days has been something around negative 11%. Analysts expect prices to continue to experience limited volatility, however, they believe that the loss of support on the chart could lead to a deeper fall in prices.

To Report Coin Desk The decline in leveraged trading positions in the futures markets of Bitcoin and Atrium could be a sign that market conditions are improving. Usually when traders use less leveraged opportunities, the downside of volatility in the market is reduced.

Genevieve Yeoh, an analyst at the Delphi Digital Research Institute, said in the middle of last week:

According to data on liquidation of trading positions, a small number of traders operating in leveraged markets expected the price to experience a bullish return and therefore lost their capital.

Liquidation of trading positions can accelerate the downward acceleration of prices and occurs when an exchange office completely closes the trader’s leveraged trading position to prevent the initial amount owed to the trader from being burned. In fact, trading platforms do not allow a trader to have less than his debt. This happens primarily in futures markets.

Bitcoin is now nearing its lowest level in three months, and prices are following the downward trend in the global stock market.

Traders take less risk

Some analysts believe that the market trend has become somewhat more stable after the increase in sales pressure on Wednesday last week. Sales prices may ease in the short term after prices plummeted to about $ 800 million in liquidity.

David Duong, one of Kevin Bess’s exchange managers, wrote in a newsletter yesterday:

In recent weeks, we have seen a decrease in risk in the Bitcoin and Atrium markets, and the fact that the rate of financing of permanent futures contracts is close to zero confirms this.

Permanent futures contracts are one of the derivatives trading products that are very similar to regular futures contracts, except that in a permanent futures market, unlike a regular futures market, contracts do not have an expiration date and do not expire.

Dong also said:

The use of trading levers has drastically decreased. The fall in the bitcoin base rate from 20 percent at the beginning of the third quarter of 2021 to 5 percent in January 2022 and the fall in the atrium base rate from 20 percent to 2 percent in the same period are indicative of this.

The futures contract, known as the “base rate”, is a measure of the price difference between long-term futures and the current market price.

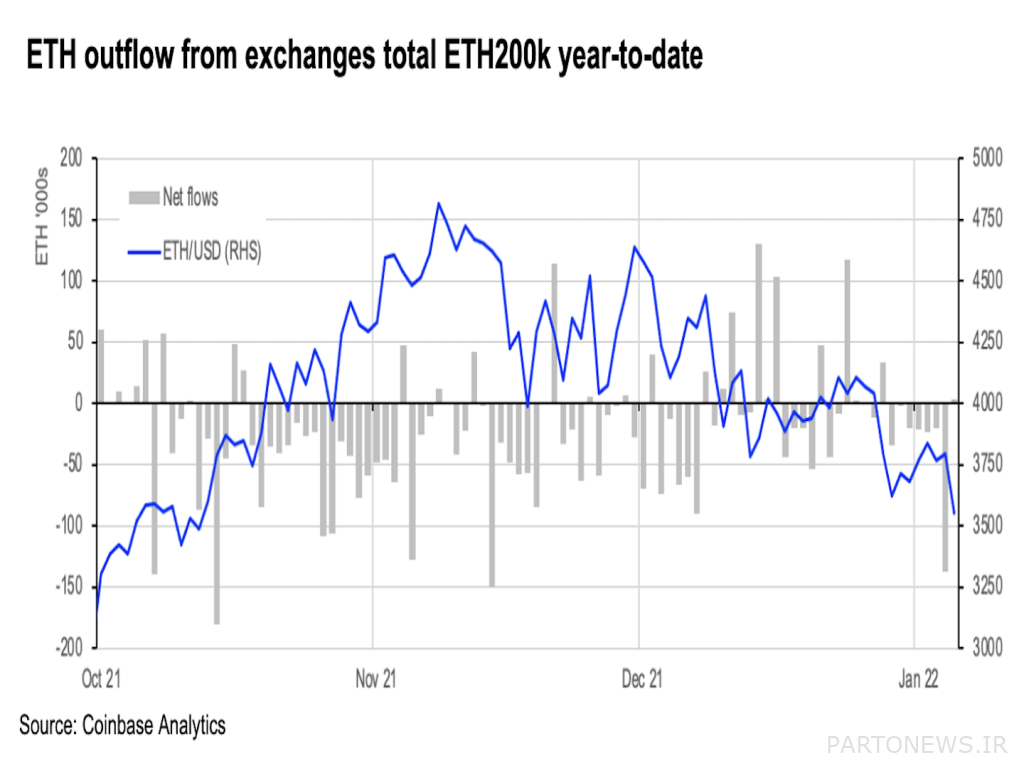

Capital outflow from digital currency exchanges

The results of bitcoin deposits and withdrawals in digital currency exchanges have been more inclined towards withdrawals over the past year. Last week, however, the volume of bitcoin deposits to exchanges exceeded its withdrawals, which may indicate a decline in traders’ sentiment.

A positive inflow figure means that traders intend to sell, and a negative figure means that traders want to keep their inventory for a long time and therefore take the supply out of the market; A move that paves the way for price increases.

While the positive influx of inflows in recent days can not currently be a sign of a change in the overall market trend, analysts are watching closely for the steady growth of inflows, as happened in January last year; Because such a change may be accompanied by a long-term increase in sales pressure in the market.