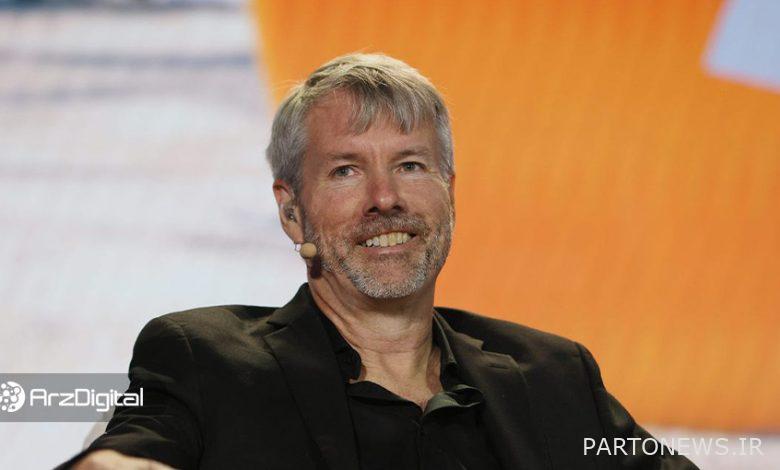

Michael Silver: The ban on digital currencies in China has no effect on bitcoin.

Bitcoin News

Michael Saylor, CEO of MicroStrategy and one of Bitcoin’s largest investors, has said that banning digital currency-related activities in China will have no long-term effect on bitcoin prices.

to the Report In an interview with Bill Barhydt, CEO of Micra Strategy Micro Strategy, Abra Barrydt, CEO of Digital Currency Management Abra, said he has previously been a shareholder in Google, Facebook and Twitter. He says he has not been allowed to be harassed by Chinese lawmakers in the past, and that will not happen now.

- The air temperature in this city reached minus 5.2 degrees!February 3, 2024

Silver said:

If you sold its stocks in 2010 when China wanted to block Google, Facebook and Twitter, you would lose a lot of money. Thousands of billions of dollars [پول] Occurs in industries that China has banned. I think China’s doing this [حوزه] It is insignificant. It’s kind of funny, because for the last five, six and seven years, China has banned something every three months.

Last week, China announced that it wanted to outlaw almost all activities related to the digital currency industry.

Documents signed by several government agencies show that the Chinese government has cited scams and illegal activities related to digital currencies as its main reason for banning activities in this area.

Michael Silver says he is not worried about the long-term impact of these measures on bitcoin prices. However, he says investors who do not want to hold their bitcoin for the next 10 years should not hold it for another 10 minutes.

On the other hand, he believes that the United States has a very positive approach to bitcoin.

Silver said:

I think if you look at the statements of the central bank or the legislators, [متوجه میشوید که] They are of the opinion that bitcoin is an asset. [آنها میگویند] Bitcoin is a commodity. [تاکنون] I have not seen any legislator say bitcoin [ابزار] Digital to store value.

The CEO of Microstrategy added:

I think the rules [ارزهای دیجیتال] It moves towards securities. These regulations are related to compliance with securities and tax laws. Such adaptations will continue, but no one denies bitcoin as a digital asset. If you look at last week’s Senate, [متوجه میشوید] There is a broad consensus between them. The professionalism and body language of all senators showed that they generally supported bitcoin and the digital currency industry. Everyone wants good rules for digital currencies, I think legislators [در این زمینه] They have agreed.

Nothing found.

wpDiscuz