Pirouz Hashemi at the press conference of the initial public offering of Pars Fener company on the Iranian stock exchange: there is a possibility of offering subsidiaries in the stock market in the horizon and future plans of the company.

The CEO of Pars Fener Company said: The possibility of enjoying tax exemption, using collateral and obtaining facilities in the banking network, as well as using the advantages of financing from the capital market for development purposes and increasing production, are among the goals of Pars Fener Company to be present in the capital market. Is.

According to the report of the stock market correspondent of the analytical news site Bursa Times, The press conference of Pars Fener company’s initial public offering on the Iranian stock exchange, before dawn today, Saturday, January 30, 1402, with the presence of Mohammad Reza Pirouz Hashemi, the CEO of Pars Fener Company, Leila Selbalizadeh, a member of the board of directors of Pars Fener Company, Azadeh Shokri, the valuation manager of Damavand Capital, and The representative of Pars Fener company’s stock valuer and a group of media members were held in the meeting hall of Farabors Iran Company.

Mohammad Reza Pirouz Hashemi, CEO of Pars Fener Company

Mohammad Reza Pirouz Hashemi, the CEO of Pars Fener Company, said at the beginning of this press conference: The main goal of “Pars Fener” entering the stock market under the Fener symbol is to increase transparency and liquidity.

He continued: The possibility of enjoying tax exemption, using collateral and obtaining facilities in the banking network, as well as using the advantages of financing from the capital market for development purposes and increasing production, are among the other goals of Pars Fener to be present in the capital market. .

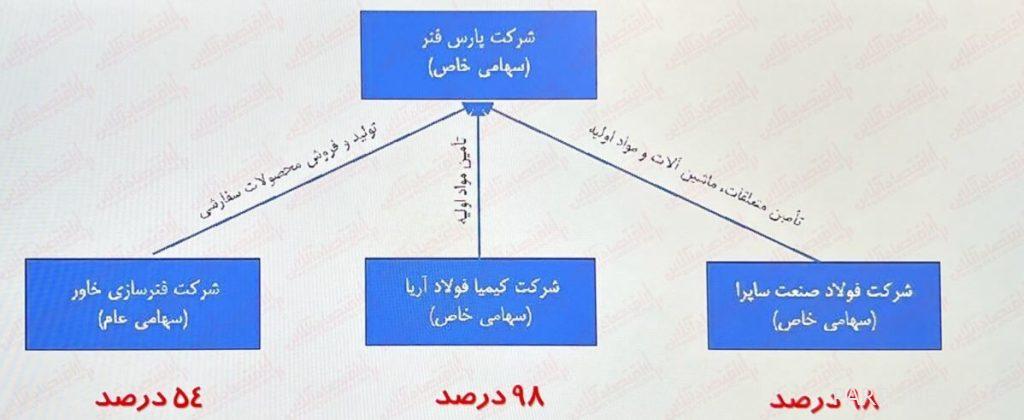

The CEO of Pars Fener Company went on to introduce the 4 companies of Pars Fener Group and said: Knowledge-based company Pars Fener, which operates in the field of producing various types of flat springs used in motor vehicles and rail industries, is the parent company. Three other companies include Fenersazi Khavor, Kimia Fould Aria and Fould Sanat Sapra.

Pirouz Hashemi, regarding the history of the establishment of Pars Fener, said: This company was established in 1363 with a license to produce 3,500 tons of various types of car bed springs, and it was put into operation in 1367, and in 1383, the production capacity increased to 10,000 tons per year. and in 2016, we also purchased 54% of the shares of Fenersazi Khavor Company from Iran Khodro Company.

He continued: In 2018, the production capacity of Pars Fener increased to 15,000 tons per year, and in 2019, Kimia Fould Aria Company was put into operation for the production of Shams and flat spring raw materials.

The CEO of Pars Fener Company added: Also, in 1401, Foulad Sanat Sapra Steel Company was purchased by Pars Fener for the production of various spring accessories.

Pirouz Hashemi said: Danesh-Baniyan Novavar Company has received approval from the Scientific and Technological Vice-Chancellor of the Presidency this year.

He said about the products of this collection: The products of Pars Fener Group include; There are types of simple flat, parabolic and parabolic linker springs, types of vehicle level springs, and types of springs and bindings for the rail industry.

The CEO of Pars Fener Company said: Considering the 11-step production process of spring industry products, there is flexibility in the production line in Pars Fener Company.

Pirouz Hashemi, pointing out that the sales share of Pars Fener spare parts market is 70%, said: This company also has 130 exclusive sales representatives in all provinces of the country.

Pirouz Hashemi, pointing out that the sales share of Pars Fener spare parts market is 70%, said: This company also has 130 exclusive sales representatives in all provinces of the country.

Regarding the entry of subsidiary companies and their listing in the stock market, he said: Currently, there is no plan for the listing of subsidiary companies and their entry into the capital market; But in the horizon and future plans of the company, there is a possibility of offering subsidiaries in the stock market.

The CEO of Pars Fener Company pointed out the problems of this industry and exports to America and Canada and said: One of the challenges of this industry is the bank interest rate and currency, which has caused problems in the import of this company. It is also exported to Syria, Iraq and Lebanon. Exports to Canada and America from 1994 to 2006 brought in 1 million dollars a year, but unfortunately, exports to these countries were completely stopped.

Pirouz Hashemi, at the end of his speech, said: The company was converted from a private stock to a public stock in 1401 and was accepted as the 311th trading symbol in the Iranian stock exchange.

Azadeh Shokri, Valuation Manager of Damavand Capital Supply

Azadeh Shukri, Damavand’s Capital Supply Valuation Manager and Pars Spring Company’s stock valuation representative, said in the press conference: “The capital of Pars Spring Company is 250 billion Tomans, and the subject of activity is the production of all kinds of car springs with a capacity of 15,000 tons of springs per year.”

He pointed out that the growth of operating revenues of Fener Pars in 1401 compared to the previous year was about 100%, and added that the profit margin of the company was also about 37% in 1401.

Damavand’s Capital Supply Valuation Manager introduced Fener Pars subsidiary companies and added: 54% ownership of Fenersazi Khavor Company is owned by Fener Pars and its factory is located in Saveh. The operating income of this company in 1401 has grown by about 120% compared to the previous year.

Shokri said: Kimia Fould Aria company, which is 98% owned by Fener Pars, has a capital of 40 billion tomans and operates with the capacity of producing 10,000 tons of alloy steel sections.

He added: Sapra Steel Company with a capital of 40 billion tomans is located in Saveh and 98% of its ownership belongs to Fener Pars.

The Valuation Manager of Damavand Capital Supply further explained the valuation assumptions of Pars Fener Company and stated: Considering that Pars Fener owns three companies, the financial statements and the profitability trend of this company were first examined.

Regarding the inflation rate forecast, Shokri said: The inflation rate for the year 1403 is equal to 30% and from 1404 to 1406, 25% is predicted for each year. The sales price of each ton of flat springs for the year 1402 is estimated at 81 million Tomans.

He went on to say: 5 methods, including dividend discount, company’s free cash flow discount, shareholders’ free cash flow discount, price-to-earnings ratio and net asset value have been used in the valuation of Fener Pars company shares.

At the end of his speech, Damavand Capital Valuation Director said: Based on the average of these methods, the estimated value of Pars Fener Company is 1970 billion tomans, and the value of each share is estimated at 788 tomans (7881 rials) in terms of 2500 million shares of 1000 rials of this company. Is.

Leila Selebalizadeh, a member of the board of directors of Pars Fener Company

Leila Selebalizadeh, a member of the board of directors of Pars Fener company, said in the continuation of this press conference: The development plan of Pars Fener company has been considered to increase the level of production and administrative warehouses with a budget of 25 billion tomans.

He added: Also, we have estimated 248 billion tomans for the launch of the site 3 project of Kimia Foulad Company, which is being done.

A member of the board of directors of Pars Fener company said: Sapra industry is also running with a budget of 247 billion tomans, including buildings, equipment and machinery.

According to this report, Pars Fener Company was established on April 7, 1363 as a private company and was registered in Tehran Companies and Industrial Property Registration Department, and on August 17, 1975, the legal location of the company was transferred from Tehran to Saveh.

The activity of the company started with a nominal capacity of 3520 tons of flat springs in 1968, and in 1983, by receiving a development plan permit from the industry organization and increasing investment and creating a production hall, developing and purchasing new machines, the production capacity increased to 10 in 1986. It reached a thousand tons per year. Then, by obtaining a license, this capacity reached 15 thousand tons per year in 1999.

The group includes Pars Fenner Company and three subsidiary companies of Khavor Fennersazi with 54% of shares, Kimia Fould Aria and Fould Sanat Sapra each with 98% of shares. Kimia Foulad Aria Company is a producer of raw materials for Khavar and Pars Fenner companies. Some of the raw materials of the above companies cannot be supplied through other suppliers and are supplied by this company.

In the composition of the company’s shareholding, Ahmed Jalili owns only 38% of shares and Reza Jalili and Kasra Jalili each own only 31% of shares.

The initial capital of the company with 360 personnel was 2 billion tomans, which reached 250 billion tomans during six stages of capital increase.

Pars Fenr company was listed in the second market

Pars Fener Company (Public Stock) was included in the list of Iranian exchange rates as the 311th trading symbol (194th company in the second market) after meeting all the acceptance conditions from 06.28.1402.

Acceptance Date: 05/15/1401 Acceptance Consultant of Sepeh Bank Brokerage Company, trading symbol is Fener. Automobile group and parts manufacturing sub-group of motor vehicle spare parts and accessories company

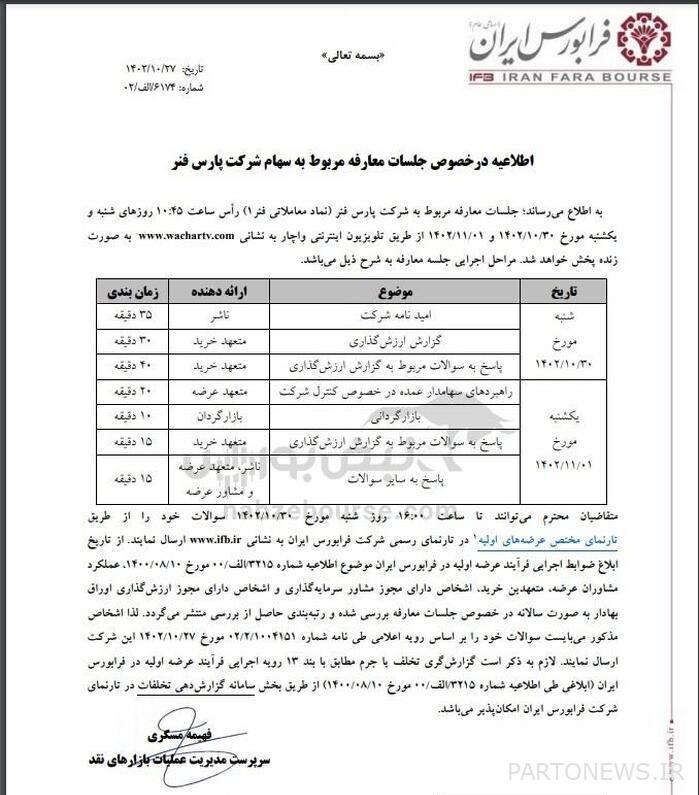

It should be noted that the introduction meeting of Pars Fenner company with the symbol “Fener” was held on Saturday and Sunday, January 30 and 1st of Bahman 1402, through www.wachartv.com It will be broadcast live.

Correspondent: Fatemeh Dadashi

Pictures of the press conference