Research: Miners Give Up, Investors Continue

Recent research based on on-chain data suggests that Bitcoin miners are likely to be disappointed with the market trend reversal and that only whales are bearing the brunt of Bitcoin buying.

To Report Cointelegraph, the results of these analyzes indicate the high probability of capitalization of bitcoin miners. Capitalization occurs when investors have lost faith in the market and there is intense selling pressure in a bear market.

Julio Moreno, senior analyst at data analysis company CryptoQuant, indicated today that we may be at the bottom of Bitcoin’s price and that the trend is over.

Surrender of miners is a sign of reaching the bottom of the price

The conditions for Bitcoin miners have changed a lot compared to March 2020 (April 2019) and they have now reached this state of continuous reduction of their profit margin from that very profitable situation.

According to the data, reaching the price of $17,600, that is, Bitcoin has fallen by 70% from its peak price in November. This has caused serious damage to a number of market participants, and this has caused a large amount of digital currency to flow from miners’ wallets to exchanges.

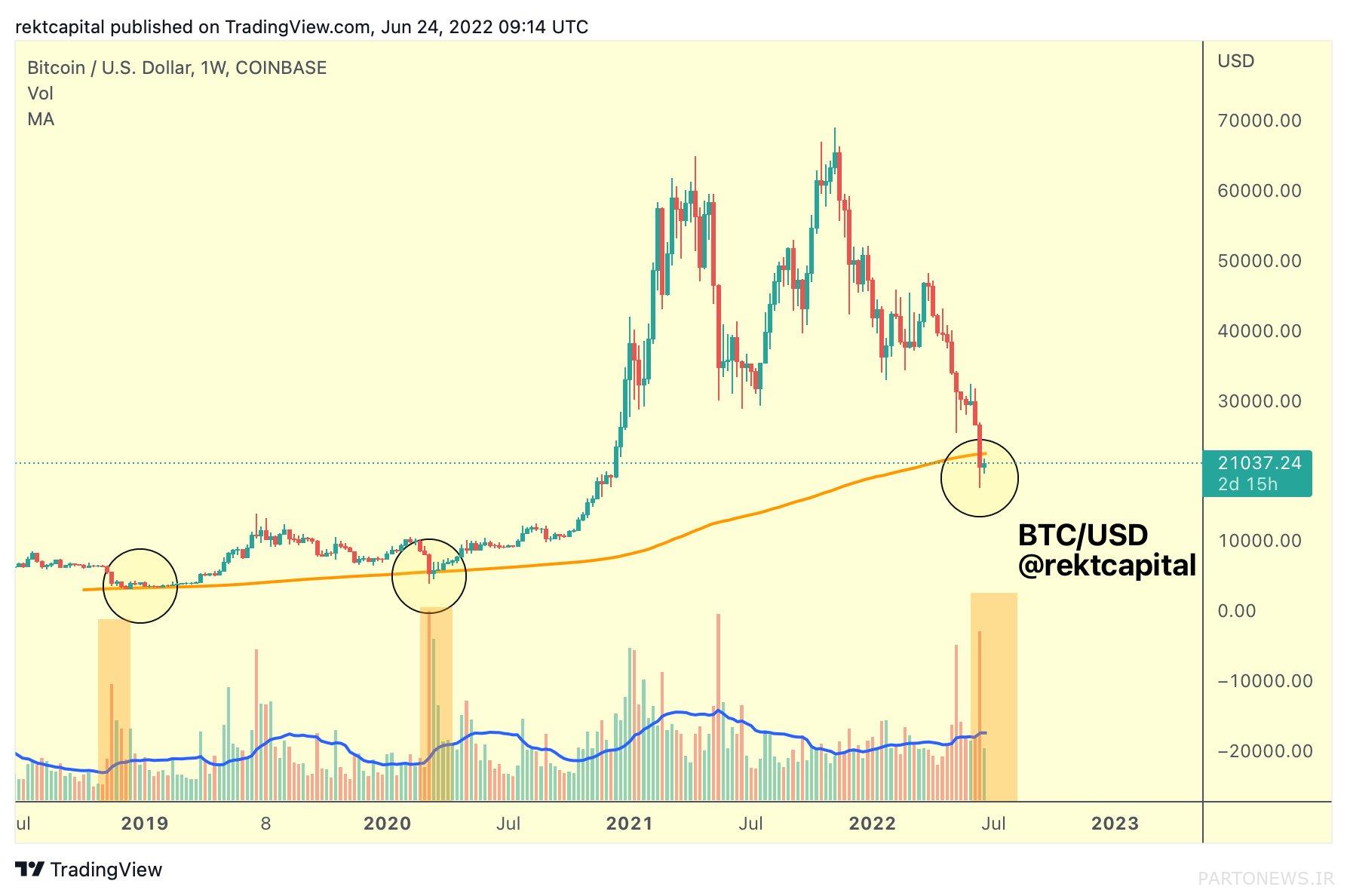

According to CryptoQuant analysts, if we look at the historical history of the Bitcoin price chart, we find that the occurrence of this disappointment was a prelude to the last stages of selling Bitcoin.

Monroe adds:

Our data suggest that a capitalization of miners has occurred. This happened in previous cycles usually before the market crash.

Also read: Best Bitcoin Mining Pools (Update 2022)

During this month, miners have been busy selling their digital currencies. Bitcoin’s Twitter account described the current situation with the phrase “miners are dumping their cryptocurrency.”

CryptoQuant CEO Ki Young Ju added in a Twitter thread last week:

To be or not to be! This is the problem with miners right now.

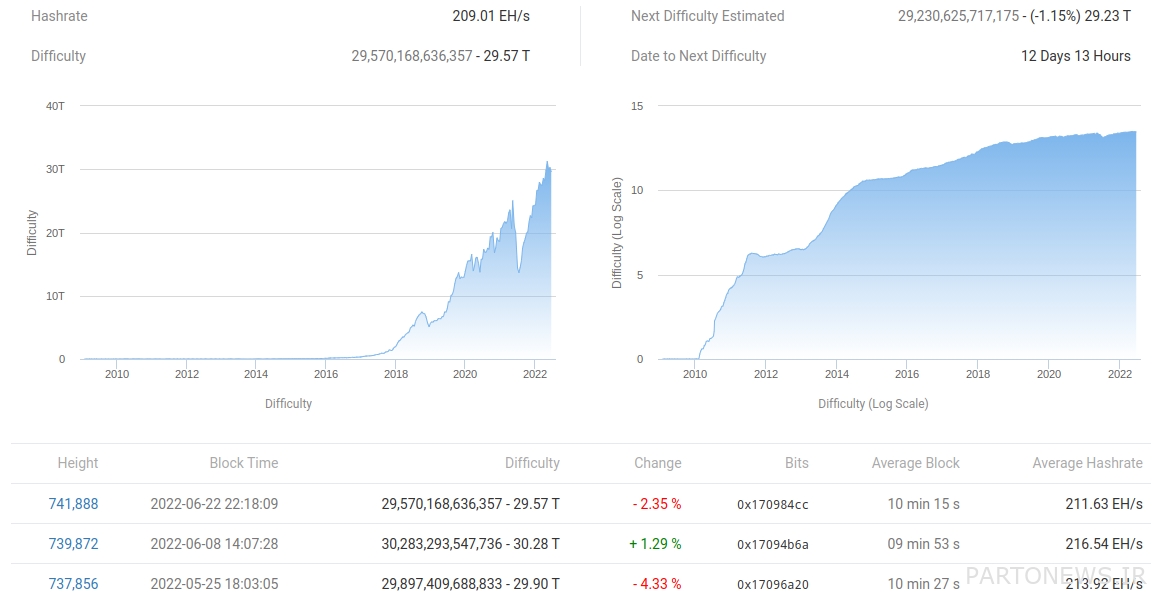

The current situation is extremely complicated; But the majority of miners are still active in the market, and this is confirmed by the fact that the main network benchmarks have only slightly decreased from the highest network difficulty record of 30 trillion.

Buyers’ interests are ambiguous

However, when we consider the status of other major Bitcoin holders other than miners, we find that a clear picture of the situation is not clear.

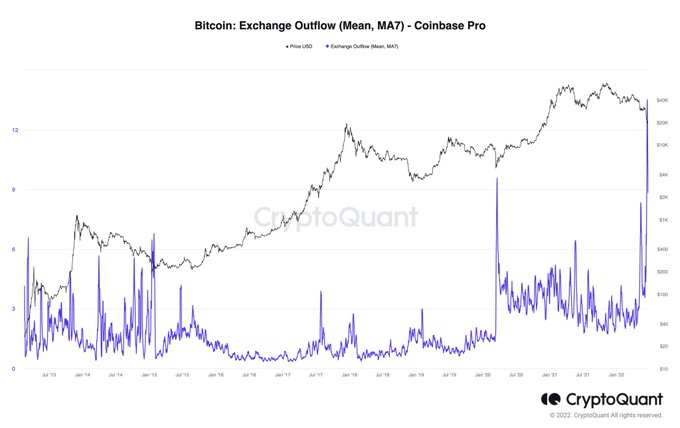

After the whales started to support Bitcoin in the $19,000 range, now the CEO of the cryptocurrency announces the entry of new institutional buyers by buying high volumes in the digital currency market.

Kay notes that the outflow from the Coinbase exchange has reached its highest level since 2013 (2013).

However, this trader and analyst of Rekt Capital (Rekt Capital) does not agree with the strength of the buying volume and based on his argument on the contrary, the sellers are still driving the future trends of the market.

Bitcoin’s 200-week moving average (MA), which was seen as a key support in previous bear markets, has yet to be picked up by buyers, even as the price has dipped below $2,000.

He adds:

With the sharp increase in the volume of Bitcoin sales, we see that the current purchase volume is lower than the level of the purchase volume in the bear market of 2018 in the 200-week moving average, let alone the purchase volume in the March 2020 market.