Technical analysis of Tapico stocks, Mehr 1402 / Does Tapico show a good side to the shareholders?

According to Tejarat News, Tamin Oil, Gas and Petrochemical Company is tradable under the symbol “Tapico” in the second market of the stock exchange. The shares of Tamin Oil, Gas and Petrochemical Company with a market value of 173 thousand 666 billion Tomans are in the group of chemical products.

The analysis of the “Tapico” trading board shows that the price behavior of this share takes place with a short break in the direction of suspicious legal movements of the share. Therefore, every time the rights started to make heavy purchases, a little later, the share of floor swings made in its chart has given good returns to the shareholders. Therefore, in order to recognize the validity of the upward wave, it is very important to examine the legal behavior of the share.

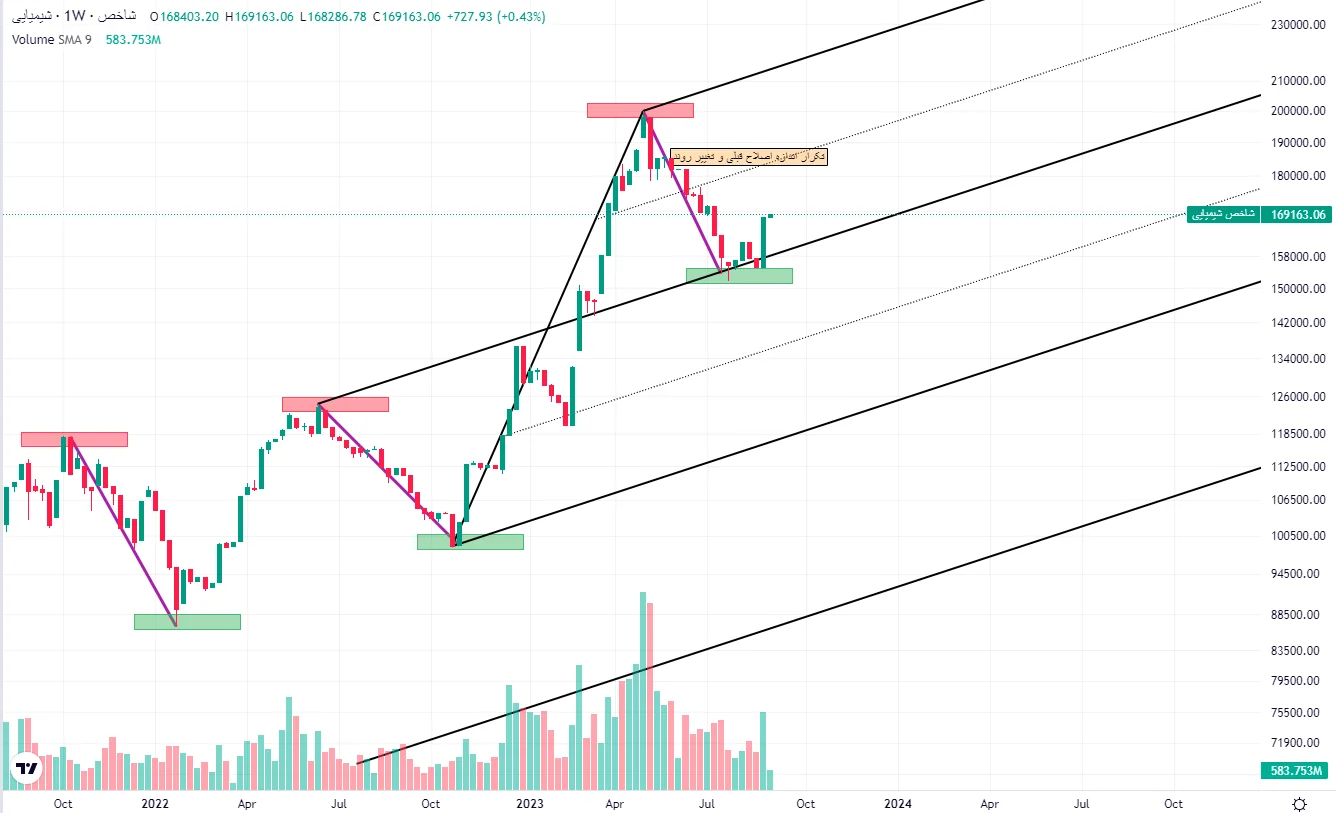

Technical analysis of chemical index

In the weekly dimensions, identifying the major structure in the chemical group index chart helps a lot to identify the trend. After the deep reform of this industry, which occurred at the same time as the market collapse in 1999, a new trend started in the chemical group in the middle of March of the same year. The structures specified in the index chart of this industry show that the index of this group is bullish.

Also, the emerging structures show that the corrective waves of the mentioned trend are very similar to each other. So that this index ended during the recent correction of the market from the middle of May of this year as soon as it reached the size of the previous correction, and the indicator of the group of chemical symbols began to make higher ceilings and floors.

The drawing of the Andrews fork tool in the pullback style shows that this indicator measured the level of support of the buyers by testing and then re-testing the middle line, and after that it was thrown upwards. If the last floor is maintained in the range of 152 thousand units, the indicator of the group of chemical symbols has the target of reaching the ceiling of the Andrews fork.

Therefore, it can be claimed that the three previous reform waves are from the same family. On the other hand, the slope of the first wave of this upward trend is very similar to the last upward wave of the market that started in November 1401. Therefore, this point can be used to draw the Andrews fork.

Based on this drawing, if the weekly candle of this indicator closes above the middle line, it has a great chance for the index to grow to a high parallel. This means that the index has crossed its previous ceiling.

Technical analysis of Tapico stock

The deep fall of 63% of Tapico started in August 2019 and continued for 37 consecutive weeks. But the trend Tapico has taken since then has been a decently steep uptrend, giving Tapico shareholders a 291% rally over 101 trading weeks.

The repetition of the size of the major correction in this upward trend is a point that has attracted the attention of technicalists. By comparing the latest price correction of Oil and Gas Supply Company with the previous correction, we find that the stock has managed to make a turning point after repeating this size.

Therefore, two analytical scenarios can be considered for predicting Tapico’s stock price. First, according to Alan Andrews’ 5th Law, when the price registers one of the swing fork lines, it will advance to the next line. With this reasoning, we can imagine the target of achieving the upper parallel of the fork. In this analytical approach, the next target can be considered as 127.2% and 1.618%, which shows the ranges of 2,510 Tomans and 3,458 Tomans, respectively.

Another scenario, the technical analysis of Tapico shares, will not be very pleasant for the shareholders of this company. If the price fails to cross the resistance range of 1,788 to 1,836 Tomans, it can be seen that the Tapico symbol is most likely stuck in a range trend between the two boxes drawn in the image. Therefore, the behavior of the price, volume and value of share transactions in the mentioned range is very important to detect the occurrence of one of the two scenarios.

Disclaimer: All contents included in this site are research, scientific and news and are not recommended for direct activity in any market.

Read more market analysis reports on the Capital Markets page.