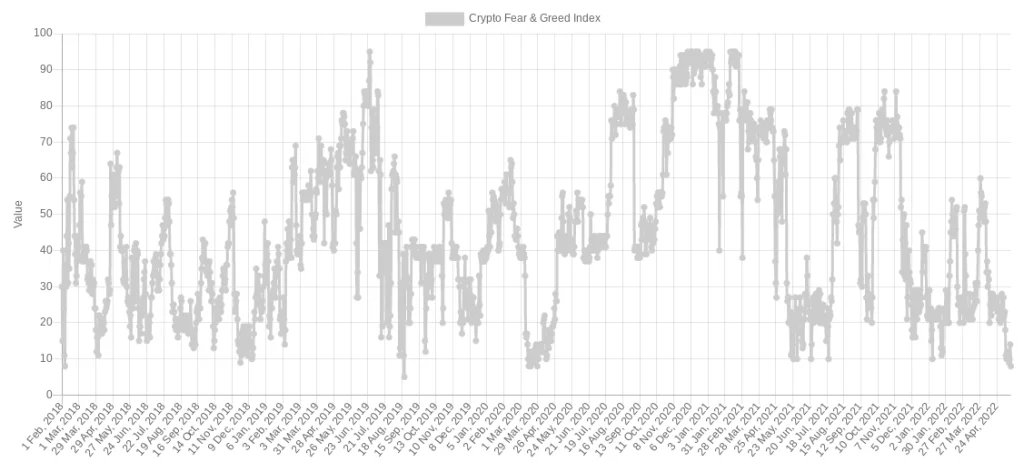

The digital currency fear index has reached its lowest level since the corona epidemic; What is the next move?

The digital currency index of “fear and greed” reached 8% today, which is the lowest level since the corona virus epidemic worldwide. Some analysts also think that bitcoin can start recovering from this point.

To Report Bitcoin Telegraph, the price of Bitcoin rose to $ 30,750 today, while some traders expect the market for this digital currency to be able to avoid falling again to the historic highs of 2017, ie $ 20,000.

As the charts show, the price of Bitcoin has now reached above this level after closing the candlestick yesterday at around $ 30,000. The general direction of price fluctuations in the dimensions of several days has not been determined yet, and with the beginning of this week, the volume of price fluctuations was reduced.

Credible Crypto, a digital currency market analyst, is optimistic that some traders are worried that deep market correction could push bitcoin prices below the level of the last 10 months we saw last week. Is. Citing bitcoin pricing behavior in the past, he said the digital currency has little inclination to try the $ 20,000 support.

He says:

The $ 13,000 or $ 14,000 price forecast for Bitcoin makes another important assumption, arguing that previous downtrends have been accompanied by an 80% drop in price from the peak; That $ 65,000 was the peak of the previous uptrend. This is the impression we had when Bitcoin reached $ 30,000 in June 2021; But three months later, Bitcoin reached its new all-time high of $ 65,000.

Some investors seem to be already preparing for the fall of bitcoin to lower levels, and Micro Strategy, the largest institutional investor in the digital currency, has said it is ready to buy new units with prices down nearly $ 21,000. Slow down and prevent further bitcoin crashes.

Asked if Bitcoin could repeat its 2019 drop from a high of $ 14,000 to $ 3,600, Crypto Crypto said:

I do not expect such a thing; However, can we see such a fall? The answer is yes; But as I said before, because in the past the price never reached its previous historical peak [بهعنوان حمایت] Has not tested, I think such a thing would be very unlikely.

Michaël van de Poppe, an analyst at the Kevin Telegraph website, points out that with the end of the uptrend in the dollar index (which compares the value of the US dollar with other major Fiat currencies in the world), there is an opportunity for risky assets to grow. , Such as digital currencies.

He predicts that the dollar index may move down from its 12-year high of 105.

“Depop has said:

Regarding the current situation of the dollar index, I imagine that we will proceed according to this scenario; My assumption is that by starting a corrective move in this index and increasing the supply pressure, we will move away from the current peaks. I think after the break of 103.7 level support, the downward pressure of this index will increase and as a result, risky assets will grow.

However, statistics on market sentiment show that most traders have come to the conclusion that anything can happen in the future and are more inclined to lower prices.

The index of fear and greed of digital currencies, which is used to measure market sentiment, has reached 8% today, which is the lowest level since March 28, 2020; Exactly two weeks after the global quarantine began to prevent the spread of the coronavirus worldwide. At that time, bitcoin, like today, was recovering its value from its price floor. Bitcoin is currently trading at $ 30,500, up about 20 percent from its $ 25,400 floor last week.