The largest capital inflow to Binance since 2018; What will be the next move of Bitcoin?

Bitcoin inflows to the world’s largest exchange, Binance, have just seen a huge jump, reminiscent of the bear market capitulation of 2018. However, the reasons behind this big move by Binance are still unclear, and analysts have mixed opinions about the next move in Bitcoin’s price.

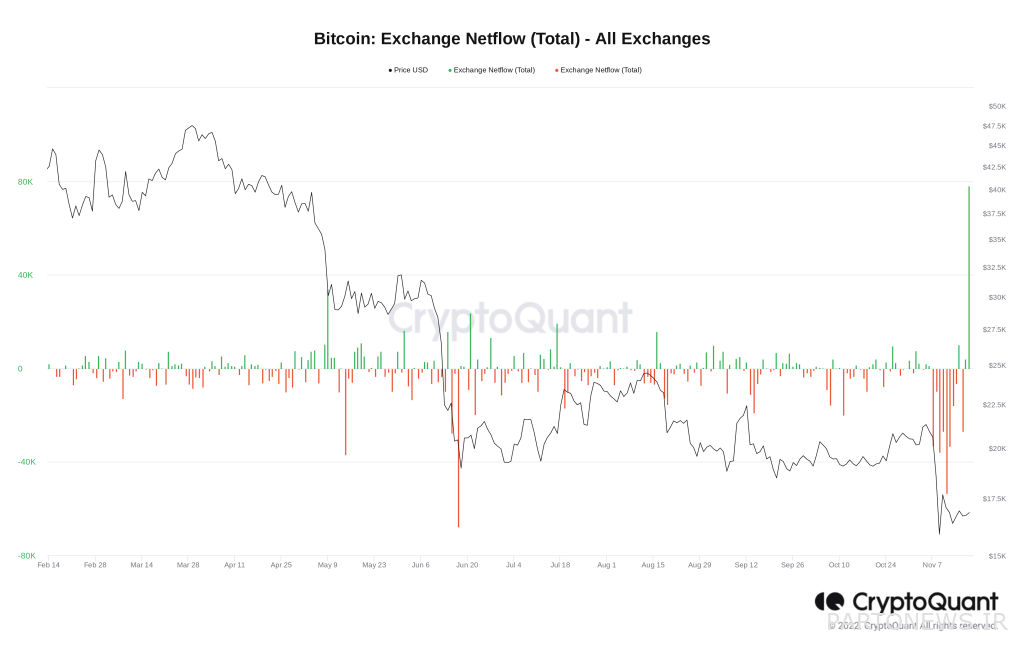

To Report Data from Cointelegraph, a cryptocurrency analysis platform, shows that on November 18, approximately 60,000 bitcoins entered the Binance wallet, which is a huge amount.

The largest capital inflow to exchanges since the end of 2008

Fears of a price shock contagion to Bitcoin thanks to the FTX bankruptcy and associated accelerated selling (pressure) persist.

Now, the latest data from Binance could act as an additional catalyst for increased market anxiety. This exchange has witnessed the largest amount of daily incoming capital.

While November 18 (November 27) has not yet ended; Cryptocoin data shows that capital inflows have so far exceeded 138,000 bitcoins per day.

To understand the importance of this event, even if we consider the capital outflow of Binance and other major exchanges, this amount of Bitcoin will still be the largest amount of capital inflow since November 20, 2018.

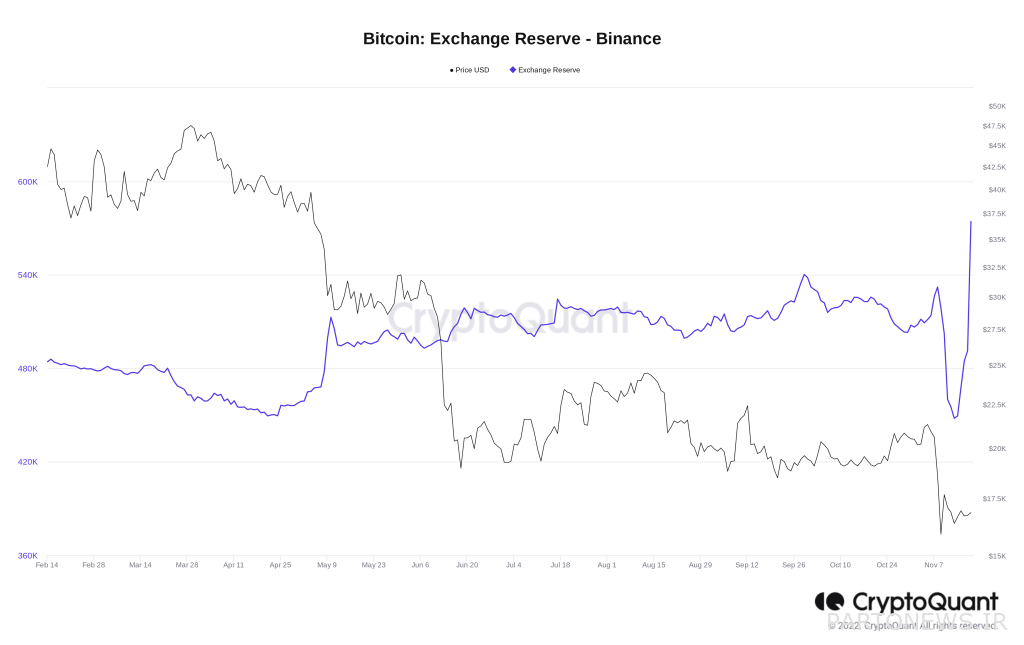

This means for Binance that its Bitcoin reserves are now worth more than they were before the FTX collapse; 573,000 bitcoins compared to 513,000 bitcoins on November 6 (November 15).

However, this incident was noticed and one analyst quickly realized that a little over 59,000 of these bitcoins were the result of de-pagging Binance’s BEP2 bitcoin token.

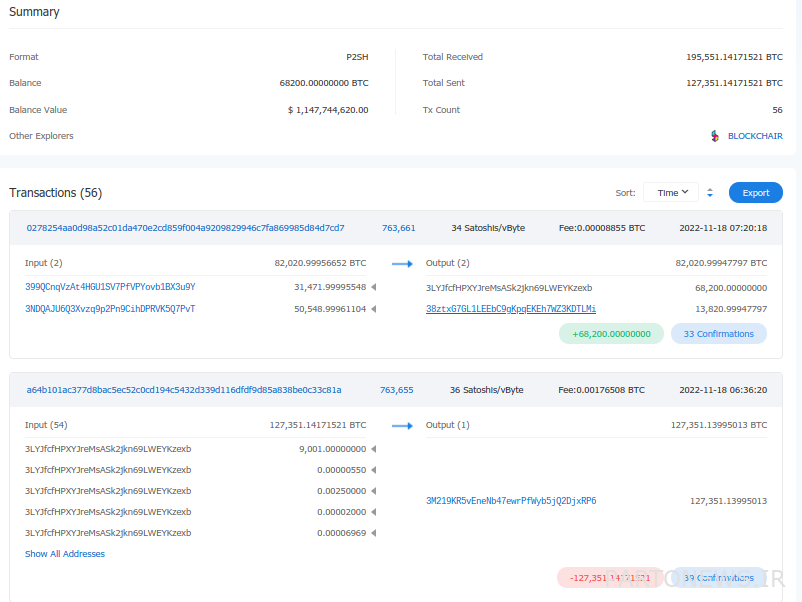

The Binance Bitcoin Token (BTCB) is a Bitcoin-backed token on the Binance Chain with a public repository address. This wallet address witnessed the withdrawal of 127,351 bitcoins today and at the time of writing this article, it contains 68,200 bitcoins.

According to Ki Young Ju, CEO of CryptoQuant, contrary to the norm, BTCB token’s decrease in market value at the same time as its Bitcoin reserves decrease indicates that a real sell-off is on the way.

In a Twitter post, Kay explained the theory behind what he calls sellside pressure:

Argument: If you are CZ, why should you withdraw bitcoins from BNB China?

Your goal will be to support BNB China projects.

The release of no announcement by Binance means that these bitcoins are the money of customers or investors.

So, I think it’s very likely that this was done by a customer or customers who were in an emergency.

A busy week for exchanges

However, there is not much agreement on this theory. Many argue that the huge capital inflow is merely an internal reorganization that will have no further consequences.

Crypto journalist Colin Wu stated in a tweet that received wide attention:

Today, Binance witnessed an inflow of nearly 127,351 bitcoins and an outflow of nearly 50,000 bitcoins. Such validation shows that these incoming and outgoing funds are organized by internal wallets, which is a transition between a cold wallet and a Proof of Reserves wallet.

Andrew T, a technical specialist at the Nansen analytics platform, tweeted about the overall statistics of inflows to Binance:

I really don’t understand the rumors of (sudden) price increases.

He continued:

The outflow of capital in the last seven days has been huge, although there has also been an inflow of capital. The idea that they are transferring bitcoins to Binance for dumping doesn’t seem right.

As we previously reported, exchange users withdrew more than $3 billion in the days following the FTX crash; A process that continues.