What is Bitcoin Dominance? Everything about the dominance of bitcoin

Dominance or bitcoin dominance is one of the most frequently used terms in the digital currency market, and understanding its concept and function is essential to understanding many aspects of this market. Many analysts and traders use this concept to predict market trends, and they argue that examining the dominance of bitcoin can greatly enhance the transparency of analytics.

If you think of the digital currency market as something like the solar system, bitcoin is at the heart of the system, exerting a kind of gravitational force on a wide range of different digital currencies with different volumes circulating around it.

This is an example of a good mindset from Level And Type of effect Bitcoin creates the digital currency market for us. In the Bitcoin literature, the term “Bitcoin Dominance” is used to describe this effect.

However, the definition we have provided was only a general definition of bitcoin dominance, and this concept has more complexities that we will continue to address in detail. In this matter to help an article Compiled from the Learncrypto website, we will first look at bitcoin’s dominance, then explain why it’s important, and finally point out the signals that can be gained from this concept.

What is Bitcoin Dominance?

The dominance of bitcoin in simple terms is equal to the market value of bitcoin relative to the total market value of digital currencies. For example, if the bitcoin’s dominance is 40%, it means that bitcoin accounts for 40% of the total value of the digital currency market. This index is widely used in analyzes.

First of all, it is necessary to state that “dominance” literally means “domination”, and the same is true of bitcoin. Thus, bitcoin dominance refers to the dominance of bitcoin over the digital currency market and other currencies in this market.

The easiest way to determine bitcoin dominance is to calculate the ratio of bitcoin market value to the total value of digital currencies; Hence, when Bitcoin was the only digital currency available, its dominance was 100%; But with the creation of new digital currencies, including bitcoin forks, this dominance gradually diminished.

Market value may not be the ideal measure of dominance in the broadest sense, but what we are discussing here are concepts such as “price” and “market” that are very easy to quantify; In other words, the dominance of a currency can depend on several factors, but they are a little difficult to represent.

That’s why when it comes to websites like Kevin Market Cup (Coinmakertcap) or Kevin Geko (Coingecko) which shows the current prices of different digital currencies, you see variable values of dominance and charts for each currency.

Why is Bitcoin dominance important?

Let’s go back to the solar system allegory for the digital currency ecosystem. Just as the sun, through gravity, has a significant effect on the planets orbiting it, so bitcoin through the factor “Price, Influences projects in the world of digital currencies.

Price is one of the components of dominance, and for this reason, the price of bitcoin is directly and strongly related to the price of other digital currencies. However, this does not mean that all currencies have such a strong effect, and that the change in the price of each currency affects other currencies. The truth is that the degree of influence is proportional to the degree of domination.

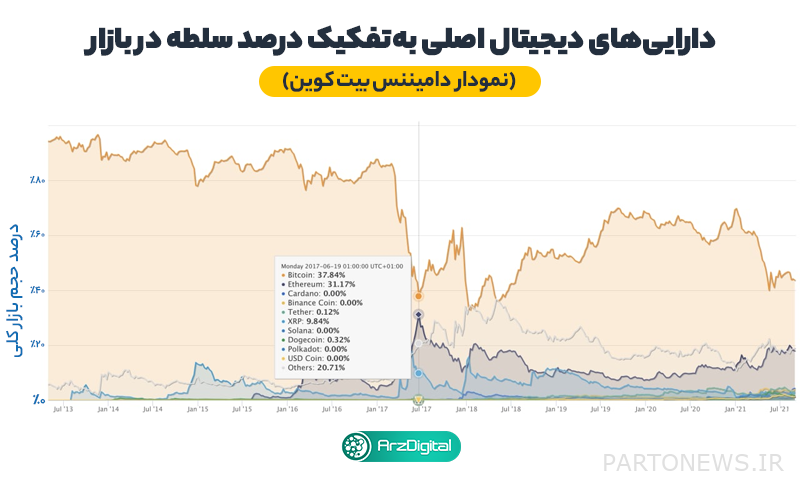

If you look at the chart above, you can see the bitcoin’s volatility fluctuate from 100% in 2013 to a point four years later when Atrium was only 6% away from taking over and becoming the new ecosystem sun. Is.

It is interesting to note that domination change, like other concepts in the world of digital currencies, has its own term. Flippenning is one of those terms; Changing the dominance of a digital currency is called flipping or flipping. A shift occurs when the market value of one digital currency outperforms another. The shift in dominance is important; Because it reflects the competitive nature of the digital currency market.

In this competition, every digital currency is trying to have a wider impact. In the case of Bitcoin and Atrium, this competition is reflected in their different consensus methods. Bitcoin uses the Proof of Work algorithm, and Atrium is moving towards full implementation of the Proof of Stake algorithm.

Bitcoin maximalists believe that in this system, only one planet can survive and the rest of the digital currencies will eventually be destroyed by Bitcoin. Of course, this belief is not unique to Bitcoin and is also found among Atrium maximalists or any other digital currency in this vast market.

Thus, the dominance of bitcoin reflects its variable influence on the digital currency ecosystem, the degree of influence and popularity of proof of work, and its relationship to decentralization, which is at the core of maximalist thinking in this area.

This is a highly political issue because proving work requires continuous energy consumption and has a negative impact on the environment. Hence, bitcoin dominance is also a measure of the acceptance of this basic need.

There is another competing indicator of dominance that “Bitcoin Real Dominance Index(Real Bitcoin Dominance Index). This index only compares digital currencies that use the proof of consensus method. This index now also includes the atrium; This is because this digital currency is currently using proof of work and is being transferred to proof of stock. The successful completion of this transfer is expected to have a significant impact on bitcoin dominance.

Use of Dominance in Analyzes

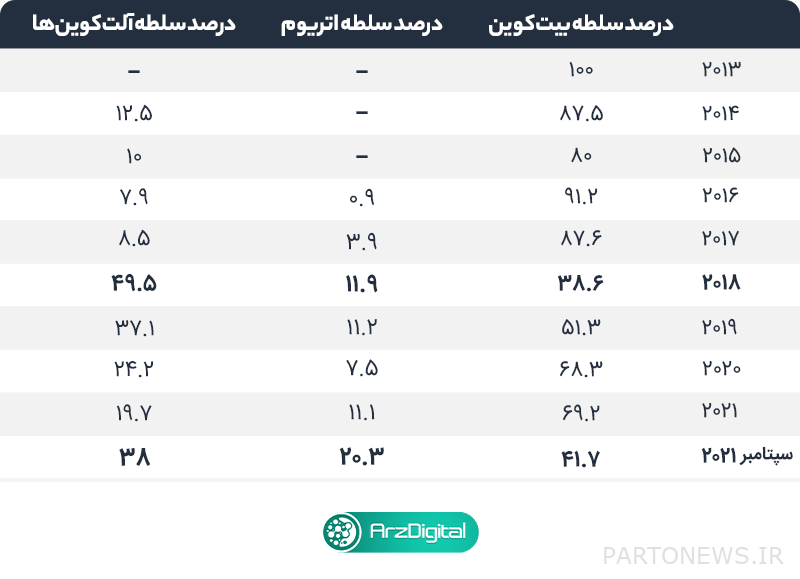

If we take a comparative table of the annual dominance of bitcoins and other digital currencies, we find that changes in dominance do not follow a linear pattern; This does not mean, for example, that Bitcoin dominance will gradually weaken. The reason for this is the effect of the cattle and bear markets, which is highlighted in the table below. The degree of dominance in the table below is calculated for each year, from January 1 of that year; Except for the last case whose date is mentioned.

In beef markets, periods of market optimism, prices rise because of buyer enthusiasm; But this desire is not evenly distributed among the pennies.

It should be noted that the Altcoin classification is a broad classification and encompasses a wide range of currencies. For example, stable coins, which play an important role as gateways from traditional money (fiat) to digital currencies, fall into the category of pennies; But because of the ease with which new currencies can be created, a wide range of emerging and unknown currencies fall into the same category, which causes the coin’s volatility to fluctuate.

Many analysts equate the decline in bitcoin price dominance with the beginning of the Altcoin or Alt Season season; That is, they believe that when bitcoin dominance reaches 40%, one can expect a sharp rise in the number of coins.

In addition, there is an issue called “bargaining for entertainment” that is more common among altcoins, and itself is another reason for the fluctuation of the coin’s dominance.

Entertainment Trading can be described as a combination of Unit Bias and FOMO. Complete unit bias is an irrational conclusion that low-priced digital currencies are considered “cheaper” than other digital currencies such as bitcoin.

Fear of being left out, or fumo, is also a condition in which investors flock to invest in new projects, hoping to grow 100-fold.

The table above shows that this bear / cow cycle lasted approximately four years and coincided with the Bitcoin Halving cycle; But it is by no means certain that this symmetry will be repeated. If you want to know more about Howing, we suggest the article “What is Howing?” Read.

Now the fundamental question is whether the dominance of altcoins has increased due to the increase in bitcoin’s dominance or not? In other words, is the growing popularity of the two major digital currencies (Bitcoin and Atrium) like a surge in the popularity of all coins?

Will Bitcoin forever remain at the center of the digital currency world and exert its hegemonic influence over coin reels? Or will its power decline and be overshadowed by the atrium and the quinces? Only time can tell the answers to these questions.