What is DiFi? DeFi or decentralized finance in simple language

What is Difai and what are its goals? Removing banks, intermediaries and centralized organizations from the financial world; This is the ideal that DeFi works to achieve.

In this article with help an article From the Binance Academy website, we explain in simple terms everything you need to know about the field of decentralized financial management.

Also, to learn more about how to work on DiFi platforms, we recommend the article “The most comprehensive DiFi training; From Garlic to Onion of Decentralized PlatformsRead the

What is DeFi?

Defay to a set of Applications It indicates that important financial matters such as Receive a loan And Financial transactions as Decentralized And No need for intermediaries Do. in other words, DiFi is not a project or digital currencybut one An ecosystem of hundreds of different projects That is all of them Decentralized financial services present.

Banks and centralized organizations have long dominated the financial world. Today, if you want to get a loan, buy and sell, or pay your installments and taxes, you have to go to the bank, the government, or other centralized organizations.

All over the world, people trust governments every moment with the assumption that they are clean and with their help the value of national currencies is protected. The people of the world trust banks with the assumption that they are honest trustees of their money. Every moment they rely on intermediary companies with the hope of receiving flawless financial services.

But history has shown that centralized intermediaries can commit corruption or unintentional error. The field of decentralized finance has come to eliminate corruption, inadvertent error, and the need for centralized trust by using blockchain and the concept of decentralization.

also We can define DiFi like this: A movement to create an open source, permissionless and transparent financial services ecosystem That’s for everyone accessible is and No central intermediary Works. In this way, the user has full control over his property and communicates with the ecosystem through decentralized applications (Dapps).

With its great goal, DeFi can be considered as one of the most promising innovations of the digital age, along with blockchain.

What are the uses of DiFi?

The applications of DeFi are very wide and most parts of the financial world can benefit from the benefits of DeFi. However, the three main uses of DeFi include:

- Receiving loans and lending

- Paid banking services

- Decentralized exchanges

Receiving loans and lending

Decentralized lending protocols are one of the most popular applications in the DeFi ecosystem. Lending and receiving loans in a free and decentralized manner has many advantages over the traditional credit system. Among the interesting features of blockchain-based lending platforms are instant payment, the possibility of collateral with digital assets, and no need for credit checks.

In these systems, liquidity providers can earn a profit by putting their assets on the platform, and other people can borrow from that liquidity.

Since these services are offered on public blockchains, the need for trust will be minimized and a very high level of transparency will be established. In general, decentralized lending systems reduce counterparty risk, making it cheaper, faster, and more accessible to more people.

Paid banking services

Given that DeFi applications are financial applications by definition, paid banking services are one of the obvious uses for these applications. These services can include issuing stable coins (stable coins), mortgages and insurance policies.

As the blockchain industry matures, there is a lot of focus on creating stablecoins that have fixed value like Tether and are also decentralized. A stablecoin is a type of digital currency that is backed by a stable asset or commodity such as the dollar. For example, a stable dollar digital currency (such as Tether) is backed by the dollar and its value is always one dollar.

Regarding credit services, in the traditional system, due to the existence of many intermediaries, the process of registering mortgage and collateral is very expensive and time-consuming. By benefiting from smart contracts, legal and underwriting costs will be significantly reduced.

On the other hand, issuing insurance on the blockchain eliminates the need for intermediaries and greatly reduces the risk of insurance policy violations. In this way, by maintaining the quality of service, the amount of the insurance policy can be reduced.

Decentralized exchanges

According to experts, decentralized exchanges will play an undeniable role in the future of financial transactions, and these exchanges themselves include DeFi.

In decentralized exchanges that work on the blockchain, traders can buy and sell digital assets directly without intermediaries. These transactions are done from users’ personal wallets.

Since a centralized organization cannot have control over exchange processes, transaction fees are very small; However, there are still challenges regarding the network’s own transaction fees.

Also, blockchain technology can be used to issue and provide ownership of a large number of financial instruments. By creating a decentralized platform, these programs eliminate the need to trust trusted organizations, and with the help of distributed ledger technology, they do not have a single point of failure that can be attacked.

For example, in the field of DeFi, tools and resources can be provided for the supply of stock tokens (securities) with which individuals and businesses can create digital currency for assets such as stocks and real estate and consider their desired parameters for it.

Derivative markets (futures and options) as well as prediction markets (such as Agar) can also be a subset of Defi.

Where are DiFi programs run?

The core of the field of decentralized finance is the smart contract, as decentralized applications work through it. Therefore, blockchains that host smart contracts can also host DeFi applications.

While normal contracts use legal materials to specify the relationship of the people involved in the contract, a smart contract uses computer codes.

Thanks to blockchain, a smart contract will be enforceable once implemented. The developer determines the terms of the contract execution in the code, and after registering it on the blockchain, even he himself cannot stop the execution of the contract.

Smart contracts are faster and easier to use and less risky for the parties. On the other hand, smart contracts still struggle with legal challenges and, for example, legal authorities do not yet recognize a smart contract as a home owner. Also, since smart contracts cannot be stopped, the presence of bugs or malicious code can cause danger.

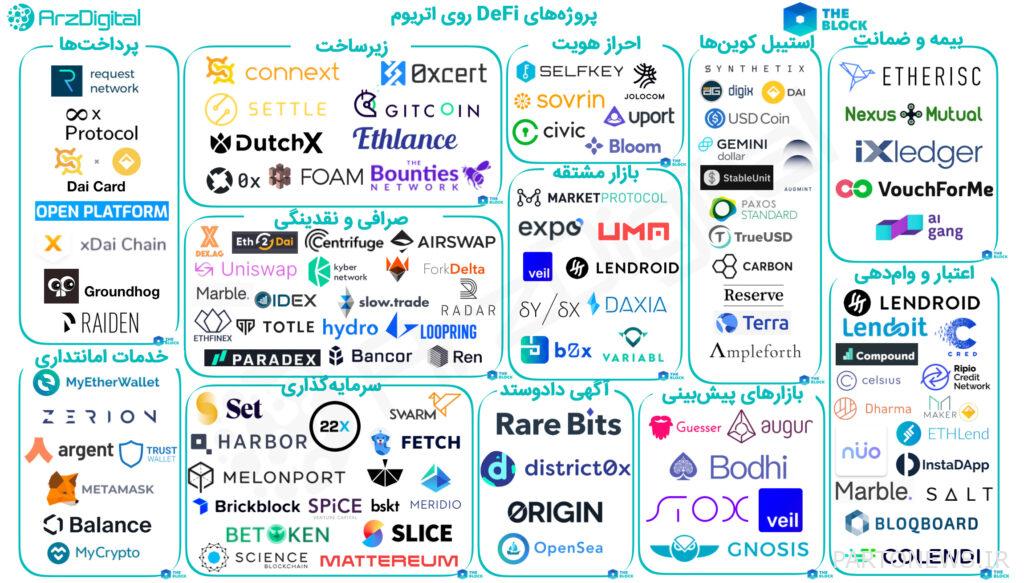

Ethereum is currently the largest platform that DeFi projects can work on. Without exaggeration, we can say that at the current stage, the Ethereum blockchain hosts more than 70% of the entire DeFi ecosystem.

In addition to Ethereum, IAS, Tezos, Tron, Cardano, Neo, Elgorand and dozens of other blockchains are capable of hosting decentralized finance applications.

What are the biggest problems of DeFi?

The most important problems that DiFi is facing are:

- Speed

- Possibility of user error

- Bad user experience

Speed

Blockchains are currently slower than their centralized competitors, and this affects the performance of decentralized applications as well. For example, Ethereum, the main host of DeFi projects, can now only process 14 transactions per second.

Of course, with various scaling solutions and potential improvements, this problem will most likely be solved in the near future. It goes without saying that dozens of DeFi projects are already working well on these slow blockchains.

possibility of user error; Everyone is responsible for their property

As we said, Defay eliminates financial intermediaries and leaves all the responsibility to the users themselves.

For example, if you lose your bank account password, you can recover it by going to the bank, but in open blockchains like Ethereum, the identity is a text string of letters and numbers called a “Private Key”. ) is determined that if you lose it, you will lose access to your wallet balance forever.

Also, blockchain transactions are irreversible, which means that if you deposit money into the wrong wallet, you will probably never get that money back. For this reason, distracted users are at risk when working with DiFi.

Bad user experience

Currently, using the DeFi domain is a little complicated for novice users, and current applications still lack a good user interface.

For a normal user, privacy and decentralization are not the first priority. The ease of working with this area can be an incentive for users to abandon centralized systems, but without a suitable user interface and easy access, decentralized applications cannot have a say in terms of user numbers.

The development of mobile software for applications in the field of DeFi is the most important issue that should be considered about user experience.

Frequently asked questions

Defay stands for Decentralized Finance. DeFi refers to a set of blockchain-based applications that provide the same traditional financial services without the need for intermediaries and in a decentralized manner.

DeFi is not a digital currency, but a set of decentralized applications that aim to remove the middleman from financial services. Of course, each of these decentralized programs can have a dedicated digital currency.

To enter the DiFi market as a user, you only need a digital currency wallet and some digital currency. The type of wallet and digital currency depends on the DeFi platform you want.

DeFi is a concept and considering its high potential, it is unlikely that this concept will disappear altogether. However, factors such as the future of the entire crypto industry could affect the future of DeFi.

Conclusion

In this article, we examined what DiFi is and what its uses and challenges are. DeFi is a broad field that tries to provide financial services needed by people by eliminating intermediaries. With the help of this field, we can move towards a freer financial system; A system that is available worldwide and prevents corruption, censorship and discrimination.

Decentralized DeFi applications run on blockchains that host smart contracts. Ethereum is currently the largest DeFi host.

DiFi’s potential to create a different future is extremely high; A future where we manage our finances without the need for banks and intermediary companies and have full control over our own assets.